By Craig Erlam

It was a mixed trading session on Thursday as we got more evidence of economic resilience from the US which has left investors wondering whether they’ve once again underestimated how much monetary tightening is going to be necessary.

This has been a common theme this year with markets repeatedly reflecting a far more optimistic outlook on interest rates despite the economic figures continuing to outperform.

Investors are finally, reluctantly, coming around to the Fed’s way of thinking, although we are still seeing a surprising amount of resilience in stock markets considering every additional rate hike increases the risk of recession and a harder landing.

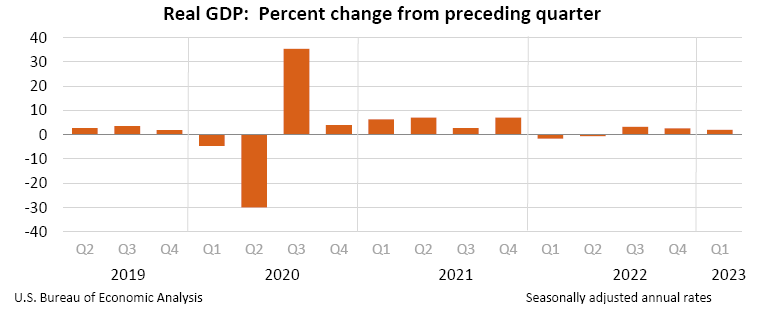

The first quarter GDP number at 2.0% was the most surprising given it significantly surpassed expectations, but initial jobless claims were also much lower than forecasts and the recent trend. In the fourth quarter, real GDP increased 2.6%, according to the Bureau of Economic Analysis.

The first quarter GDP number at 2.0% was the most surprising given it significantly surpassed expectations, but initial jobless claims were also much lower than forecasts and the recent trend. In the fourth quarter, real GDP increased 2.6%, according to the Bureau of Economic Analysis.

Resilience is not something we usually complain about, but on this occasion, it could be to the economy’s detriment.

Oil continues to consolidate

Oil prices continued to recover on Thursday after falling back toward their range lows on Wednesday. The gradual consolidation that we’re seeing in crude doesn’t appear to be nearing an end, with the price simply fluctuating between the range highs and lows over the last couple of months.

The uncertainty around inflation, interest rates, and therefore the economy may well be behind us, as investors have frequently been caught out by just how stubborn price pressures have been and how much central banks will need to do in order to contain them.

Until we get more clarity on that, this range trading may continue.

Gold under pressure

Gold broke below $1,900 for the first time in more than three months earlier Thursday on the back of stronger US data which in turn boosted US yields and the dollar.

The economy remains incredibly resilient which will only make the Federal Reserve more nervous and convince policymakers that more tightening will be needed to get inflation under control.

A rate hike in July now looks highly likely and you can see that reflected in the markets, with it now more than 80% priced in. And that’s got investors wondering whether the Fed’s insistence that at least two more will be needed is as over the top as they first appeared to think.

Recently, traders have found themselves chasing Fed expectations rather than the other way around.

BTC consolidates after surge

Bitcoin remains in consolidation between $30,000 and $31,000 after jumping more than 20% over the last couple of weeks on the back of some favourable news.

It hasn’t all been favourable recently, of course, but perhaps the ETF filings are viewed as a more significant development than the SEC charges which could ultimately prove to be a positive if it creates some much needed clarity on the regulatory landscape.

Craig Erlam is Senior Market Analyst, UK & EMEA at OANDA

Opinions are the author’s, not necessarily that of OANDA Global Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. Losses can exceed investments.