The total transaction value in the fintech market hit almost $16 trln last year, with the landscape constantly growing, driven by technological advancements and surging consumer demands, according to data presented by Stocklytics.com.

Besides a massive increase in the amount of money flowing through the market, the fintech market has also seen a surge in the number of companies operating in it.

The value of transactions is expected to jump by 12.5% and hit a whopping $18 trln this year, as the number of fintechs has doubled in the past five years and hit almost 30,000 in the beginning of 2024.

Over the past five years, the financial services industry has drawn tens of thousands of tech companies whose services and products transformed how people and businesses spend, invest, save, and borrow money.

From cryptocurrencies and blockchain, mobile POS and real-time payments, to crowdfunding, crowdlending, robo advisors and neobrokers, all parts of the fintech landscape have seen users and transaction values skyrocket. As AI-driven solutions continue pushing the sector forward, the fintech landscape counts more companies than ever.

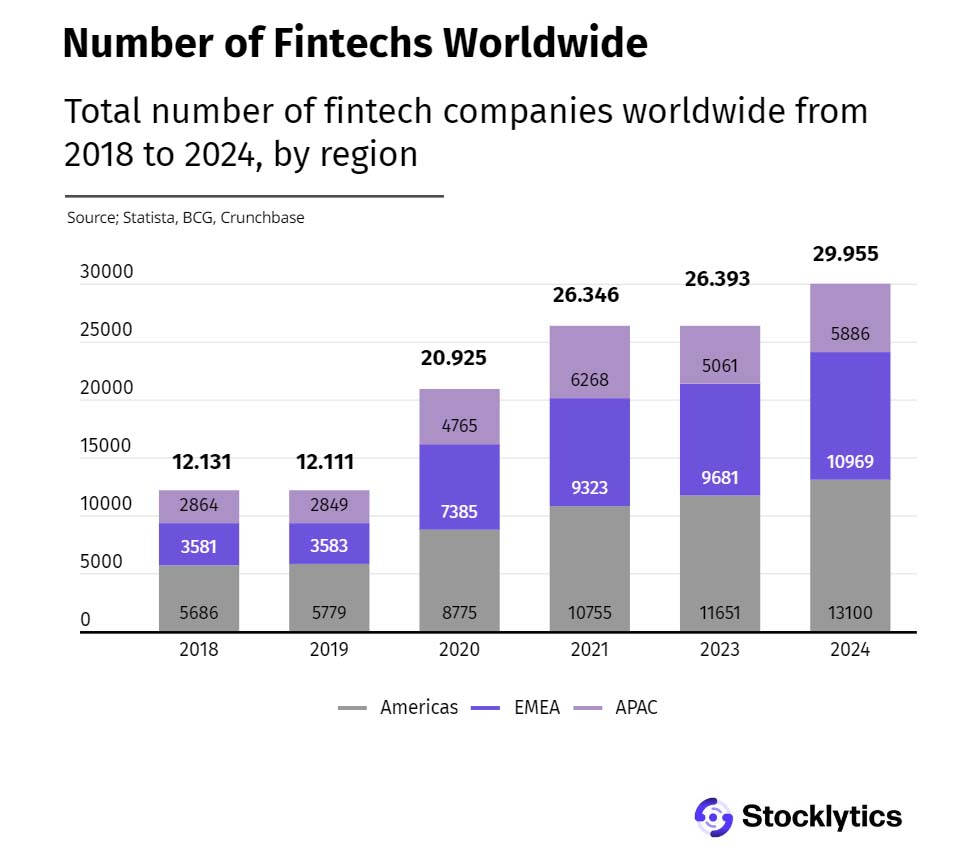

In 2019, there were 12,211 fintech companies in the world, according to Statista, BCG, and Crunchbase data. After the pandemic triggered a surge in fintech solutions and created a huge space for new companies, this figure jumped by 71% and hit 20,925 in 2020.

The number of new companies working in this market continued surging in 2021, with the total number rising to 26,346 by the end of the year. After a slowdown in 2022, the rising trend continued last year, pushing the total number of fintechs to 29,995 in the first month of 2024.

North America leads, EMEA has biggest growth

Statistics show North American companies make 43% of that number, with 13,100 operating in the market as of January. The EMEA region follows with 10,969 fintech companies and a 36% market share, while another 5,886 fintechs, or 20% of the total, come from Asia and the Pacific.

And while North America is the world’s largest fintech market, Europe, the Middle East, and Africa have seen much bigger growth in the number of fintech companies in the past five years.

Since 2019, the number of fintechs in this region has swelled by 206%, rising from 3,583 to 10,969. In comparison, the number of companies in North America, and Asia and the Pacific increased by 126% and 106% in this period, respectively.

The surge in the number of fintech companies has helped the technology to reach businesses and customers across the world.

According to a Statista survey, almost 5.3 bln people, or 65% of the world’s population, will use fintech products and services this year, nearly 600 mln more than in 2023.

Statista expects digital payments, the market’s largest segment, to hit 3.56 bln users in 2024.

Digital assets, including cryptocurrencies, blockchain, and NFT, will count roughly 830 mln users this year, and digital investments and neobanking follow with 591 mln and 301 mln users, respectively.