Some countries are ranking significantly higher in the share of citizens owning digital assets, as cryptocurrencies move to the mainstream, with more people embracing different assets for various purposes, including investment.

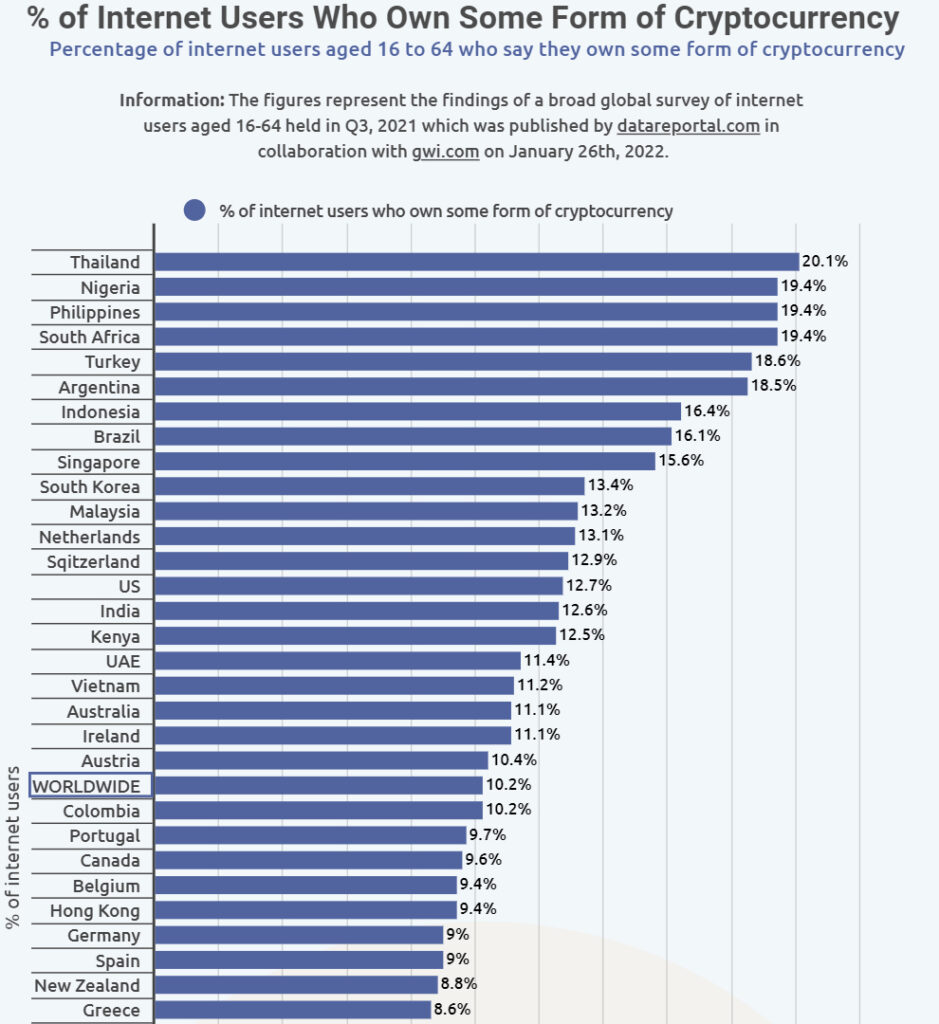

According to data acquired by Finbold, about 10.2% of the world population using the internet owns some form of cryptocurrency.

As at the end of Q3, 2021, Thailand accounts for the highest per capita share at 20.1%, followed by Nigeria at 19.4%, similar to users in the Philippine. South Africa ranks fourth at 19.4%, followed by Turkey in fifth with 18.6%.

Other countries in the top ten category that recorded a significant share of crypto owners include Argentina (18.5%), Indonesia (16.4%), Brazil (16.1%), Singapore (15.6%), South Korea (13.4%) and Malaysia (13.2%).

United States users ranked in the 14th spot with a share of 12.7%, while Russia ranked last at 2% among the surveyed countries.

Millennials, mostly males

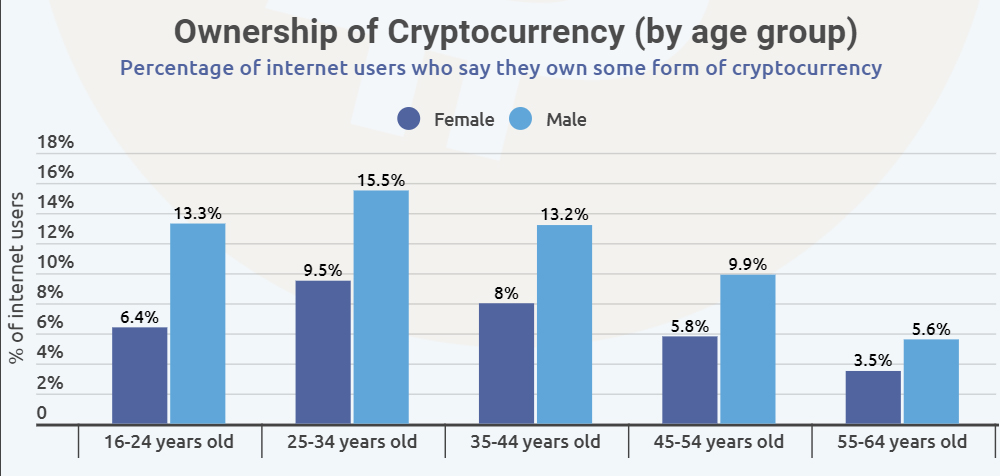

Elsewhere, the ownership is more contracted among individuals aged between 25-34 years, with males accounting for 15.5%, while the female share stands at 9.5%. Internet users aged 16-24 years saw males account for 13.3%, while female owners stood at 6.4%.

In general, most crypto ownership is centered among individuals aged between 16-44 years.

In general, most crypto ownership is centered among individuals aged between 16-44 years.

The ownership figures follow an increase in cryptocurrency penetration, with different assets being utilized for various roles. According to the research report:

“The increased adoption has resulted in cryptocurrencies becoming part of people’s daily lives, replacing some of the roles played by the traditional monetary systems,” the Finbold survey found.

“For instance, the cryptocurrency sector offers services like lending and emerging as alternatives to conventional finance aspects like paying salaries.”

The report also highlighted the significance of cryptocurrencies among developing countries.

“Elsewhere, top cryptocurrency holders are based in developing countries that have experienced economic turmoil in recent years, a situation that was complicated by the coronavirus pandemic. The sector is emerging as an alternative to the unbanked population in these countries and a hedge against rising inflation amid local currency devaluations.”

Moving into the future, the crypto ownership figures could be impacted either negatively or positively based on factors like the regulations in different jurisdictions.