By Moody’s Analytics

U.S. consumers finally got a little relief on the inflation front in July because of a significant decline in gasoline prices, but the Federal Reserve isn’t going to celebrate as one month isn’t a trend.

The consumer price index was unchanged in July, compared with our forecast for a 0.1% gain and the consensus forecast for a 0.2% increase. This comes on the heels of a 1.3% gain in June.

The CPI for energy was down 4.6% in July after rising 7.5% in June. Within energy, the CPI for gasoline dropped 7.7%, shaving 0.4 percentage points off the monthly changes in the headline CPI.

Food prices continue to rise at a rapid pace, up 1.1% in July, which is the third consecutive monthly gain of at least 1%. Excluding food and energy, the CPI was up 0.3%, weaker than the 0.7% gain in June.

Lower jet fuel prices cut into the CPI for airfares. The CPI for airfares fell 7.8% in July, the second consecutive monthly decline. Apparel prices slipped 0.1% in July after rising 0.8% in June.

The CPI for owners’ equivalent rent rose 0.6%, a little softer than the 0.7% gain in June. The CPI for rent of primary residence increased 0.7%, softer than the 0.8% gain in June. Owners’ equivalent rent was up 0.6%, compared with the 0.7% gain in June. Rents are normally fairly sticky, but will likely accelerate in August, with growth peaking this summer.

All told, it was a better CPI report, but inflation is still high and costly. With the CPI up 8.5% on a year-ago basis in July, the typical American household now needs to spend $460 more per month to buy the same goods and services as it did last year.

Decomposing inflation

The issue facing the Federal Reserve is that, even though there is a lengthy list of forces driving inflation higher, the massive shocks to the supply side of the economy, including the Russian invasion of Ukraine and the COVID-19 pandemic, are far and away the most important.

The removal of monetary policy accommodation will not solve the supply-side issues that are behind our inflation problems.

The removal of monetary policy accommodation will not solve the supply-side issues that are behind our inflation problems.

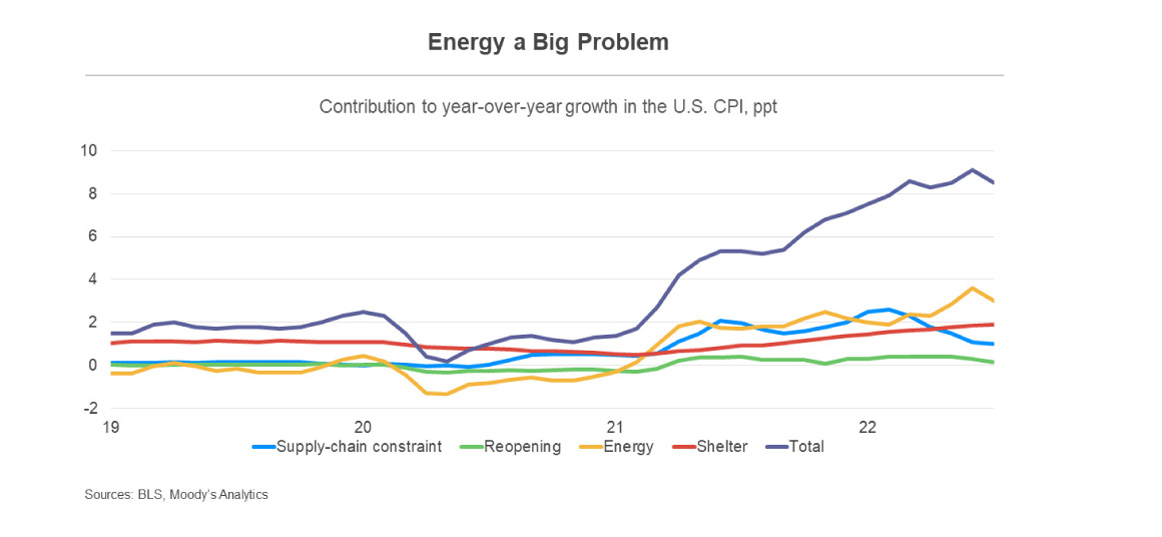

There was a sizable decline in energy prices in July, particularly gasoline. However, energy is still adding a ton to year-over-year growth in the CPI. Energy prices added 3 percentage points to year-over-year growth in the CPI in July, compared with 3.5 percentage points in June.

There was slightly better news on supply-chain-linked inflation. Supply-chain-constrained components of the CPI added 1 percentage point to year-over-year growth in the CPI in July, compared with the 1.1-percentage point contribution in June and was the smallest since April.

Energy is important to the inflation outlook. The forecast is for its contribution to year-over-year growth in the CPI to continue to decline. This is key as some of the stickier components of inflation are accelerating, including rents.

The CPI for shelter added 1.9 percentage points to year-over-year growth in the CPI in July, the largest since the early 1990s. This is nearly double the contribution seen prior to the pandemic. Growth in rents hasn’t peaked.

