Financial analysts believe that Cyprus’ Citizenship for Investment Scheme (CIS) should be scrapped as it causes more harm than good with reports of dodgy investors buying their way into the European Union.

Following a week-long series of unflattering reports about the programme based on an Al Jazeera investigation of more than 1,400 leaked documents, Cyprus has once more come under the spotlight for its suspect CIS.

The global media outlet dubbed its exposé the ‘Cyprus Papers’, making parallels with the ‘Panama Papers’ scandal.

These accusations follow warnings from international watchdogs and the EU.

In comments to the Financial Mirror, UCY economics professor Sofronis Clerides said the scheme has tarnished Cyprus’ reputation beyond repair and should be shut down as soon as possible.

“The scheme was set up wrong from the beginning and should not have been allowed by the authorities to continue operating under more or less the same framework.

It will take years for Cyprus to clear its name and regain investor confidence as a trustworthy investment destination,” said Clerides.

He argued that the scheme is beyond any repair and cannot be ‘fixed’ by merely introducing more controls or measures.

“We have tried doing so over the past few years, which does not seem to have gotten us anywhere.”

Clerides said he would not rule out the possibility of introducing a new scheme to attract investors, even with the motivation being a Cypriot passport, but that program would have to be put on the right track from the beginning, making sure that criminals do not have access to it.

“We need a scheme that would attract investors who are interested more to invest in the real economy, rather than just people looking to buy themselves a passport.”

Asked where the scheme’s problems lie, at a time when all Cypriot stakeholders are praising it, Clerides said that things are not as they are presented.

“Who, apart from ourselves has said that we have an exemplary citizenship scheme?

We are just cheering ourselves on while the European Union and other watchdogs have been warning us about loopholes in the scheme that allow a lot of scope for abuse,” said Clerides.

He said the problem is not limited to just some 30 cases, but a much larger number, a clear indication that the programme is problematic.

“Al Jazeera’s reports presented at least 100 cases of foreign investors who have obtained a Cypriot passport with a problematic profile.

To make matters worse, all of these investors had applied during the period 2017-19, after attempts had been made to make the programme safer.”

Clerides said that with the latest changes, these investors would not be eligible for a passport, which says a few things on how the scheme was originally set up.

A clean criminal record can be bought

“All we had asked from investors in the earlier stages was a clean criminal record, which in some countries, someone can buy at the cost of €20. How could we introduce such a programme?”

Asked to comment on whether he feels that Cyprus is being singled out for its citizenship programme while some other EU countries have similar schemes, Clerides said that this is not entirely true.

“Cyprus is the only country that sells passports in the manner we do. Other countries have other kinds of programmes with the majority offering ‘golden visas’, i.e. permanent residency for an investment of 300,000 to 400,000 but not the nationality.”

The economist noted that the way the scheme is set up has created a cast of people travelling the world, trying to find possible investors without having any responsibility to make sure that the investor they will be introducing to the authorities is not a criminal or of high risk.

Another financial source told the Financial Mirror that the scheme is flawed and should be closed to give way to another sounder programme aiming to attract investors who would be keener to invest in other areas, not just construction.

“One of the main problems is that we left the due diligence to the banking system alone, which could not cope while they had no gain from carrying out checks,” the source said.

He noted that a recent EU Committee of Experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism (Moneyval), noted that while Cyprus had made progress it has taken steps backwards when it came to administrative services such as lawyers, accountants.

“These being said, we have to be clear that the scheme did help out the Cypriot economy at a time when it was at its worst, during the 2013 crisis.

However, from one point in time and onwards the cons of the scheme started to outweigh the pros.”

He argued that changes made were “too little and too late”.

“What we need to do is to close the existing citizenship for investment scheme immediately and replace it with a new one which will aim to attract investments in more productive sectors of the economy such as renewable energy, education and innovation,” the source said.

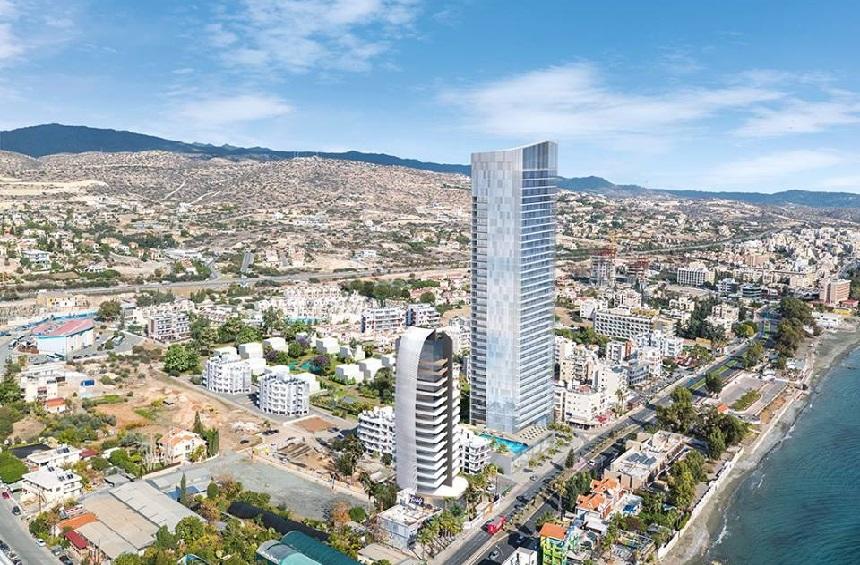

He argued that this is what the authorities should be aiming for with the construction sector already reaching saturation.

“This is what we should be doing if we want to turn things around and do away with the image that we are all about building towers and selling overpriced luxury apartments.”