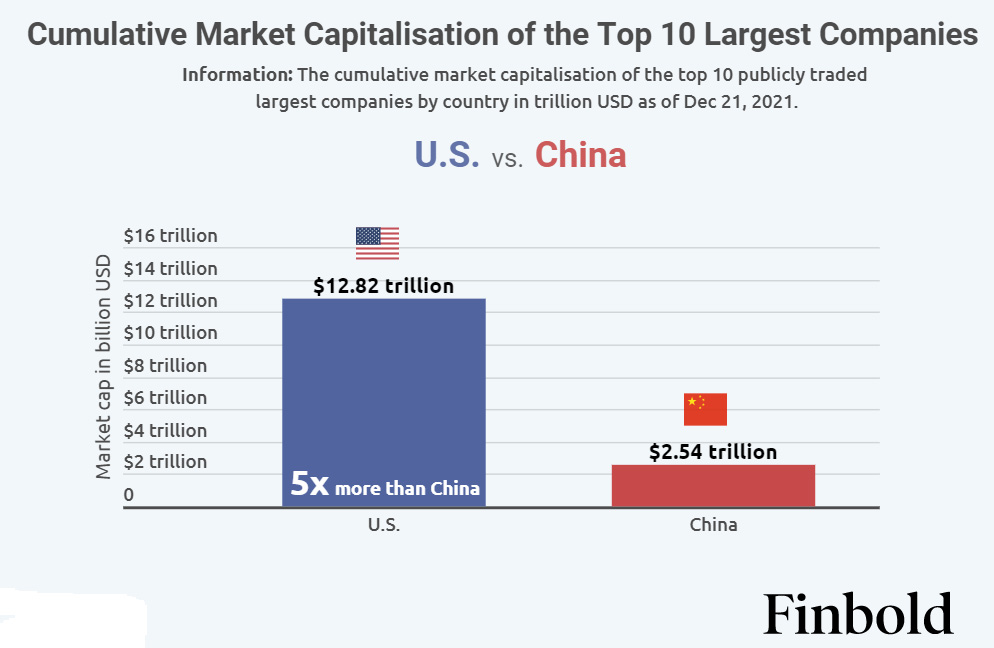

The top ten U.S. publicly traded companies have a cumulative market capitalisation of $12.82 trln as of December 21, a valuation that is at least five times more than China’s top ten counterparts that have a market cap of $2.54 trln.

The United States and China host various competing companies with a global reach aiming to assert dominance in multiple sectors. However, U.S. firms appear to be prospering, registering high valuations, according to data compiled by Finbold.

Tech giant Apple ranks top with a market cap of $2.7 trln, followed by Microsoft at $2.4 trln, while Google’s parent Alphabet is third at $1.8 trln. Amazon ranks fourth at $1.6 trln, followed by Facebook owner Meta at $905.3 bln.

Other companies with a high valuation in the U.S. include Tesla ($903.7 bln), Nvidia ($690.7 bln), Berkshire Hathaway ($648.6 bln), United Health ($455.6 bln), and JPMorgan Chase ($454.9 bln).

Other companies with a high valuation in the U.S. include Tesla ($903.7 bln), Nvidia ($690.7 bln), Berkshire Hathaway ($648.6 bln), United Health ($455.6 bln), and JPMorgan Chase ($454.9 bln).

In China, technology conglomerate Tencent ranks as the largest firm with a valuation of $529.2 bln, followed by beverage giant Kweichow Moutai at $401.2 bln, with eCommerce giant Alibaba ranking third at $311.7 bln. ICBC is in the fourth spot with a market cap of $242.2 bln, followed by CATL at $220.7 bln.

Other Chinese companies with a high valuation include CM Bank ($200.2 bank), China Construction ($171.1 bln), Meituan ($166.8 bln), Agricultural Bank of China ($157.4 bln), and Wuliangye Yibin ($140.9 bln).

U.S. dominated by tech companies

The Finbold report acknowledges that the U.S. companies are dominated by technology giants that have experienced significant growth over the recent months.

“The valuation comes after the technology sector experienced unprecedented growth inspired by the pandemic. The industry’s stocks gained prominence as their products offered consumers the means to navigate the lockdowns initiated to control the health crisis.”

The U.S. companies are also backed by a large domestic market, a large GDP, and a homogenous language.

Interestingly, despite China boasting a significantly higher population, the domestic market seems to have minimal influence on the companies’ valuation.