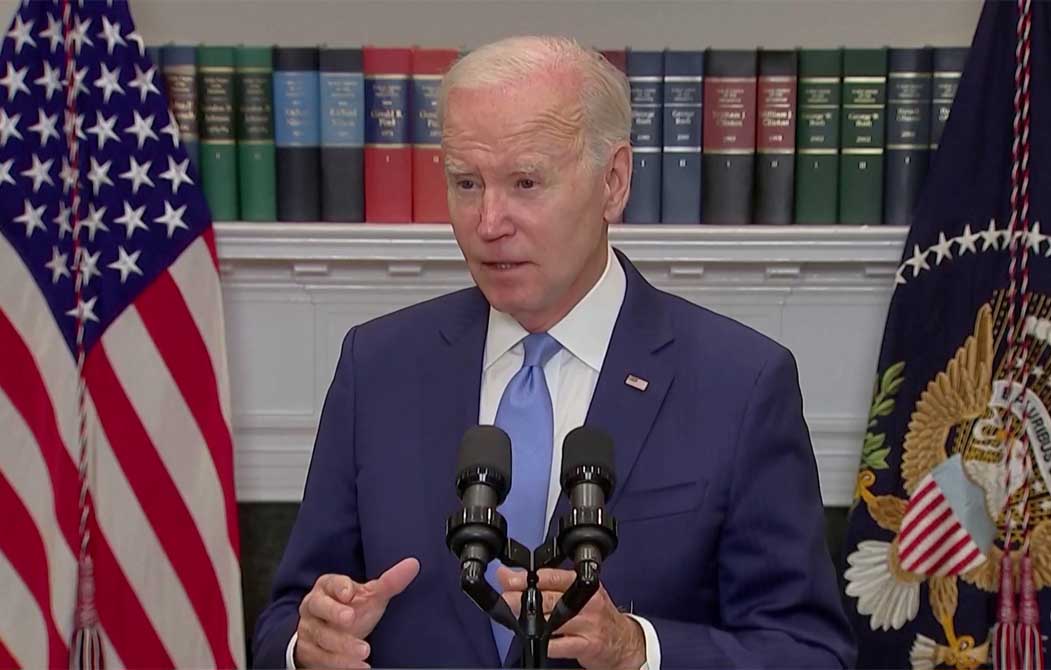

Oil prices will surge further, impacting the global economy and investors, if U.S. President Joe Biden fails to cool rising tensions in the Middle East during his visit to the region, warned the CEO of a leading independent financial advisory and fintech.

An Israeli air raid reportedly struck a Gaza City hospital on Wednesday morning, killing at least 500 people, according to health authorities, and hours before President Biden will land in Israel – Washington’s closest ally in the Middle East – for a high-stakes visit with regional leaders.

Jordan, which was also meant to host Biden for a summit with King Abdullah II, Egyptian President Abdel Fattah el-Sisi and Palestinian Authority President Mahmoud Abbas, has cancelled the meetings.

“Oil prices rallied 2% following the deadly explosion at the Gaza hospital as it boosts tensions across the Middle East just before the arrival of US President Joe Biden,” said Nigel Green of the deVere Group.

“Clearly, the US is a major influence in the Middle East due to its economic interests, military presence, national security concerns, strategic alliances, and diplomacy efforts.

“If the US President – who is, of course, one of the major powerbrokers – fails to cool rising tensions in the Middle East during his visit to the region, we expect oil prices to surge further.”

Rising hostilities, potential conflict and a prolonged crisis in the Middle East are likely to disrupt oil production, transportation, and exports in the region, explained Green.

“This could be due to attacks on oil infrastructure, shipping routes, or other bottlenecks that prevent the smooth flow of oil. Such disruptions will cause supply shortages, pushing up oil prices,” he noted.

Far-reaching impact

“The global economic impact is far-reaching. Rising oil prices lead to higher production costs for businesses, typically resulting in higher inflation. Increased prices for gasoline/petrol and energy-related products also squeeze consumers.

“Also, high oil prices weigh on economic growth because when the cost of energy rises, businesses often cut back on production, and consumers reduce their spending.

“Developing economies are particularly vulnerable to oil price spikes. Many of these countries rely heavily on imported oil, and surging prices can strain their trade balances and currencies.

“Oil price fluctuations have a direct impact on financial markets. A surge in oil prices contributes to stock market volatility, and this particularly hits industries sensitive to energy costs,” said the deVere CEO.

Green concluded that the Israel-Hamas war underscores the intricate web between geopolitical events, oil prices, the global economy, and investments.

“Unless President Joe Biden can effectively manage the rising tensions in the region, a further surge in oil prices is a real possibility, with potentially far-reaching implications.”