Since the corona crisis has paralysed life in the United States, cannabis sales on some days have almost doubled. On March 16, around 90% more marijuana was sold in California than in the previous months.

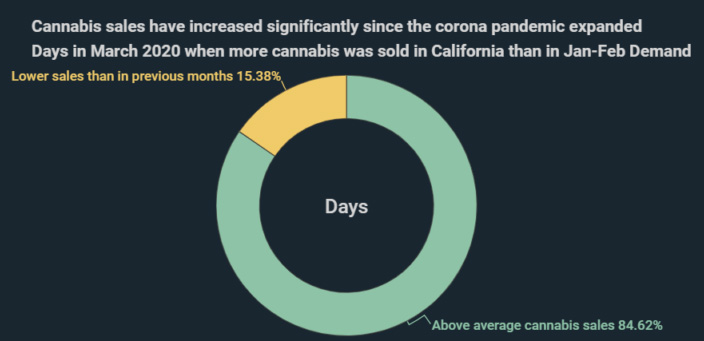

Cannabis companies reported a sales increase on 22 out of 26 days in March compared to the previous months – as shown in a new infographic by the cryptocurrency news site Kryptoszene.de.

The demand increased in particular in the second week of March. According to the infographic, the online retailer “Weedmaps” had reported that 66% more customers picked up cannabis products than in the previous week.

In particular, the proportion of women among cannabis buyers has increased since the spread of coronavirus. The increase in cannabis purchases by gender saw purchases by women up 31.7% while the increase among men was 15.6%.

Meanwhile, buying behaviour in the U.S. varies by generation. The proportion of marijuana purchases among baby boomers has even decreased by 2.1%. On the other side, the youngest Generation Z, born between 1997 and 2012, has seen the biggest increase of all generations – 42.1%.

“Although the coronavirus is fuelling the demand for cannabis, listed corporations in the industry don’t seem to be benefiting yet,” said Kryptoszene analyst Raphael Lulay. “Some of them have suffered price losses. One possible reason for this – overproduction. The companies still store tons of cannabis unused.”

Sales are increasing everywhere, not only in the United States. However, there is no exact data on sales and sales growth worldwide.

In Europe, although the Dutch health minister emphasised that it was unnecessary to hoard things, long lines formed in front of marijuana shops in mid-March.

As regards the fortunes of the cannabis retailers and distributors, data suggest that cannabis shares and listed companies are supposed to profit from the recent rises in sales. A look at the latest developments, however, shows that that is not the case.

Canopy Growth stocks lost around 21% in value in the past month. Tilray has lost as much as 51%. As shown on the infographic, the fall of DAX and Dow Jones indices is significantly lower – by 17% and 12%, respectively.