By Justin Begley, Moody’s Analytics

Despite a resilient U.S. economy, the mood on Main Street continues to be dour. In November, the NFIB’s small business optimism index ticked down slightly to 90.6 and has been stuck below the long-run average of 98 since January 2021.

Among the concerns facing U.S. small businesses are labour constraints, inflation and taxes, each of which are weighing on both their assessments of current and future economic conditions.

Labour

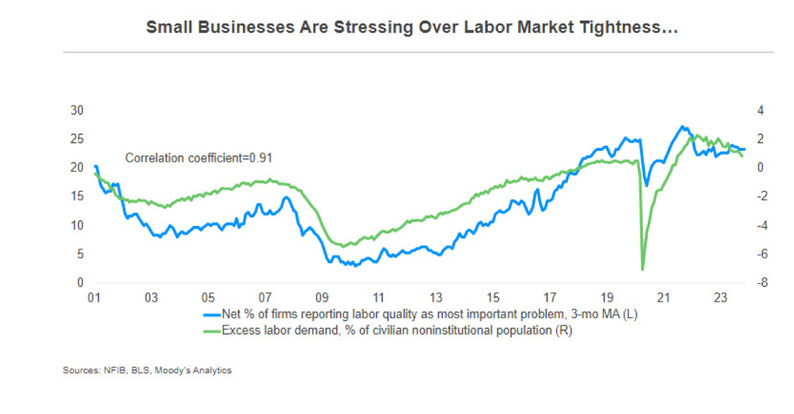

Since June, the availability of qualified labour has been the leading concern for small businesses. Most are still trying to hire, despite their pessimistic outlook. In November, the net percentage of respondents planning to increase employment rose 1 percentage point to 18%.

Moreover, a net 40% of respondents to the NFIB survey reported having job openings that were hard to fill, while 93% of those seeking to fill open positions reported having few or no qualified applicants. Tightness in the labour market, therefore, seems to be causing aggravation for Main Street.

Indeed, as labour demand— defined as employment plus job vacancies—soared beyond labour supply in the wake of the pandemic, more and more small businesses reported labour constraints as their chief problem. The correlation coefficient between excess labour demand and the net percentage of firms reporting labour quality as their most pressing issue is 0.91.

Small businesses should soon experience some relief, however, as the job market loosens with the influx of new workers. In November, more than 500,000 new workers entered the labour force, bringing the yearly total to 3.3 million.

Prime-age (25-54) labour force growth has slowed considerably since the beginning of the year, suggesting that the recent uptick in labour supply is coming from younger and older workers. Nevertheless, new prime-age workers represent three-fifths of the labour supply gains this year, which should soon alleviate at least some of the shortage in qualified applicants that Main Street is reporting.

Prices

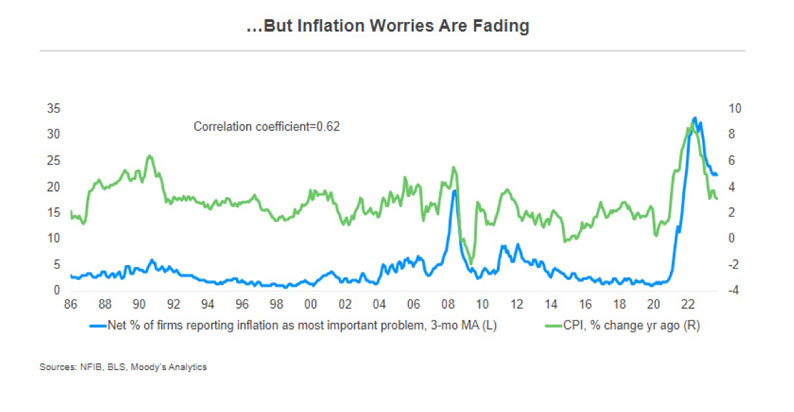

As the labour market loosens, wage-related pressures on inflation will dissipate. Beginning in February 2022, inflation was the single-most cited problem facing small businesses for more than a year. However, Fed rate hikes have resulted in slower price growth.

In November, the consumer price index was up 3.1% on the year, down from June 2022’s peak of 9%. While inflation remains above the Fed’s 2% target, it is clearly on the right trajectory, alleviating some of the cost pressures facing small businesses.

To be sure, Main Street still views inflation as a problem— and a net 34% of small firms plan to raise prices over the next six months to offset cost pressures—but not nearly as much as it did a year ago.

To be sure, Main Street still views inflation as a problem— and a net 34% of small firms plan to raise prices over the next six months to offset cost pressures—but not nearly as much as it did a year ago.

Taxes

One other concern that seems to always be on the mind of small business owners is taxes. There is a moderate-to-strong positive correlation between the effective corporate tax rate—calculated as the ratio of total taxes paid by corporations and before-tax corporate profits reported by the Bureau of Economic Analysis—and the net percentage of owners reporting taxes as the chief problem facing their business. In November, a net 14% of small firms said taxes were their biggest problem.

Although, this is well below the long-run average of just over 21%, as the effective tax rate on corporations is well below its long-run average of about 29%. In other words, most small businesses recognize that their tax burdens could be significantly higher than they currently are and so are not stressing too much about paying Uncle Sam.