Moody’s has deemed the latest Bank of Cyprus transaction to offload nonperforming loans and a property portfolio worth €700 mln as credit positive for the group’s balance sheet.

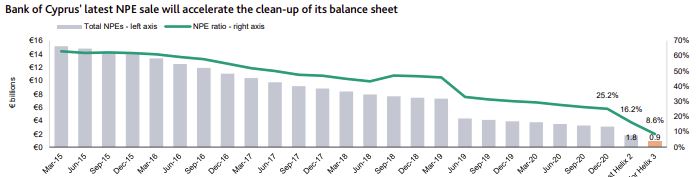

It said the transaction, termed Helix 3, and part of the bank’s balance sheet de-risking efforts, will reduce Bank of Cyprus’ stock of legacy nonperforming exposures (NPEs) by 36% and reduce its stock of real estate property by 9% compared to June 2021, a credit positive.

Bank of Cyprus announced on 15 November an agreement to sell a portfolio of nonperforming loans with a gross book value of €577 mln and real estate properties with a book value of €121 mln to funds affiliated with Pacific Investment Management Company LLC (PIMCO), a global fixed-income investment manager.

Despite difficult market conditions, this is Bank of Cyprus’ third NPE sale in the past 15 months, following agreements to sell NPE portfolios with a gross book value of close to €1.3 bln to PIMCO, announced in August 2020 and in January 2021 (together known as Helix 2) and completed in June 2021.

Pro forma for the latest sale, which includes primarily loans to retail clients, and organic reductions during the first nine months of 2021, the bank’s high NPEs will halve to €900 mln as of September from €1.8 bln as of December 2020, including Helix 2.

Likewise, the bank’s ratio of NPEs to gross loans will decline significantly to 8.6% as of September from 16.2% as of year-end 2020 (it was 25.2% before Helix 2), said a Moody’s analysis.

Upon the transaction’s completion, Bank of Cyprus will receive €385 mln and expects the transaction to add 66 basis points to its Common Equity Tier 1 ratio, which was 14.2% as of June 20212 and add around €21 mln to its income statement.

“This compares with a broadly neutral capital effect from the two previous large NPE sales (Helix 1, a €2.7 bln gross NPE sale completed in 2019, and Helix 2) combined.”

The bank expects to complete the transaction in the first half of 2022, subject to several conditions, including customary regulatory and other approvals.

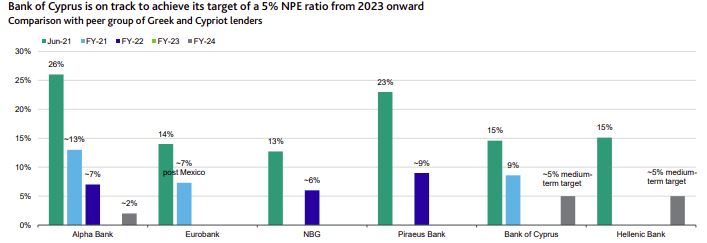

“Bank of Cyprus has made significant progress in improving its asset quality in recent years, and following this sale, the bank is currently best positioned within its peer group of Greek and Cypriot lenders, which have had the highest stock of NPEs in Europe in recent years,” said Moody’s.

The bank has reduced its stock of legacy NPEs by 94% from the peak in March 2015 (€15.2 bln), lowering its NPE ratio to 8.6% from 63% over the period.

“With this transaction, the bank achieves its strategic target of reducing its NPEs to a single digit by 2022 and is on track to achieve its target of a 5% NPE ratio from 2023 onward.

“The bank will continue to work toward this goal while managing the post-pandemic NPE inflow, while simultaneously offloading of legacy problematic loans, which will allow the bank to focus on building more sustainable profitability, which remains structurally weak for the bank.”

The rating agency said the NPE sales significantly reduce asset and capital risks for Bank of Cyprus, with the bank’s Texas ratio (NPEs divided by the sum of shareholders’ equity and accumulated provisions, based on reported figures), a ratio indicating the vulnerability of capital and reserves to NPEs, falling to less than 40% following this sale, from above 150% in 2015, when the bank carried peak legacy NPEs on its balance sheet.

“A residual risk is the bank’s €1.4 bln of accumulated foreclosed property, representing around 70% of shareholders’ equity as of June 2021.

“Partly mitigating the risk of losses upon disposal of these properties are the buffers that the bank has built on its balance sheet, given that it on boards assets at a 25%-30% discount from the current prices.

“However, potentially unfavourable (to creditors) changes in the foreclosure framework pursued by Cypriot authorities risks lengthening the foreclosure process and negatively affecting the recovery value of collateral.”