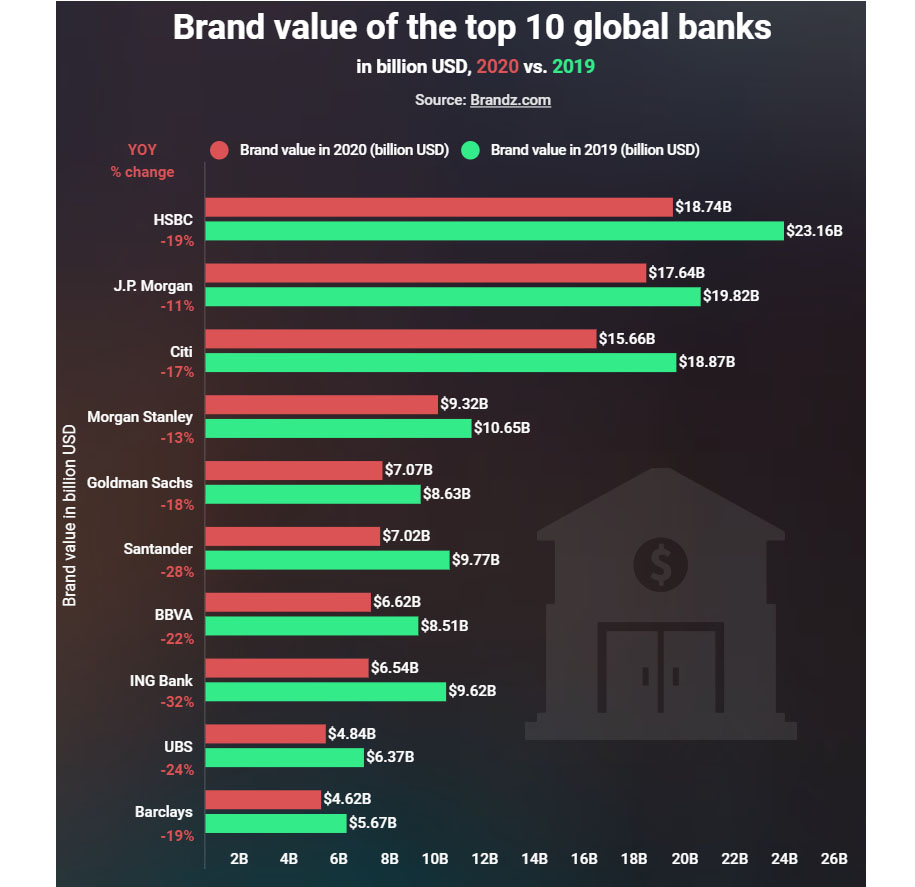

The top ten international banks, including industry leaders HSBC and Citi, cumulatively lost $23.01 bln in brand value in 2020, research has shown.

Data compiled by Trading Platforms UK indicates that the banks recorded a total brand value of $98.12 bln, representing a drop of 18.99% compared to 2019’s $121.13 bln figure.

HSBC had the highest brand value in 2020 at $18.74 bln, a drop of 19% from 2019’s $23.6 bln. JP Morgan is second at $17.64 bln, representing a drop of 11% from 2019’s $19.82 bln. Citi ranks third at $15.66 bln, a decline of 17% from the $18.87 bln value recorded in 2019.

The report attributed the drop in brand value partly to the digitisation of banking services in 2020.

Morgan Stanley ranks fourth with a $9.32 bln brand value, a drop of 13% from 2019’s $10.65 bln. Goldman Sachs had $7.07 bln, a drop of 18% from 2019’s $8.63 bln. Santander follows at $7.02 bln, having dropped by 28% from $9.77 bln recorded in 2019. Elsewhere, BBVA is sixth with a value of $6.62 bln from 2019’s $8.15 bln.

ING ranked eighth with a value of $6.54 bln, which dropped by 32% from $9.62 bln in 2019. UBS follows at $4.84 bln, a drop of 24% from $6.37 bln in 2019, and Barclays is tenth at $4.62 bln, dropping 19% from the 2019 figure of $4.62 bln.

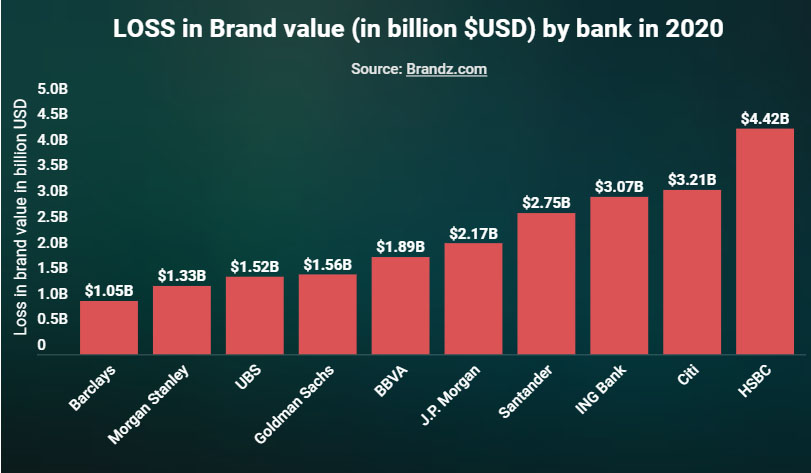

HSBC, Citi, ING biggest losers

The analysis also shows that HSBC was the biggest loser in brand value by $4.42 bln, followed by Citi at $3.21 bln, while ING Bank is third with a $3.07 bln loss in value.

Santander lost its value by $2.75 bln, while J.P Morgan ranks fifth at $2.17 bln. Other banks that lost significant value include BBVA ($1.89 bln), Goldman Sachs ($1.56 bln), UBS ($1.52 bln), Morgan Stanley ($1.33 bln), and Barclays ($1.05 bln).

“Overall, the crisis strengthened the competitive pressures among banking institutions through accelerating the shift towards digitalisation of financial service providers,” the report said.

“Some of the traditional banks heavily invested in digital services, enabling them to compete with fintech and other banks. At the same time, some of the traditional banks showed intentions to acquire existing challenger banks.”