Emerging markets continue dominating the global IPO landscape, with the stock exchanges from China and India seeing more deals and proceeds this year than their US or European counterparts.

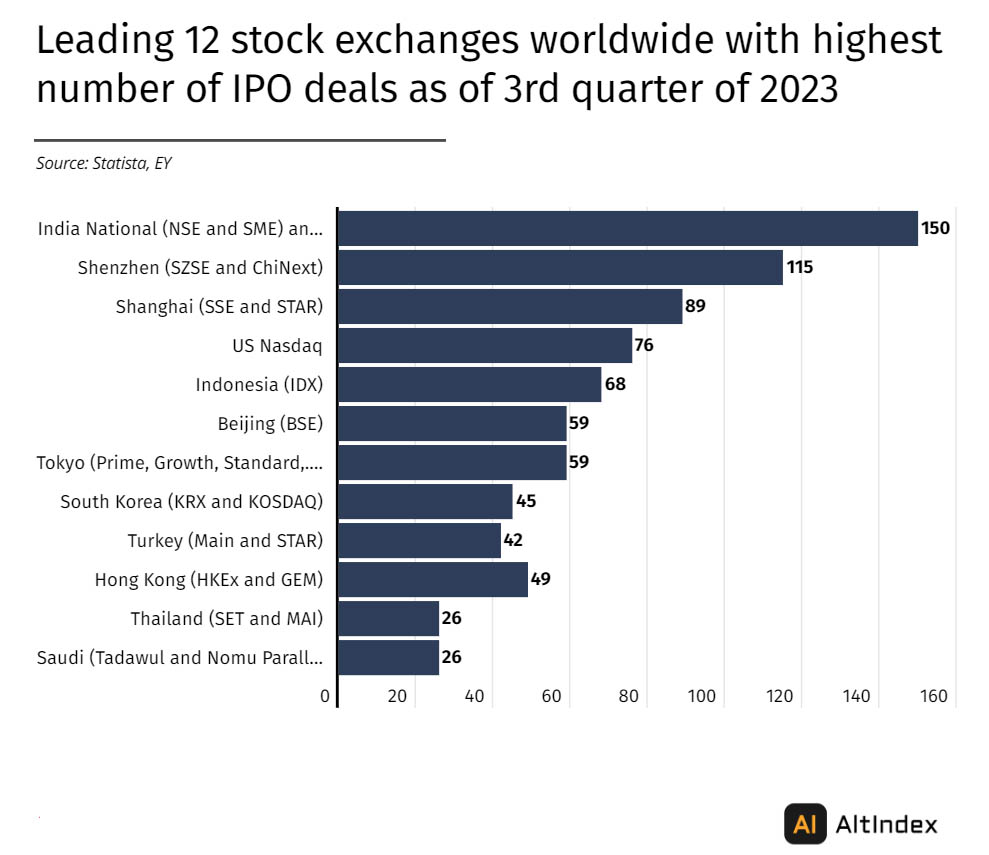

The National Stock Exchange of India and the Bombay Stock Exchange lead in initial public offerings with 150 deals in the nine months of the year, nearly double the US Nasdaq, according to data presented by Altindex.com.

The latest Ernst & Young Global IPO Trends survey recorded 968 IPO deals in the nine months of 2023, 5% less than last year, and $101.2 bln in total proceeds, 32% less than a year ago.

