US chipmaker Nvidia (NVDA) is having another fantastic year. After ending 2023 as the best S&P 500 performer, with a whopping 236% gain, the AI giant added over one trillion dollars to its stock value in Q1, or 15% more than in the entire 2023.

The company’s 2024 price rally has brought investors 70% gains. However, its five-year investment return is even more impressive.

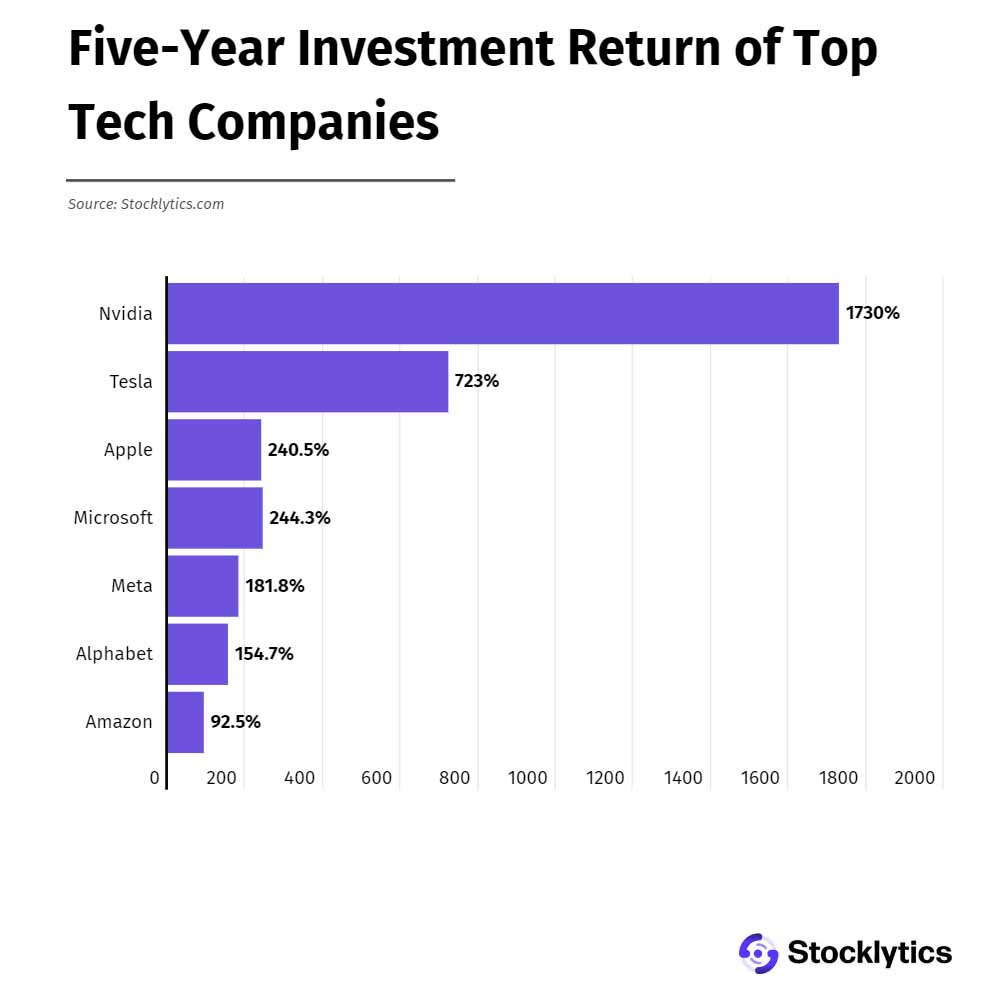

According to data presented by Stocklytics.com, Nvidia’s five-year investment return hit a whopping 1,700%, seven times more than Apple’s and 18 times more than Amazon’s.

$1,000 5 years ago worth $18,000 today

Ever since revealing how much it expects to profit from the rise of artificial intelligence, Nvidia’s stock has been on a meteoric rise.

Last year, the US chipmaker added almost $880 bln to its stock value, rising from $359 bln in January to over $1.1 trln in December. While this is quite an impressive gain, the company managed to outdo it in the first three months of 2024 after adding more than $1 trln to its market cap.

Although many investors are questioning whether Nvidia stock is in a bubble, its strong fundamentals and growth potential show it’s on a stable path, and those who have invested in it have seen quite impressive gains.

According to Stocklytics data, Nvidia’s five-year investment return hit over 1,700%, much more than any other tech giant.

Assuming an investor bought $1,000 worth of Nvidia stocks in April 2019, they would have picked up 22 stocks priced at around $46. Since then, NVDA’s price has jumped more than eighteen times and hit $846 last week, turning that $1,000 investment into $18,200.

Nvidia’s five-year investment return is even more impressive when compared to other tech giants.

Tesla saw 723% return in 5 years

The world’s most valuable car producer and AI giant, Tesla (TSLA), has the second-highest investment return in five years at 723%, or less than half of Nvidia.

Apple (AAPL) and Microsoft (MSFT) stocks brought around 240% gains to their investors in the same period. Meta, Alphabet (GOOGL), and Amazon (AMZN) follow with 181%, 154%, and 92% gains, respectively.

Besides bringing impressive profits to its investors, Nvidia’s stock price rally has helped the company add more than $2 trln to its stock value in the past five years.

Statistics show the US tech giant’s market cap stood at around $113.7 bln in April 2019. Since then, this figure has jumped more than eighteen times, reaching over $2.1 trln last week.

This impressive growth has turned Nvidia into the third-largest tech company in the world by market cap, ahead of Amazon, Alphabet, and Meta Platforms and right behind the industry’s giants, Microsoft and Apple.