By Naeem Aslam

As geopolitical tensions escalate further after attacks by Israel on Iran, crude oil prices closed the week on a volatile note.

Interesting to note when it comes to oil prices is that despite so many anchored geopolitical tensions that have brought the Middle East to the brink of war, oil prices are still way off the highs that we saw earlier this week.

This indicates some important factors:

Traders have been concerned about oil prices amid the geopolitical tensions that started last year when the Israeli government started its military action in Gaza. The concern was that the actions taken by the Israeli government would have consequences, and risk traders started to bet on safe haven assets to seek safety.

Oil prices started their rally on the back of those events, and since then, the price has been very much trading in an uptrend. The overall focus has been on the supply side and on “what if” scenarios, which mainly involved Iran and Israel. When Israil bombed the Iranian embassy in Damascus, oil traders saw that as a massive risk to the oil supply, as Iran produces more than 3 million barrels per day and is an important part of the OPEC cartel.

The geopolitical tensions in the Middle East continued to anchor as Iran was pushed into the corner, and it was left with no choice but to react in light of the attacks by Israel on the Iranian embassy. The real price move happened in oil prices earlier this week (in the future’s market) when Iran’s retaliation attacks directly targeted Israel.

The US and its allies, among other countries, all called for cool heads to prevail, as no one wants to see another war breaking out, as the whole world is still very much under the influence of the Russia-Ukraine war. Now that Israel has also responded to those attacks, traders are looking at different scenarios altogether.

What Now

The fact that Israel has also attacked Iran, according to the reports, shows that perhaps the tit-for-tat reaction may be over. The reason that I believe that this may be the base case scenario is that the attack has been limited by the Israeli government, and Iran has fewer reasons to take any aggressive measures.

Oil traders are very much paying attention to this very fact, and it is this factor that moved the oil prices lower on Friday from their high.

What Is Next?

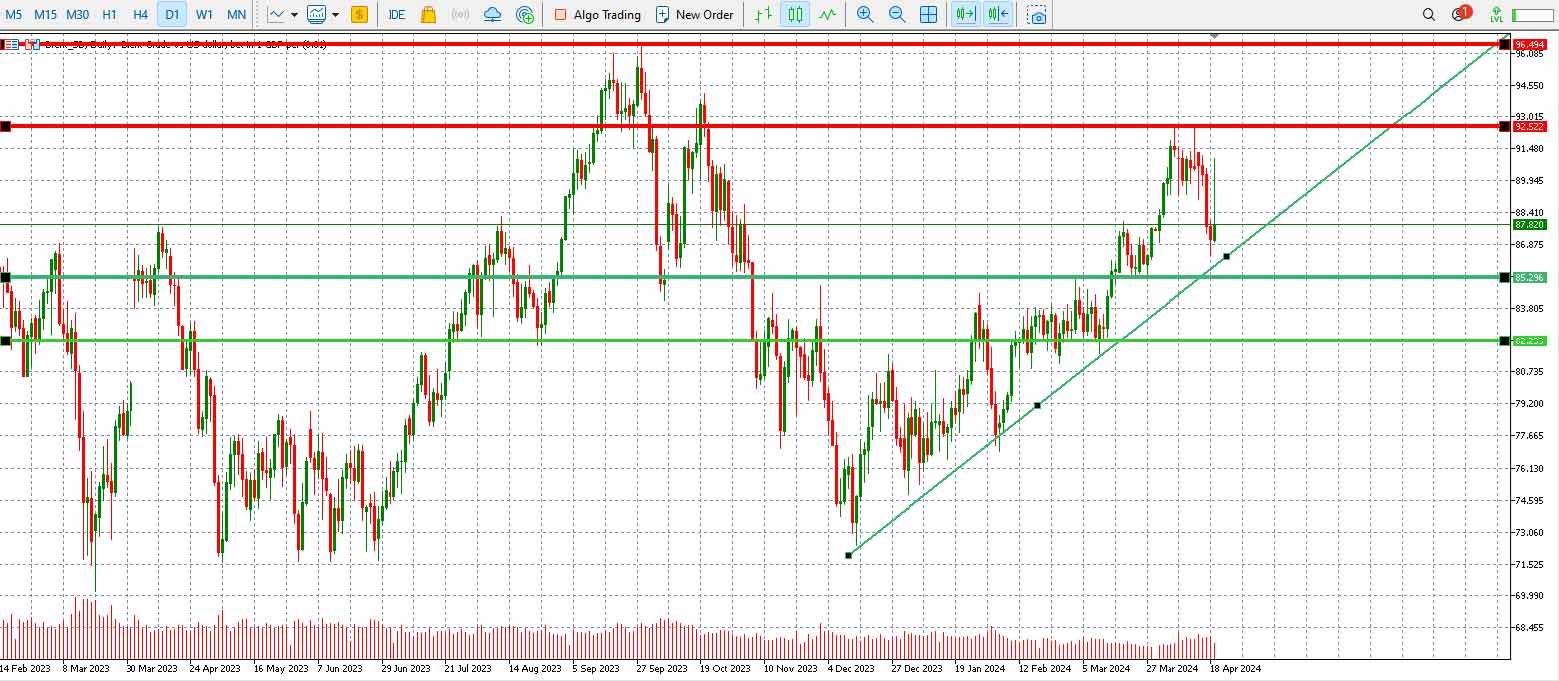

Looking at benchmark Brent crude prices, two things become very clear.

Firstly, the overall upward trend is still very much in play, and it is likely to hold its position as long as the price continues to trade above the green line.

The second is that despite all the events that have unfolded, the price is still very much set to close in negative territory, which really sends the message very loud and clear, that the whole out-of-war risk is still very limited and traders are not ready to price that in.

The only time that will happen is if the Brent price begins its journey above the $100 a barrel mark. The important support and resistance zones are shown on the chart below.

Naeem Aslam is Chief Investment Officer at Zaye Capital Markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Zaye Capital Markets.