By Han Tan, Market Analyst at FXTM

Investors will have a lot to digest on Friday, with several key themes set to play out ahead of the weekend. Risk assets are taking a breather from recent gains with Asian stocks and currencies mostly in the red, while US equity futures are in negative territory in early trading.

US lawmakers are battling against a self-imposed Friday deadline and against one another in a bid to pass the next stimulus package for the US economy.

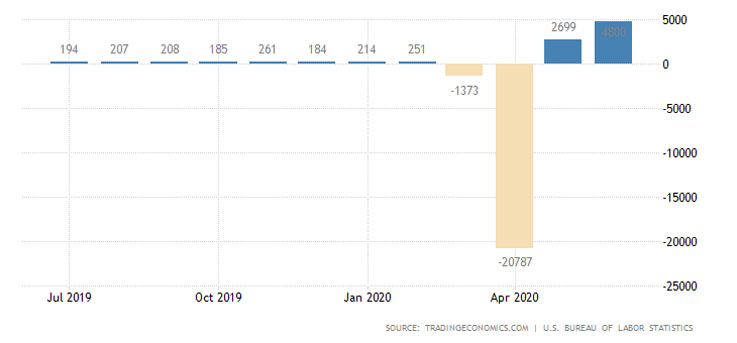

Geopolitical tensions have also been stoked by the Trump administration’s decision to reimpose 10% tariffs on some aluminium products imported from Canada beginning August 16, and his executive order to ban TikTok and WeChat in the US in 45 days from now. There’s also the keenly awaited July non-farm payrolls (NFP) data, which is forecast to show some 1.48 million jobs being added to the US economy.

The S&P 500 is currently just over 1% away from its record high, due partly to the optimism that more fiscal stimulus can be agreed upon and passed.

Unemployed Americans could do with a fresh injection of financial support given that jobless benefits under the previous package ended last month, in order to preserve hopes that the world’s largest economy can keep its still-fragile recovery intact. With President Trump threatening to bulldoze his own plan through, investors are gearing up for a matter of ‘when’ rather than ‘if’ the next round of fiscal stimulus comes pouring in, which should bode well for US equities.

The upcoming NFP print may help shed light on how much more stimulus could be needed in the future.

The July jobs figures is expected to unveil a marked slowdown in hiring compared to stunning gains seen in the prior two months, which may fuel concerns that the US recovery is losing its momentum.

Still, Thursday’s better-than-expected weekly jobless claims figure of 1.19 million, the lowest number of applications for US jobless benefits since March, offers hope that the economy can continue moving into the post-pandemic era. If the jobs market can stage a sustainable recovery from here, that could spur more risk-on market activity while offering relief for the beleaguered Dollar.

Gold should soon hit $2100

As things stand, the investment landscape only spells more upside for Gold, which has been on a tear this quarter. The precious metal has surged by over 15% since June 30, with the $2100 psychological level within its near-term grasp.

Promises of more incoming stimulus speaks to the persistent economic frailties around the world, which should hearten Bullion bulls, and heightened geopolitical tensions only serve to fuel risk aversion.

As ever, Gold stands ready to pounce on any Dollar weakness. The precious metal is expected to face little resistance in exploring new record highs in the mid-$2000 region over the coming months.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius