Americans own 714 mln, or nearly one-third of all Mastercard and Visa credit cards worldwide according to data presented by AltIndex.com.

As of Q3 2023, there were nearly 2.4 bln Visa and Mastercard credit cards worldwide, meaning that every third person owns them. Still, most were issued in the United States.

The use of credit cards ramped up in 2023 as inflation continues crunching consumer purchasing power and pushing prices of goods and services to never-seen highs.

Consumers worldwide use credit cards more than ever, as high prices make life costs unbearable for many. This surge is best shown by the total number of new Visa and Mastercard credit cards, the two largest operators in the market.

Last year, Visa processed 61.6% of all credit card transactions in the United States and 40% globally, according to Money Crashers data.

Mastercard, America’s second-largest card processor by purchase volume, processed 25% of all transactions in the U.S. and almost 30% globally. However, the final 2023 figures might be even higher, as Americans use Visa and Mastercard credit cards more than ever.

Visa and Mastercard +37 mln in U.S.

According to Statista and official company data, the total number of Visa and Mastercard credit cards in the country jumped by 37 mln year-over-year, rising from 677 mln in Q3 2022 to 714 mln in Q3 2023.

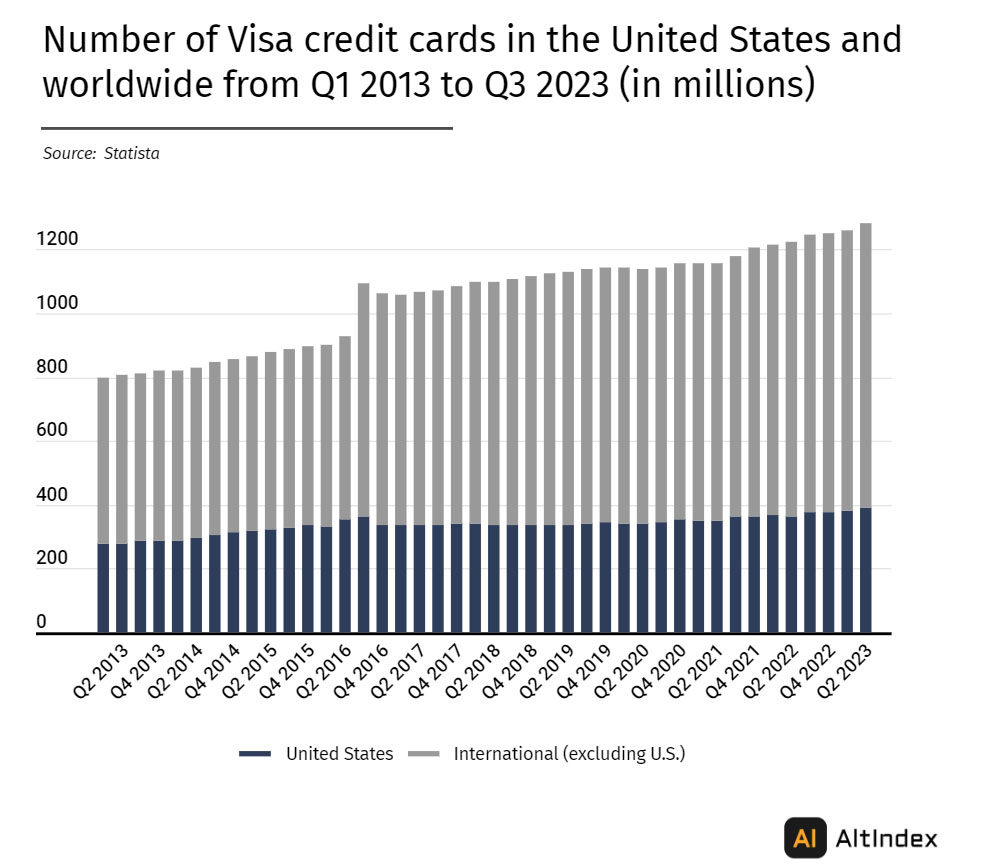

Visa, the largest credit card provider in the market, issued 15 mln new credit cards in the United States in the past year, with their total number rising from 376 mln to 391 mln.

