Cyprus’ significant links with Russia have increased the downside risks to otherwise strong medium term economic prospects for the island, rating agency DBRS said in a commentary, echoing concerns by local firms that the services sector faces at least 15% in losses from the war in Ukraine.

DBRS Morningstar said inbound tourism flows from Russia will be severely affected this year and that the overall impact will remain contingent on the duration and depth of the crisis.

In a review of Cyprus’ prospects, the DBRS commentary said that sanctions on Russia could cost, as it noted that “the main transmission channels for Cyprus are through tourism revenues and higher energy prices”.

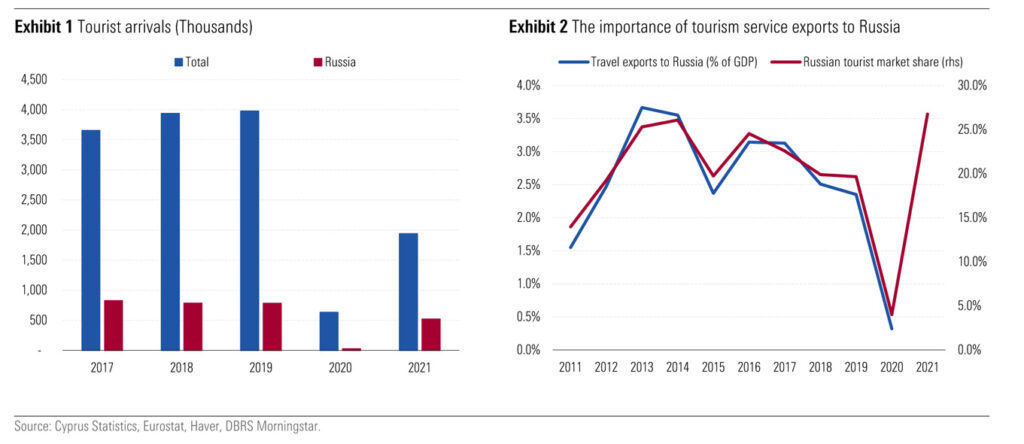

The rating agency noted that with respect to the first channel, Russia has been the second largest source market for Cyprus since 2007 and the main market in 2021, accounting for approximately 27% of total tourist arrivals, playing a key role in the strong but still partial rebound in foreign tourism last year.

For the period 2011-2019 travel services exports to Russia averaged 2.7% of GDP annually.

In response to the Russian invasion of Ukraine, the EU announced the closure of its airspace to Russian aircraft and airlines on February 26, which was quickly followed by Russia’s decision to close its airspace to EU countries, including Cyprus.

“The impact on the tourism industry will be higher if the restrictions are still in place around the summer season, when the bulk of the tourism inflows to Cyprus usually occur,” noted DBRS.

Related to the second channel, while Cyprus’s dependence on Russian energy sources is small, households and firms face substantially higher energy costs, weighing on real incomes. At the same time war uncertainty is likely to affect confidence and delay business decisions.

Airline sanctions to cost 1.5-2% of GDP

DBRS Morningstar estimates that Cyprus stands to lose 1.5-2.0% of GDP in 2022 if the airspace closures remain in place for the whole year.

The report comes as representatives of a number of sectors in Cyprus have reported losses from the war in Ukraine, as the EU also imposed banking sanctions on Russia, excluding certain Russian banks from SWIFT.

Accountants and lawyers on the island have said that the island’s services’ sector is to lose up to 15% of its business due to the war and sanctions.

In comments to the Financial Mirror, the chair of the Institute of Certified Public Accountants of Cyprus, Pieris Markou, said: “As a small economy which relies heavily on foreign investment and services, it is vulnerable to international developments, whether they are positive or negative”.

In comments to the Financial Mirror, the chair of the Institute of Certified Public Accountants of Cyprus, Pieris Markou, said: “As a small economy which relies heavily on foreign investment and services, it is vulnerable to international developments, whether they are positive or negative”.

“We must not forget that our economic model is based on attracting foreign investment.

“So, when these companies cannot do business, either in Russia or in Ukraine, the services sector will inevitably be affected.”

Markou added that some offshore firms are directly affected by banking sanctions, as they have no access to frozen assets or the banking system in Russia.

Other firms dealing with these companies are indirectly affected, as sanctions hinder transactions.

Markou said it is not only the financial services sector that is suffering. The industry has one of the highest economic multiplier factors: lawyers, taxi drivers, restaurants, and bars.

In its report DBRS noted that, “financial services exports to Russia have increased in recent years and accounted for approximately 7% of GDP in 2020; however, this figure could be significantly inflated by the presence of Special Purpose Entities with limited links to the domestic economy”.

Cyprus ‘more resilient’ than expected

DBRS Morningstar highlighted that the agency found Cyprus’ economy to be more resilient than expected.

While noting that the European Commission’s growth forecast for Cyprus of 4.1% in 2022 published in February before the invasion now appears optimistic, DBRS praised the island’s economy for recovering faster than expected.

“This has happened despite the importance of the travel and tourism sector for the overall economy, which contributed 13.8% to overall GDP in 2019, according to the World Travel & Tourism Council.

“The latest national account figures show that Cyprus had already recovered its pre-crisis level during Q3 2021 and by Q4 2021 output was already 1.4% above its pre-crisis levels,” noted the agency.

DBRS further added that on an annual basis, Cyprus’ GDP in 2021 expanded by 5.5% in 2021 after a 5.0% drop in 2020.

It concluded by saying that compared to pre-pandemic levels, the substantial growth in financial services (+17%), the information and communication sector (+12%), and the public administration, education and social works sector (3%) have helped offset the impact of the pandemic restrictions on the close-contact services.