Boeing has had a tumultuous last couple of years, with the airline giant experiencing sharp declines in various metrics, even before the coronavirus pandemic, due to a major global controversy around one of its aircraft.

According to data presented by Buyshares.co.za, Boeing’s revenue of $58.16 bln in 2020 was a 42.5% decrease compared to 2018’s record-high revenue of over $101 bln – a CAGR of -24.16%

Back in 2018, Boeing was flying high after crossing the $100 bln mark in revenue for the first time in company history. However, late in 2018 and early in 2019 one of its new aircraft models, the 737 MAX 8, experienced two crashes in the span of 5 months.

Both crashes put the blame on Boeing’s new MCAS flight control system and resulted in the grounding of the entire global fleet of the 737 MAX and orders for the new model were either suspended or cancelled.

As a result, Boeing’s revenue dropped by 24% YoY in 2019.

To further compound the crisis that Boeing was already facing, the world was hit by the COVID-19 pandemic in 2020 resulting in a huge downturn for the entire travel and tourism industry. This caused Boeing’s revenue to drop a further 24% YoY in 2020.

From 2018-2020 Boeing’s revenue experienced a CAGR of -24.16%

Falling behind rival Airbus

The entire airline industry was significantly impacted by the pandemic in 2020. Many countries closed their borders to protect their citizens from the onslaught of the virus putting a halt to global mobility. As a result, both aircraft providers suffered significant drops in revenue in 2020 with Airbus experiencing a 37% YoY drop.

However, Boeing’s problems began prior to 2020 and the 2019 safety issues are still causing Boeing to lag behind Airbus in orders and deliveries.

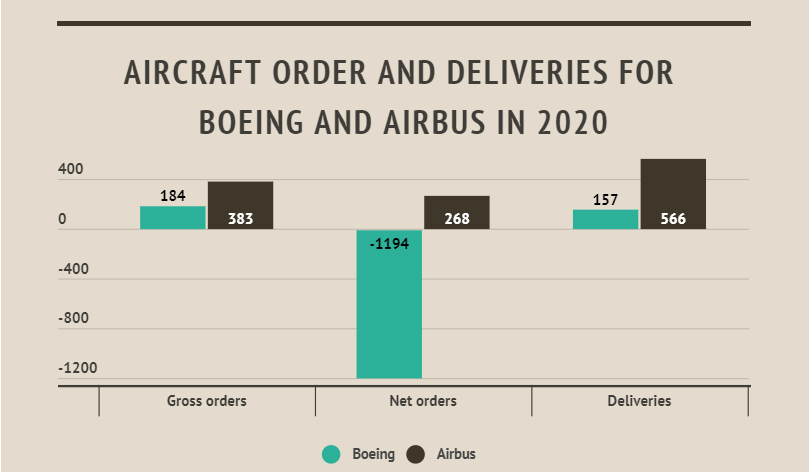

In 2020, Airbus registered 383 gross orders compared to Boeing’s 184. After calculating for contractual adjustments and cancellations, Boeing’s net order figure falls considerably to -1194 for 2020, compared to Airbus’ 268.

In 2020, Airbus registered 383 gross orders compared to Boeing’s 184. After calculating for contractual adjustments and cancellations, Boeing’s net order figure falls considerably to -1194 for 2020, compared to Airbus’ 268.

In 2020 Airbus also delivered almost 400 more aircraft than Boeing, amounting to 566 and 157, respectively.

As a form of damage control, Boeing initiated a few cost-cutting initiatives in 2020.

Boeing cut R&D expenditure by 23% YoY in 2020, its lowest allocation since 2005.

Boeing is the larger employer of the two aircraft manufacturers with a workforce of 141,000 in 2020, after downsizing by 20,000 from 2019.