No change to our Fed call, markets rethinking

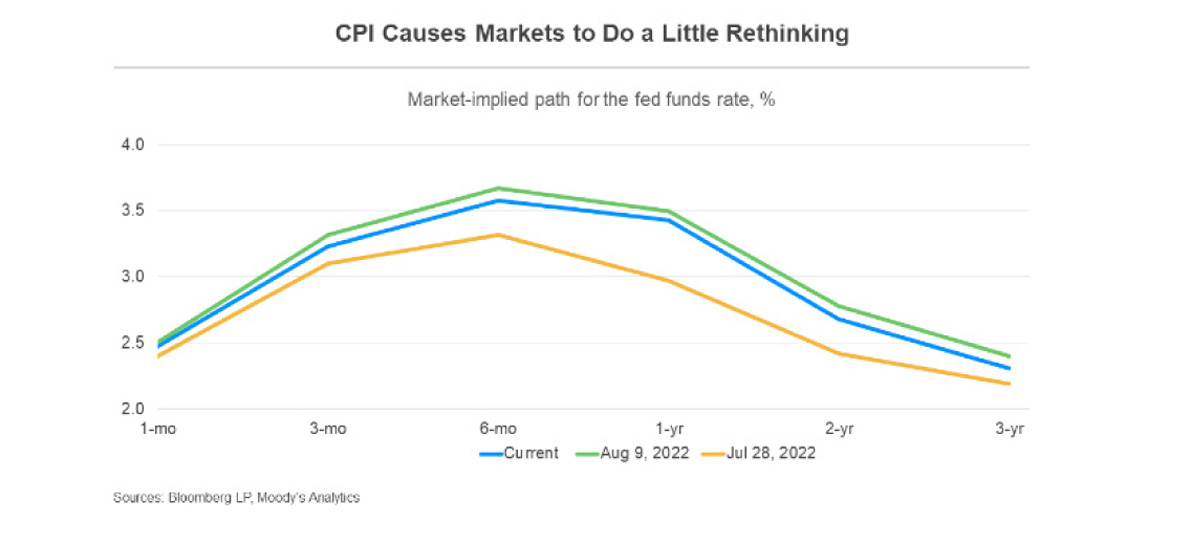

The July U.S. CPI has caused financial markets to modestly adjust their expectations for the path of the fed funds rate. Our baseline forecast is for the Fed to increase the target range by 50 basis points in September and then 25bp at each subsequent meeting until the fed funds rate hits 3.5%.

Our subjective odds of a 75bp hike in September have declined following the July CPI, but a lot can still happen between now and the September meeting of the Federal Open Market Committee.

Our subjective odds of a 75bp hike in September have declined following the July CPI, but a lot can still happen between now and the September meeting of the Federal Open Market Committee.

However, the August CPI should also be tame because of the ongoing decline in energy prices. Therefore, we’re increasingly comfortable with our baseline forecast.

Markets have tweaked their expectations and now anticipate 20bp less of tightening over the next year. The expectation for the fed funds rate is 11bp lower over the next two years and 8bp lower over the next three years.

The markets’ estimate of the terminal rate, or the rate where the fed funds rate peaks this tightening cycle, fell from 3.67% to 3.58%. Though expectations have been lowered, the implied path for the fed funds rate is still noticeably higher than what was expected on July 28, the day after the July FOMC meeting.

The Fed isn’t celebrating and one month isn’t swaying them.

Minneapolis Fed President Neel Kashkari said he hasn’t altered his view that the fed funds rate should be 3.9% at the end of this year and 4.4% in 2023. Kashkari has moved from the Fed’s most dovish regional Fed presidents pre-pandemic to one of the most hawkish. Separately, Chicago Fed President Charles Evans described inflation as “unacceptably high” and anticipated that rate hikes will continue into next year.

August U.S. CPI should be another good one

It’s never too early to start thinking about the next CPI report. There should be continued weakness in airfares, lodging away from home, and car rental prices as summer travel winds down.

Energy will also be another big drag. Changes in retail gasoline prices closely track changes in the CPI for gasoline. Retail gasoline prices in August point toward a 6.5% decline in the CPI for gasoline in August, which would reduce monthly growth in the headline CPI by 0.3 percentage point.

Energy will also be another big drag. Changes in retail gasoline prices closely track changes in the CPI for gasoline. Retail gasoline prices in August point toward a 6.5% decline in the CPI for gasoline in August, which would reduce monthly growth in the headline CPI by 0.3 percentage point.

This could be conservative as wholesale gasoline prices, which lead retail gasoline prices by one to two weeks, suggest that retail gasoline prices should be $4 per gallon toward the end of this month. Therefore, it wouldn’t be surprising if gasoline prices fall 10% in August, which would reduce growth in the CPI by 0.5 percentage point.

Growth in the CPI for food at home should also moderate in August as there is a lag between changes in diesel prices and changes in prices at grocery stores. There are also signs that used-car prices have been falling in August.

Depending on what happens with retail gasoline prices for the rest of August, early indications are that the headline CPI fell in August.

Q3 U.S. GDP on the rise

In each of the past two quarters, our U.S. high-frequency GDP model’s tracking estimate steadily declined as new source data were released, but the opposite is occurring so far in the third quarter.

There is still a ton of missing source data, but our tracking estimate has been climbing and is now at 1.5% at an annualised rate, compared with 1.3% prior to the new data on consumer prices and wholesale inventories.

The July CPI increased our tracking estimate of third-quarter real consumer spending to 1.8% at an annualised rate. Separately, wholesale inventories increased 1.8% in June following a 1.9% gain in May. This raised our estimate of the inventory build this quarter.

It still won’t duplicate the increase in the second quarter, but the drag on growth this quarter is smaller than previously thought. Inventories are on track to shave 0.6 percentage point off third-quarter GDP growth.