Although Russia does not account for a significant revenue share for Apple products, the tech giant’s exit will likely leave a mark on its smartphone sales that have been growing in the country.

Based on a 15% market share, estimating daily sales at about $3.1 mln, annual losses as a result of the Russia-Ukraine conflict could reach $1.14 bln.

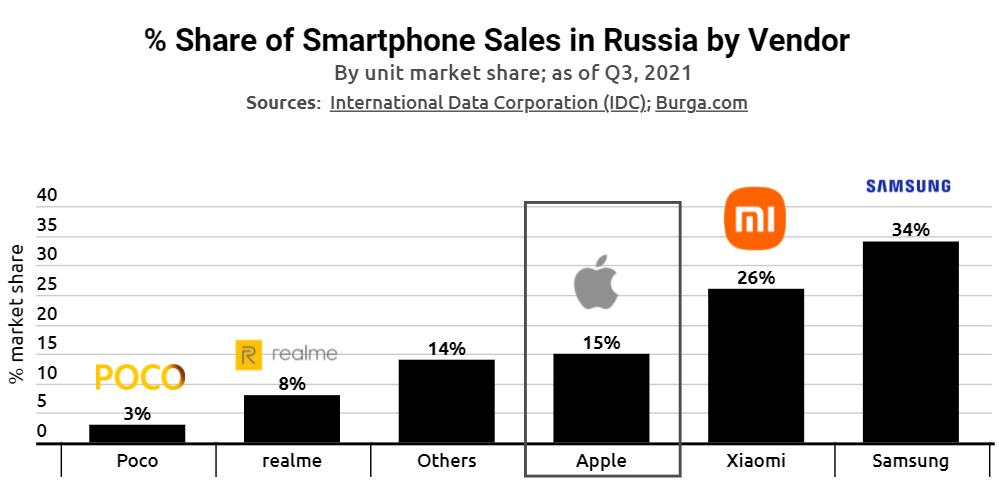

Data presented by premium smartphone accessories maker Burga indicates that based on vendor, Apple accounts for 15% of the Russian smartphone sales to rank third overall. South Korea’s Samsung occupies the pole position with 34%, followed by Xiaomi in the third spot at 26%.

Realme has a share of 8%, followed by Poco at 3%, while other smaller brands account for 14%.

Elsewhere, as of 2021, Russia’s smartphone sales stood at ₽730 billion ($7.6 billion). Therefore, based on Burga’s calculation, Apple might lose an estimate of at least $3 million in iPhone sales revenue daily or $1.14 billion annually.

Elsewhere, as of 2021, Russia’s smartphone sales stood at ₽730 billion ($7.6 billion). Therefore, based on Burga’s calculation, Apple might lose an estimate of at least $3 million in iPhone sales revenue daily or $1.14 billion annually.

The amount is based on Apple’s latest recorded Russian market share and the company’s revenue from sales as of 2021.

The revenue lost might be higher considering that Russia’s general smartphone sales income has risen steadily in the last few years. As of 2020, the revenue stood at ₽570 billion ($5.93 billion), while in 2019, the figure was at ₽500 billion ($5.2 billion). Overall, between 2014 and 2021, the figure has spiked almost 200%.

Rocky relationship

The Burga report acknowledges the tough relationship between Russia and Apple in recent years.

“Apple’s exit in Russia puts a close to the rocky relationship between the two entities,” according to the research report.

“Notably, Russia has in the past enacted questionable policies for companies like Apple to comply with. Apple had only recently adhered with a government mandate to open offices in Russia to offer online services there.”

After Apple’s decision on Russia, the move has placed pressure on other brands like Samsung that have also stopped shipping products to the country.

Consequently, the exit by the two manufacturers might be a window of expansion for Chinese operators that are likely to stay put.

However, such firms might suffer the impact of any follow-up sanctions that can bar companies from operating in Russia using U.S. origin technology.