A Limassol-based fintech startup, eCredo, plans to revolutionise e-payments with quick and low-cost transfers, as high street banks continue to charge high rates, frustrating customers who are seeking alternative ways to do business.

“E-payment is the electronic means of making payments in what is still a developing sector of the economy,” said a senior eCredo executive.

“We are a young business, although we have more than 20 years of experience from international banking and financial services,” he added.

Opening a current account with a high street bank is a painful process nowadays, taking up to two months to complete, with an endless requirement of data and paperwork, and pricing of fees and charges that have reached sky-high.

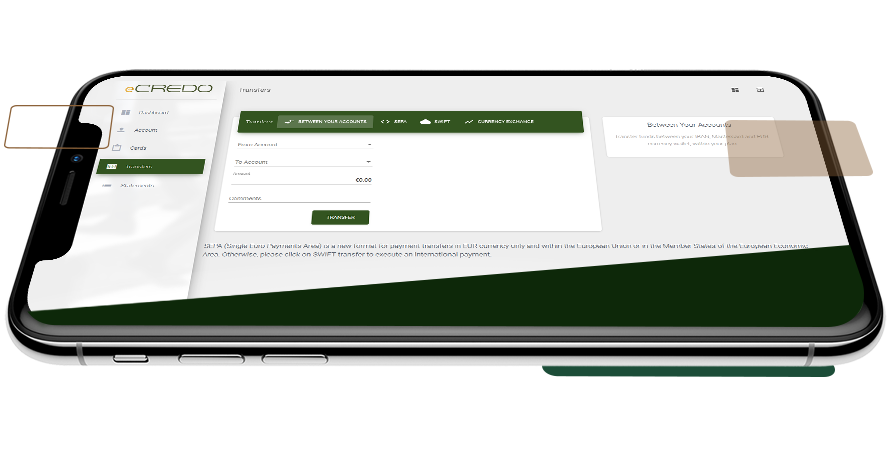

eCredo’s digital payment services app comes with five main products and services, which include an electronic money account with an Irish IBAN, a prepaid Mastercard, local and international transfers and multi-currency wallets for currency conversion.

The platform also allows clients to withdraw funds from an ATM and use the Mastercard internationally across 210 countries.

The company’s head of operations and digital payments development, Harout Der Bedrossian, added that although there are other similar digital payment apps and platforms, “eCredo’s difference is that we are on the ground, we are 100% transparent and we can meet our clients face-to-face.”

He said that individuals and businesses within the European Economic Area can apply for a free prepaid Mastercard and conduct their usual daily payments.

The registration and the verification process can be done remotely and electronically through the eCredo platform.

“Our onboarding is very fast and can be done from anywhere in the EEA. It takes about 48 hours for individuals and three to four days for companies.

We use the SEPA system for transfers, which means no charges for euro-to-euro within Europe. Also, ‘loading’ of Euro funds from EU banks is free.”

The secret to their successful launch is that they have minimum overheads that high-street banks have with branches, staff and operating costs, and other ‘middlemen’.

“We don’t have deposit products, and most payment apps are focusing on current account transactions. We think that there is still a gap in the market for a challenger, focused on quality customer service with low fees.”

Although officially launched on February 7, eCredo is already utilising innovative services and products and looking ahead to the next generation of e-payments.

It is among the first to split customer limits between IBAN and card limits, so users can benefit from the standard issued card limit, but also have the holding account with a higher threshold of funds.

The funds are safely kept in leading European top-grade banks, mainly Tier 1 institutions that have also embraced fintech. They have been approved by the UK FCA and the Irish central bank.

eCredo clients will not have the hassle of credit checks and reams of historical data, while the company has been approached by major corporations for their payroll and payment needs, and are looking to grow the business organically.

At present, eCredo employs about 10 staff but plans to grow the workforce to 40.

“For individuals, most of our services are free, and where we charge fees, these are still far below what it costs at a high-street bank,” Der Bedrossian said.

Corporate clients will benefit from business card packages and monthly fees, that again, work out at a fraction of bank charges.

They also provide currency wallets in 10 popular currencies for currency conversion and also, SWIFT outgoing payments for international transfers.

“The term ‘fintech’ has been misunderstood. It is financial services that use technology. Banks put finance first, before technology, while we say that technology comes first,” Der Bedrossian said.