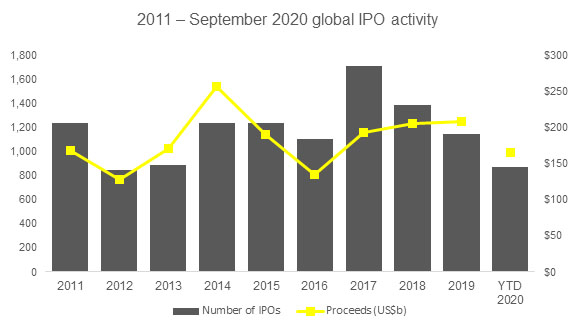

Initial public offerings (IPOs) saw the most active third quarter in the last 20 years by proceeds, and the second highest third quarter by deal numbers, as travel slowed, work from home and the markets were awash in liquidity, according to the latest EY quarterly market report.

Year-to-date, IPO activity accelerated in Q3 2020, resulting in a 14% increase in total IPOs to 872, and an impressive 43% rise in proceeds of $165.3 bln, as published in EY Global IPO Trends: Q3 2020.

And the outlook for the rest of 2020 is just as rosy.

“Although market sentiment can be fragile, the scene is set for a busy last quarter to end a turbulent 2020 that has seen a strong IPO performance,” said Stelios Demetriou, Partner and Head of Strategy and Transactions Services, EY Cyprus.

“The US presidential election, as well as the China-US relationship post-election, will be key considerations in future cross-border IPO activities among the world’s leading stock exchanges. Despite the uncertainties, companies and sectors that have adapted and excelled in the ‘new normal’ should continue to attract IPO investors.”

The Americas saw 188 IPO deals raise $62.4 bln in proceeds, up 18% and 33%, respectively, while Asia-Pacific saw 554 IPOs raise $85.3 bln in proceeds, rising 29% and 88%, respectively. Both markets have already exceeded YTD 2019 levels.

While the EMEIA region (Europe, Middle East, India, Africa) rose quarter over quarter, the region is still down YTD by 27% in IPOs (130) and 24% decrease in proceeds ($17.6 bln). Cross-border IPO activity levels have held steady by deal numbers and proceeds, accounting for 8% and 10% of global IPO activity, respectively.

As for sectors, technology, industrials and healthcare once again topped the ranks.

As for sectors, technology, industrials and healthcare once again topped the ranks.

Technology saw 210 IPOs raise $53.9 bln, industrials saw 168 IPOs raise $23.3 bln and health care saw 159 IPOs raise $33.3 bln.

Americas picked up pace in Q3

IPO activity in the Americas year-to-date gained momentum, seeing an 18% increase in IPOs (188 total deals) and 33% increase in proceeds ($62.4 bln), exceeding 2019 YTD levels.

While the healthcare sector dominates YTD in number of IPOs (71), the technology sector leads in proceeds, raising $22.3 bln through the quarter in the Americas. The Americas have proven to be the birthplace of unicorn IPOs, launching 12 of 2020’s 18 IPOs in Q3 alone.

So far this year, Asia-Pacific IPO activity has surpassed YTD 2019 activity by both volume (29%) and proceeds (88%). Activity in the region accelerated in part due to COVID-19 pandemic-related government stimulus policies.

EMEIA gains momentum

Following a slower H1 2020, EMEIA IPO markets gained significant momentum in Q3 2020 with deal numbers increasing 34% and proceeds up 49% from Q3 2019, due in part to several large IPOs in the region. The region’s big winners are those riding on the tech digitalisation wave – in particular technology, industrial and healthcare sectors.

In Europe, markets are beginning to rally, with Q3 2020 IPO numbers up 48% and proceeds increasing 51% compared to Q3 2019. At the same time, the UK IPO activity was a boon for EMEIA as a whole with a mega IPO demonstrating the available liquidity of the market and showcasing international investor interest for the right deal.

Q4 2020 outlook: expect the unexpected

This year has been nothing if not unpredictable. As we move into the final quarter of the year, investors may look to lock in profits as soon as they see signs of market uneasiness.

A divergence between economic well-being and GDP, and stock market valuations, are also causing anxiety among some investors around thye world. While there are some unknowns in the US-China trade tensions, the outcome of the US presidential election and uncertainties still surrounding Brexit, the outlook for Q4 remains positive with a healthy spread of deals in the pipeline across many markets.

As long as the window of opportunity remains open, it is expected that deals will continue to be made, concluded the EY report.