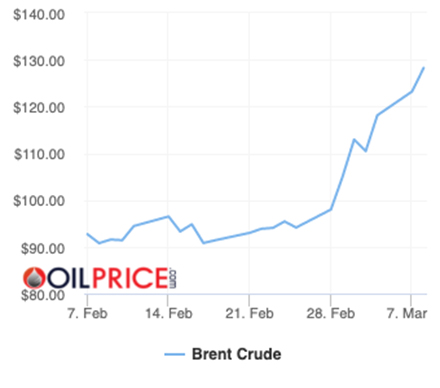

Ever since Russia’s invasion of Ukraine, the price of oil has been rising relentlessly.

On February 24, Brent crude was trading at $95/barrel. However, following President Biden’s announcement that the US is banning all Russian oil, gas, and energy imports, it rose to $134/barrel.

And it will rise further if more countries, in addition to the UK, follow suit.

This is more of a symbolic decision by the US, as last year, it imported only about 8% of its oil and refined products from Russia.

Others can easily cover this. But it is a lead, and the pressure on others to follow will only increase.

Nevertheless, the US petrol price increased to $4/gallon, the highest it has been since 2008 and is likely to increase further.

The EU is not participating, but it has proposed to make Europe independent from Russian fossil fuels well before 2030.

It hopes to reduce Russian gas imports by two thirds before the end of the year.

So, would that be the end of it? Highly unlikely.

Big companies, such as Shell, and oil traders, concerned about the possibility of escalating sanctions are now increasingly shunning Russian oil.

And while that is happening, the oil price will carry on rising.

These actions will not necessarily stop Russian oil exports that reached 7.8 million b/d in December.

Chinese buyers are waiting in the wings to buy any oil that becomes available, presumably on the cheap.

Even before these events, the oil market was very tight.

The IEA estimates that demand outstripped supply by 2.1 million b/d in 2021 and likely by 1.0 million b/d in 2022.

This led the oil price to rise to $90/barrel before the Ukraine events.

But all of this has now been upended by developments and sanctions, with more to come.

Oslo-based consultancy Rystad Energy said that further import bans could send global oil prices to $200/barrel.

When asked, OPEC Secretary-General Mohammad Sanusi Barkindo said: “We have no control over current events, as geopolitics have overtaken the market.”

“There is not enough capacity worldwide that would be able to make up for the loss of Russian supply… at about 7 million b/d of crude and fuel to global markets, Russia is the second-largest exporter of oil and liquids in the world.”

Following the news of US sanctions on Russian oil, Goldman Sachs hiked its Brent forecast for 2022 to $135/barrel from $98 and its 2023 outlook to $115 from $105.

It warned that the world economy could face the “largest energy supply shocks ever”, for a prolonged period, due to the key role of Russian energy.

Cyprus

Such prices could have a devastating impact on Cyprus’ energy prices – electricity, petrol, and diesel – for a prolonged period, impacting the economy in general.

It will also impact tourism.

Airlines will be unable to absorb such oil price hikes and will have little option but to pass it on to passengers through higher fares.

Little can be done in the short-term to ameliorate this, other than use revenues from the Emissions Trading System to reduce the impact of such high energy prices on vulnerable households.

Dr Charles Ellinas is Senior Fellow at the Global Energy Center, Atlantic Council

Tw: @CharlesEllinas