By Naeem Aslam

This will be another pivotal week for investors and traders who have been trying to gauge the next move from the Federal Reserve in terms of its monetary policy.

If we look at the US equity markets or fixed income markets, one can see that there have been a few adjustments in terms of the Fed rate cut expectations.

However, we are going to have the most important event this week that is more than likely to dictate the future path of the Fed rate cut. While Wall Street giants have already scaled back in terms of their rate cut bets for this year while being a lot more optimistic for 2025.

Controlling inflation and navigating the economy in current turbulence times have been the most challenging tasks for the Fed in the aftermath of the COVID-19 crisis.

Last week, two punches of bad news on producer prices and consumer prices once again raised alarm bells among investors and traders that the inflation reading, which was on the right track in terms of easing off and moving closer to the Fed target rate of 2%, has started to plateau. The data confirmed that the inflation data’s nature has become more sticky than their current anticipation.

The Fed Chairman has already let the cat out of the bag, if one paid close attention to his comments during his Senate and House testimony a few weeks ago, when he said that the nature of inflation and how the Fed measures it have been impacted on a permanent basis due to COVID.

Basically, reading between the lines, the Fed needs to think about their inflation target once again, and this is because an inflation target of 2% is no longer a realistic value.

The recent readings of consumer prices (a broad measure of goods and services costs that increased by 0.4% for the month and by 3.2% from a year ago) and producer prices (which measure pipeline costs for raw, intermediate, and finished goods and jumped by 0.6% on the month, double the Dow Jones estimate) have had the echo of the same argument.

The data

On Wednesday, the Chairman Jerome Powell will once again be in the spotlight as the Fed announces its monetary policy decision.

A few months ago, traders were expecting a rate cut during this meeting, but the sticky nature of inflation changed all of that. Going into this event, it is now widely anticipated that the Fed will keep the rate at its current level, which is 5.50%.

So, if market players already know that the Fed is not going to move its muscle with respect to its interest rate, why is this event important? Mainly because the Fed will clarify monetary policy, and it is in this speech that traders are going to look for further evidence of future rate cuts.

Remember that the Fed already knows that its 2% inflation target is not realistic anymore and is not going to be achieved as COVID has changed some dynamics forever. The interesting fact to note will be if the Fed will mention this particular factor once again during the press conference.

But the fact that inflation reading continues to remain immensely sticky means that the Fed will have less incentive to take any aggressive measures to bring the interest rates back to their normal level, which means that any hope of interest rate cuts of four times are more than likely to face a reality check.

Wall Street giant Goldman Sachs has already scaled back on its expectations of rate cuts. The bank said that now it expects the Fed to cut rates three times this year, rather than four.

Data is not everything

This is also an election year, and the fact that there are more chances than before of Donald Trump returning to office opens a new door for the rate cuts. In his previous term, he made his views clear about the Fed’s monetary policy: he favours lower interest rate cuts, and although the candidates that are announced by his advising team for the Fed Chairman role are still hawks, the odds are that as president, he would put pressure on the Fed to lower interest rates faster in order to give a big push to the economy.

What about the stock market and gold?

US stock indices have been on a roller coaster ride, and it is mainly due to the sell-off among some members of the so-called ‘magnificent seven’ stocks. Anything which is less than currently hawkish would be positive for the US stock market and vice versa.

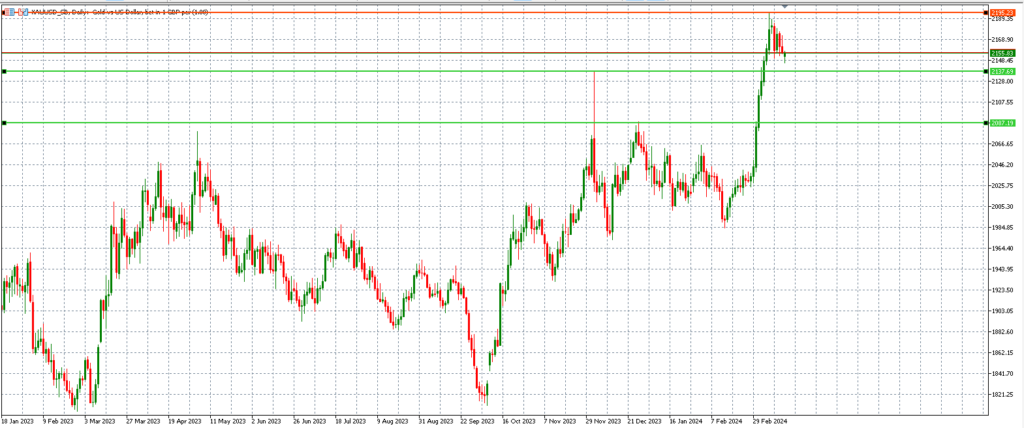

As for the precious metal, it recorded its first negative week on Friday in more than three weeks, during which period it recorded several new highs. The current record high for the yellow metal is only about $5 shy of $2,200, and seems to be holding near the 2155 price mark.

The first immediate support level stands at $2137, and any violation of this price point would open the door towards the next support level, which is at $2087. The resistance continues to remain at the previous high of $2195.

Naeem Aslam is Chief Investment Officer at Zaye Capital Markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Zaye Capital Markets.