Real activity growth in Cyprus is expected to continue this year at a similar pace as in 2023 and to gather momentum in 2025, according to a quarterly survey published by the University of Cyprus.

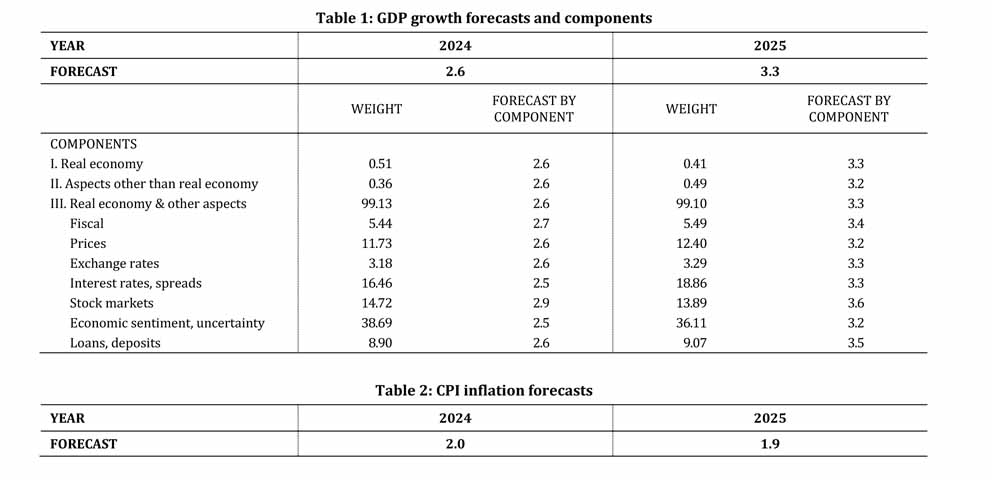

The April ‘Economic Outlook’ produced by the university’s Economics Research Centre expects real GDP growth at 2.6% in 2024 and at 3.3% in 2025. The growth forecasts have been revised up, by 0.2 percentage points for 2024 and by 0.1 percentage point for 2025, relative to the January issue.

Economic growth in Cyprus slowed to 2.5% in 2023, from 5.1% in 2022. In the final quarter of 2023, the year-on-year (y-o-y) growth rate of real GDP moderated to 2.2%, compared with 2.4% in the third quarter, but remained well above the EU average.

Economic activity and the labour market in Cyprus remained resilient in the final quarter of 2023, fuelling growth in the following quarters.

Over the last two quarters domestic activity has been backed by falling inflation, a relatively tight labour market, increases in earnings, and the strong fiscal position.

However, the high levels of domestic interest rates, sliding domestic economic sentiment, and weak activity in trading partner economies weigh on the growth outlook.

Forecasts by other organisations point to a robust growth outlook in 2024 and 2025.

Real GDP growth in Cyprus for 2024 is forecast at 2.8% by the Central Bank and the European Commission, and at 2.7% by the International Monetary Fund.

Growth in 2025 is projected to pick up to around 3.0% by the above organisations (3.1%, 3.0% and 2.9% according to the Central Bank, the European Commission, and the International Monetary Fund, respectively).

Inflation is projected to remain on a downward trajectory over 2024-2025. CPI inflation is forecast at 2.0% in 2024 and at 1.9% in 2025, lower by 0.1 percentage point in each year vis-à-vis the forecasts in the January issue of the ‘Economic Outlook’, as domestic inflation eased further during the first quarter of the current year.

Risks to the outlook for growth and inflation stem primarily from increased geopolitical tensions, especially a possible escalation of the conflict in the Middle East, the economic performance of trading partner economies, and the future path of interest rates.