Increased mortgage rates have dashed dreams of owning a home, leaving many in a catch-22 situation as rents are rising, exceeding what families pay in monthly instalments for a housing loan.

Interest rates on mortgages could reach 5%, from 2.5% by the end of next year, affecting the buyer’s cost.

Meanwhile, the housing market has entered a new cycle of price increases, especially in the capital Nicosia.

For a €200,000 mortgage, to be paid over 20 years at an average market interest rate of 4.5%, the monthly instalment is around €1,270.

This is just under the average salary in Cyprus; according to the statistics, the median wage in Cyprus is €1,573.

Meanwhile, interested parties should have a deposit set aside to finance at least 30% of the property’s value.

Essentially, with €200,000, borrowers can buy an apartment of less than 100 sqm, most probably not new.

If the property’s value is higher, this means a higher loan amount.

Cyprus banks provide plans, which in the first years have a fixed interest rate, so the loan instalment does not change depending on the policies followed by the ECB.

According to data from Danos RICS, rents in 2023 could double in some areas.

Danos notes rents in Larnaca could double from €4.5-€5 per square metre to €6 to €10 monthly.

Similarly, Paphos rents are expected to increase from between €4.5 to €5.5 to €5 to €10.

This means renting a 100 square metre flat in Larnaca or Paphos could cost a family €1,000 a month.

Famagusta rent rates are also to go up from €4 to €5, to €5 to €8 per square metre.

In Limassol, prices are to increase from €7 to €14 per square metre, to €10 to €15, with an almost 50% increase for lower-end properties.

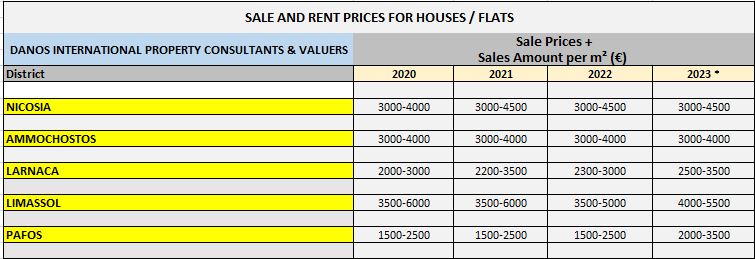

The cost of buying a home in the capital and Famagusta is expected to remain the same in 2023, pushing up by up to 15% and 20% in Larnaca and Limassol.

Obtaining property in Paphos will cost buyers up to 40% more.

With house prices increasing and borrowing costs increasing, Cypriots on the lookout for their new home have a lot to consider.

Borrowers also need access to between 20% and 30% of the money needed for a deposit to buy the property and meet the basic banking criteria, such as a steady income.

The interest rate on home loans rose to 2.95% in November, compared to 2.93% the previous month.

According to the Central Bank, the effective annual rate borrowers must pay is 3.63% in November 2022, from 2.86% in 2021 to 2.78% in 2020.