Economic sentiment in Cyprus improved for the third month in a row in July, albeit at a slower pace after the March lockdown due to the Covid19 pandemic and subsequent deceleration of the entire economy.

The Economics Research Centre of the University of Cyprus said the Economic Sentiment Indicator (ESI-CypERC) increased by 4.5 points in July compared with June.

The monthly indicator rose to 79.7 points, up from 75.2 in June and 72.9 in May.

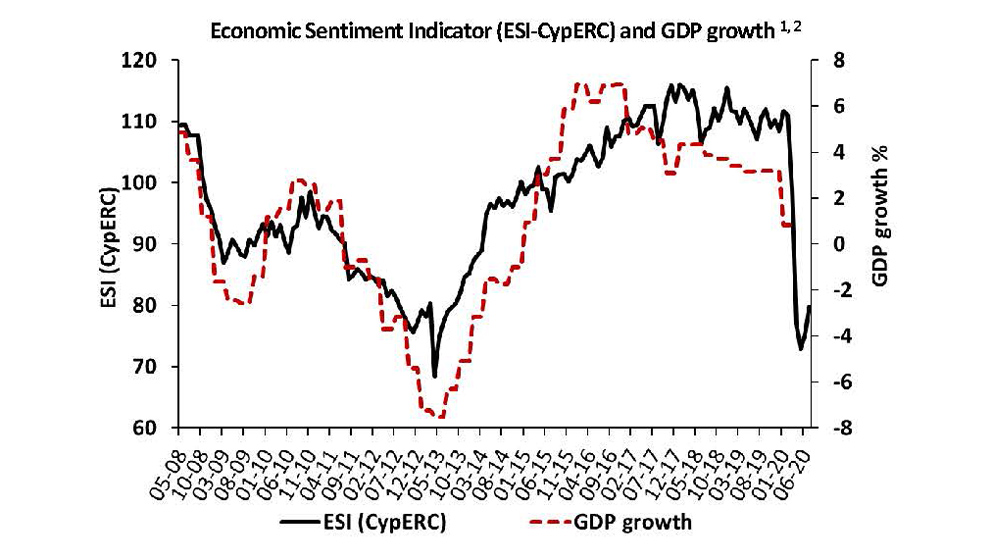

Starting the year at a relevant high of 111.7 points in January, the indicator receded mildly in February to 111.0, stumbled in March to 98.9 and crashed in April, after the full impact of the pandemic-imposed lockdown to 77.0.

However, the rate so far this year is still far better than the April 2013 all-time low when it dipped below 70 points following the economic and banking crisis and rescue by the troika bailout.

The increase in the July ESI-CypERC was driven by confidence improvements in services and among consumers, the university research said.

It said the increase in the Services Confidence Indicator resulted from firms’ less adverse assessments of their recent turnover and upward revisions in demand expectations.

The marginal decrease in the Retail Trade Confidence Indicator was due to worsening views on past sales and current stock levels, despite the upward revisions in sales expectations.

The Construction Confidence Indicator decreased as firms’ assessments of the level of order books deteriorated further and future employment plans were more pessimistic.

The Industry Confidence Indicator remained unchanged as the improved views on the current level of order books and upward revisions in production expectations were offset by more adverse assessments of the current level of stocks of finished products.

The improvement in the Consumer Confidence Indicator was mainly driven by upward revisions in consumers’ expectations about their future financial conditions and the future economic conditions in Cyprus.

In July, uncertainty in services, construction and industry declined, the UCY research unit said.

The largest decrease was recorded in services. Uncertainty among firms in the retail trade sector and among consumers increased. Uncertainty in all sectors and among consumers remains elevated compared to a similar period in 2019.