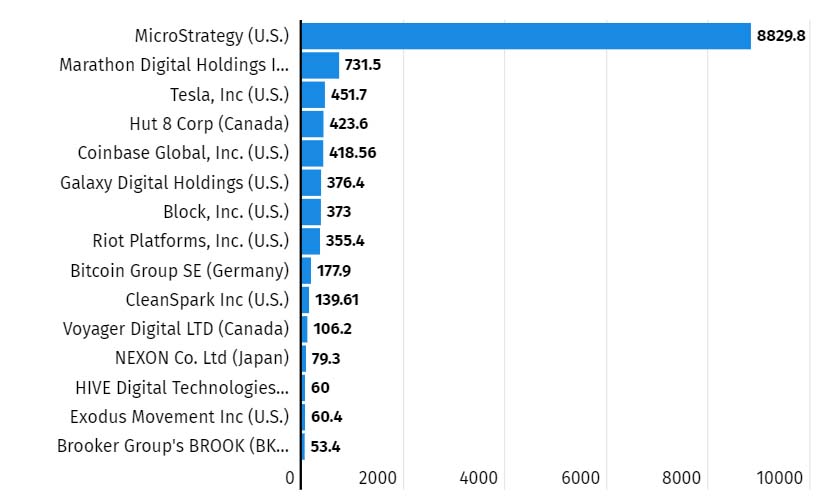

MicroStrategy had by far the largest Bitcoin holdings worth over $8.8 bln as of last week, 17 times more than Tesla and 21 times more than Coinbase, according to data presented by AltIndex.com.

Although Tesla (TSLA) made headlines three years ago with its announcement of investing in Bitcoin, data mining and business intelligence software giant MicroStrategy (MSTR) quickly took over its place as the public company with the largest BTC holdings.

Before 2021, the idea that publicly traded corporations might buy Bitcoin for their reserves raised eyebrows or was even considered laughable.

But ever since the crypto market boom three years ago, several major firms have continued buying hundreds of millions of dollars worth of Bitcoin, pushing their total holdings in the world’s largest cryptocurrency to impressive figures. Still, one name stands out among them.

That year alone, MicroStrategy held over $5 bln in the flagship cryptocurrency, twice Tesla’s BTC holdings, showing the company doubled its investment in less than a year.

The downside was that MicroStrategy used more than $1.6 billion in convertible debt to finance this. However, unlike some other major companies, MicroStrategy has continued investing in BTC ever since.

Waiting for BTC halving

Many investors are hoping that the BTC selling price goes from strength to strength, perhaps buoyed by the halving event in April.

“The post-ETF sell-off in bitcoin didn’t last very long and a break above $50,000 will be widely viewed as a significant milestone in its comeback,” said Craig Erlam, Senior Market Analyst, UK & EMEA at OANDA.

“It’s been a rough couple of years, but the ETF approvals were an important achievement that’s helped propel the price higher,” he said.

The Statista and Bitcoin Treasuries data show MicroStrategy’s BTC Holdings increased by 53% in the past three years and hit more than $8.8 bln this month, much more than any other public company owns.

Far below, Marathon Digital Holdings (MARA) ranked second with $731.5 mln in total BTC holdings, up from $330 mln the company owned three years ago.

Once the biggest Bitcoin buyer among public companies, Elon Musk’s Tesla dropped to third place.

Statistics show Tesla now holds $451.7 mln in Bitcoin, almost six times less than three years ago when the crypto boom started. Bitcoin mining giant Hut 8 Corp and Coinbase follow, with $423.6 mln and $418.5 mln in BTC holdings, respectively.

The Bitcoin Treasuries data also showed that, besides these five largest Bitcoin buyers, another 33 public companies have invested in buying BTC. The total value of their combined Bitcoin holdings hit over $13 bln last week.

In regional comparison, American and Canadian companies lead in BTC investments.

Statistics show that two-thirds of all companies that have invested in the world’s most expensive crypto come from the two countries. Europe counts five Bitcoin buyers among public companies, and Asia follows with only three.