While economic and fiscal costs remain manageable, the expected increase in the number, intensity and duration of extreme climate events in the coming years will have longer-term credit-negative effects on Europe, said a Moody’s analysis.

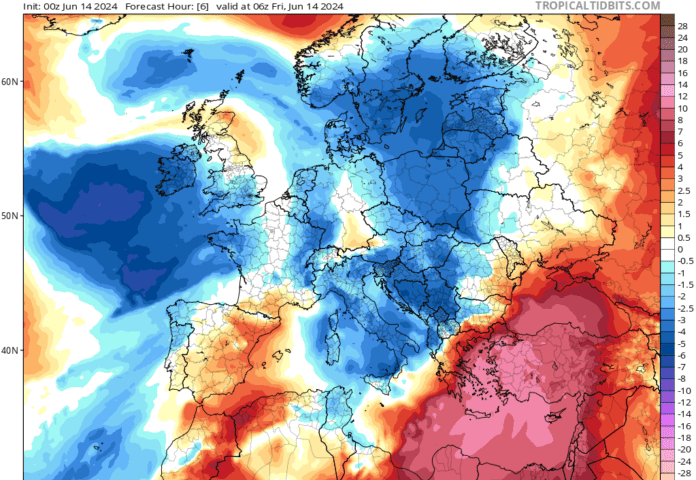

A severe heatwave continues to affect large parts of Southern Europe. Temperatures in Italy exceeded 40°C for a week, and in Croatia, Greece and Spain, thousands of hectares have been consumed by wildfires.

Because agriculture plays a small role in most of these economies, the current heatwave is likely to have relatively limited economic implications, although it could affect food prices and tourism – thousands of visitors are being evacuated from Greek islands.

Greece has the largest agriculture sector, accounting for 4.5% of gross value added and 10.9% of employment in 2022.

“However, the countries are major suppliers of olives, grapes, grains and fruits, and production shortfalls will pressure food prices: in 2022, high temperatures reduced EU cereal harvest by 10.2% relative to the last five years.

“Heatwaves may reduce Southern Europe’s attractiveness as a tourist destination in the longer term or at the very least reduce demand in summer, which will have negative economic consequences given the sector’s importance,” said Moody’s.

“Under our ESG framework, we assess these four countries as having moderately negative1 exposure to physical climate risk, alongside Portugal, Cyprus and Malta.”

It said Southern European countries are among the most exposed to heatwaves.

Hot and dry weather conditions will also affect northern European countries.

“For example, supply chains are affected because water levels in main river transport routes are near historical lows.

“Transportation costs on the Rhine have increased, and traffic has declined.

“In 2022, shallow waters caused freight ships to operate at just 25%-35% of their capacity.”

Electricity generation, particularly hydropower, is also adversely affected by heat and drought at a time when air conditioning usage increases energy demand.

Among the four countries, Croatia and Italy are the most reliant on hydropower in their energy mix, with hydropower comprising 49% of electricity production in Croatia and 17% in Italy.

“Because reservoir levels in both countries are much higher than this time last year following heavy rainfall in the spring, we expect energy supply will be sufficient.

“Supply is also aided by excess supply from renewables in Northern Europe and the recovery of nuclear output from France.”

Price volatility

Moody’s argues that severe weather conditions will increase price volatility as countries resort to alternative fuels or imports.

Wholesale electricity prices in Southern Europe are currently higher than in the rest of Europe.

“Governments are likely to extend support to affected regions if extreme weather conditions persist. “Moreover, heat increases the risk of wildfires, which will add to government costs.”

The EU estimates that wildfire damage in 2022 cost at least €2 bln.

To strengthen its preparedness, the EU doubled the size of the stand-by firefighting fleet it finances this year.

“Adaptation measures to strengthen resilience to extreme weather-related events will require significant but manageable public expenditure.

According to the European Commission, to limit the rise in global temperatures by 1.5°C above preindustrial levels, adaptation investments will be around €40 bln per year (0.3% of EU GDP).

Reflecting this, the government of Spain approved in May a package of measures worth €2.2 bln to combat the threat of water shortages from droughts.

The bulk of the funds will go towards building new infrastructure, such as seawater desalination plants and systems for wastewater reuse, and the remainder on support for agriculture.

Without such measures to dampen the negative fiscal implications of climate-related events, the EC believes that the cost of extreme weather events will have consequential fiscal effects.

If global average temperatures rise by around 1.5°C above preindustrial levels, the EC estimates that debt ratios would be 4.5 percentage points higher in Spain by 2032, 2.6 percentage points higher in Greece and 2.2 percentage points higher in Italy mainly as a result of the economic and fiscal costs of extreme climate events.

In a scenario where global average temperatures rise by 2°C, it estimates that debt ratios would increase by an additional 0.4 percentage points on average.

“The fiscal impact appears relatively small, particularly compared to other challenges European sovereigns face, such as ageing.

“However, more frequent and intense climate events will add to a number of existing competing spending priorities such as the financing of the green transition and increasing ageing costs, adding to pressures on the public finances.”