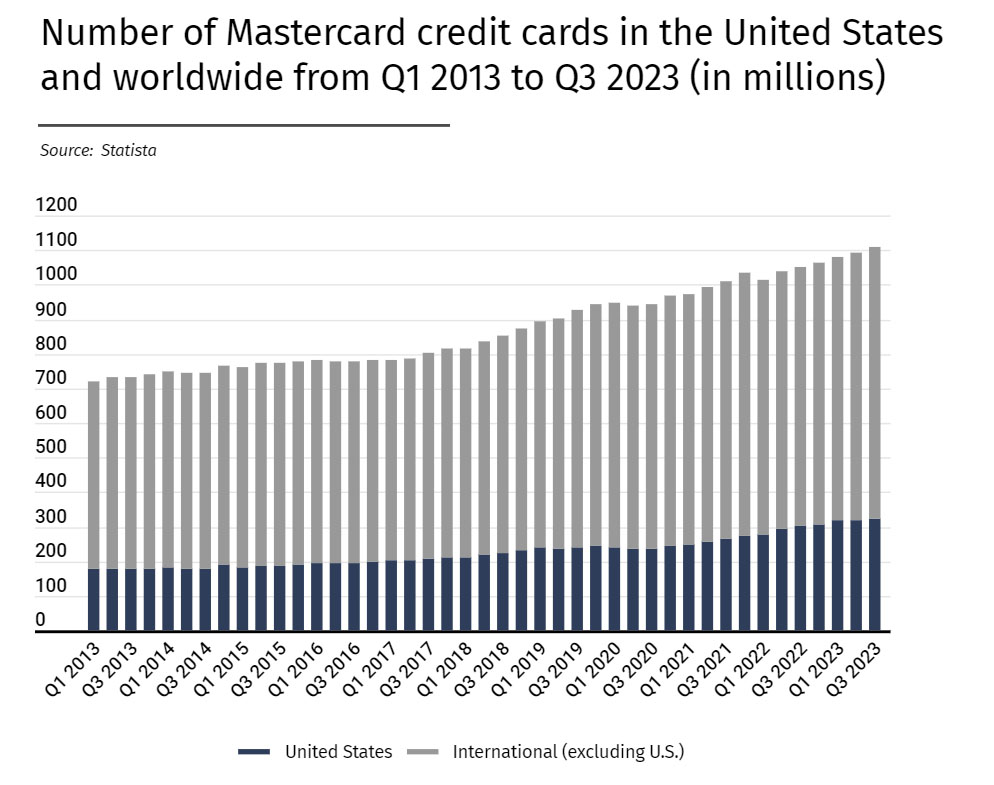

However, Mastercard saw even more significant growth.

However, Mastercard saw even more significant growth.

Statistics show the total number of Mastercard credit cards in the U.S. increased by 22 mln year-over-year and hit 323 mln in Q3.

U.S. credit card industry growing faster

Thanks to a sizeable share of Americans who use Visa and Mastercard regularly, the U.S. credit card industry is growing faster than the global market.

Over the past year, the total number of Visa and Mastercard credit cards in the United States jumped by 37 mln, or more than 5%.

On a global level, the growth was a bit smaller, with the total number of credit cards of the two providers rising by 92 mln or 4% year-over-year.

As of Q3 2023, there were 2.38 bln Visa and Mastercard credit cards worldwide, up from 2.29 bln in the same period last year.

As of Q3 2023, there were 2.38 bln Visa and Mastercard credit cards worldwide, up from 2.29 bln in the same period last year.

Tens of millions of new credit cards and the surging number of transactions have helped both credit card providers to hit a record payment volume.

Statistics show Visa hit $6.2 trln in total payment volume between January and September, 42% more than in the same period a year ago and $324 bln more than in the entire 2022.

Mastercard’s nine-month payment volume jumped by 10% and hit an all-time high of over $3 bln.

The impressive results have helped the credit card issuer to add almost $85 bln to its stock value year-over-year. In November 2022, Mastercard’s market cap was around $300 bln, and now it’s nearly $385 bln.

According to the AltIndex platform, the overall sentiment for investing in Mastercard on the top investing forums is positive. The company has a sentiment score of 78 out of 100 and overperforms most of its industry peers.