Russia’s invasion of Ukraine and subsequent economic sanctions have increased risks to the global economic outlook, Moody’s Investors Service said in a report on Friday, adding that the magnitude of the effects will depend on the length and severity of the crisis.

The rating agency said rising prices for commodities from the region, such as oil, grains and metals, are increasing inflationary pressures, and that if disruptions and uncertainty translate into a significant and extended squeeze on liquidity, it would weaken funding conditions for high-yield issuers, and for some emerging market countries.

“Escalation of the military conflict would put Europe’s economic recovery at risk,” said Kelvin Dalrymple, VP-Senior Credit Officer at Moody’s.

“The rest of the world will be affected by commodity price shocks at a time when inflation is already high, and by financial repercussions from the sanctions against Russia and from financial market volatility.”

“The rest of the world will be affected by commodity price shocks at a time when inflation is already high, and by financial repercussions from the sanctions against Russia and from financial market volatility.”

Russia and Belarus will feel the most direct impact of sweeping sanctions imposed by the US and its allies. The sanctions will also have an indirect impact on foreign entities that do business with Russia. All of these developments could have knock-on consequences for the global economy.

Commodity price shocks

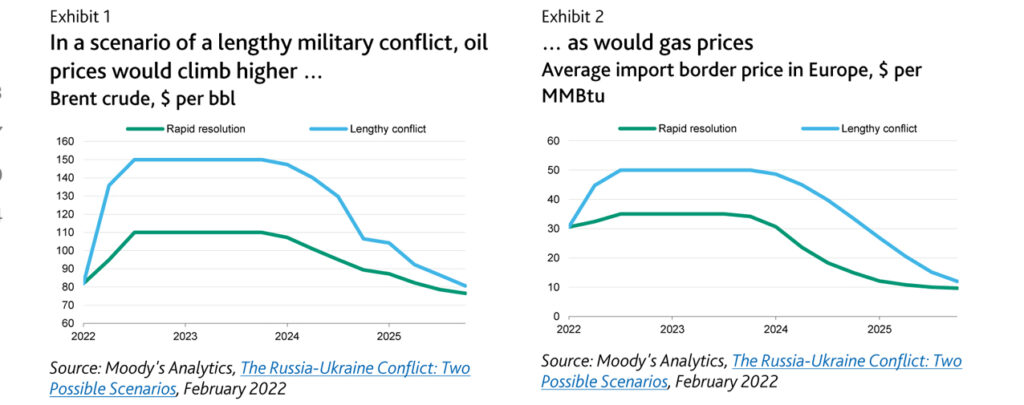

Commodity price shocks will increase inflationary pressures, particularly in economies that are heavy importers of Russian commodities.

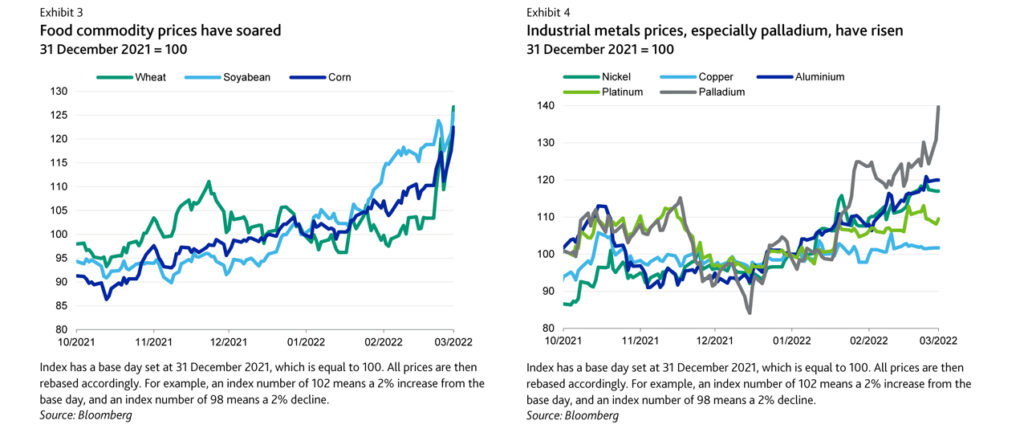

Since the invasion, oil prices have soared above $100 per barrel. Russia is a big producer of metals including aluminium, platinum, copper and palladium and their prices have also climbed because of the crisis.

While other countries that produce these metals will benefit from higher prices, consumers will face higher costs as the increases are passed on to them.

Russia and Ukraine dominate in global production of neon gas, a component in semiconductor manufacturing, which could further exacerbate chip shortages and supply problems in the auto industry.

The two countries provide roughly 14% of the world’s wheat supply and 25% of wheat exports.

Wheat and other grain prices have risen sharply following the invasion, even though the impact on food supply is mitigated as events are unfolding during the winter and not during harvest season.

Russia is a leading producer of soybeans, which is increasing in price. The cost of oil-based fertilisers is also likely to rise. Food price inflation, alongside other rising costs, could worsen social tensions in some countries.

Financial markets have been volatile since the invasion.

Financial markets have been volatile since the invasion.

Geopolitical uncertainty, higher commodity prices, escalating sanctions and regional business disruptions will weigh on market sentiment. If this translates into a significant and extended squeeze on liquidity, it would weaken funding conditions for high-yield issuers, and for emerging market countries that are reliant on global capital flows, some of which are already experiencing constrained access to financing.

Against this backdrop, the dollar continues to strengthen. So far, however, credit spreads in the euro area have widened only moderately, and are still below the peak during the start of the pandemic.