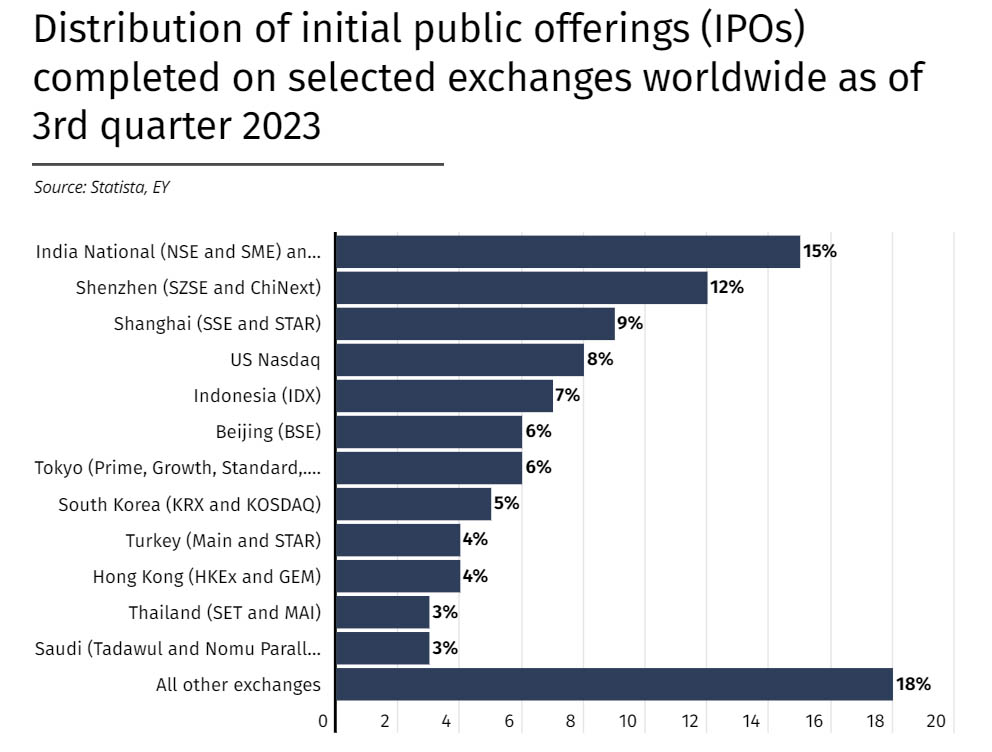

The emerging markets collectively made up 77% of the global share by number and 75% by value in the nine months, despite a slowed momentum from mainland China.

Statistics show that between January and September, the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) were the leading stock markets in terms of IPO activity, with a total of 150 deals, or 15% of the world’s total throughout this period.

Statistics show that between January and September, the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) were the leading stock markets in terms of IPO activity, with a total of 150 deals, or 15% of the world’s total throughout this period.

The Shenzhen Stock Exchange ranked second with 115 IPO deals and a 12% share in the first three quarters of 2023.

Shanghai Stock Exchange saw 89 IPO deals, representing 9% of the total. US Nasdaq came fourth with 76 deals (8% share), followed by Indonesia and Beijing stock exchanges, which saw 68 and 59 deals, respectively.

China leads in value

While Indian stock exchanges saw the highest number of deals, the Chinese stock exchanges led in the total value of proceeds.

The EY survey showed Shanghai was the leading stock market in terms of IPO proceeds, raising $26.2 bln in nine months, more than double that of Nasdaq.

Shenzhen was second on the list, with IPO proceeds reaching $19 bln. Nasdaq and New York Stock Exchange ranked behind the Chinese stock markets, with $10.6 bln and $8.2 bln in total value of proceeds, respectively. Far below, the Abu Dhabi Securities Exchange followed with $3.7 bln.

Shenzhen was second on the list, with IPO proceeds reaching $19 bln. Nasdaq and New York Stock Exchange ranked behind the Chinese stock markets, with $10.6 bln and $8.2 bln in total value of proceeds, respectively. Far below, the Abu Dhabi Securities Exchange followed with $3.7 bln.

The growth of IPO activity in emerging markets is even more impressive when comparing their market share throughout the years. Ten years ago, these markets made up roughly 45% of the global share by number and 40% by total value of proceeds.

Since then, the number of IPO deals and the total value of proceeds from the emerging market has grown by more than 30%, with these markets today representing three-quarters of the global IPO landscape.