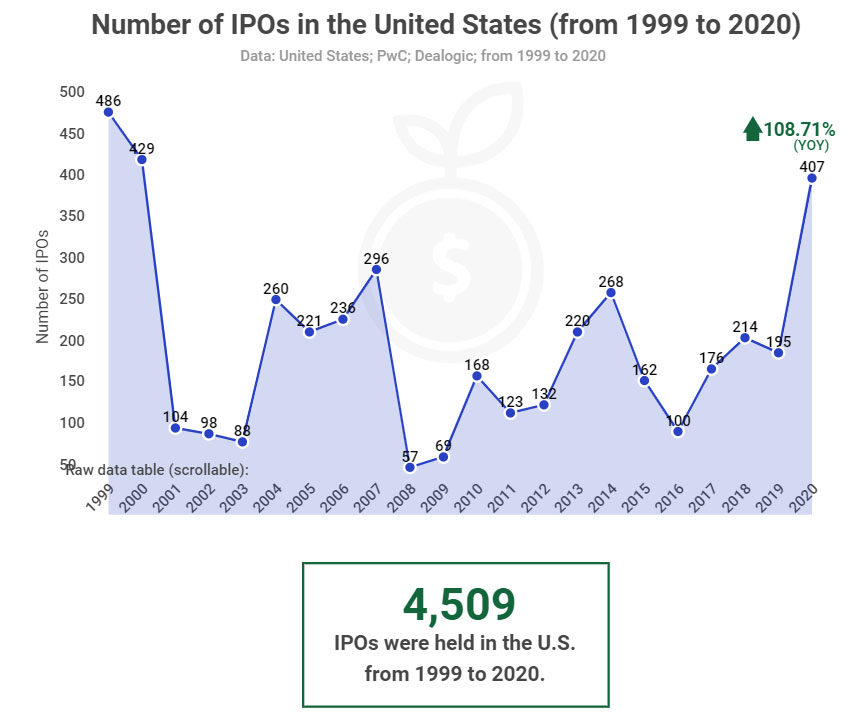

Initial public offerings (IPOs) in the U.S. equity markets more than doubled last year, rising by 108.71% from the 195 share offers in 2019 to 407 in 2020, research collected by Trading Platforms has shown.

This is the highest number in two decades, despite the economic uncertainty resulting from the coronavirus pandemic.

Over the last 21 years, 1999 registered the highest number of IPOs in history at 486, which dropped to 429 in 2000. The number also dropped sharply by 79.48% to 88 in 2003 before rising to 260 in 2004.

In 2007, the number of IPOs rose to 296 before declining by 80.74% to 57 in 2008. This was the lowest number of IPOs in the last two decades. The IPOs slightly rose to 69 in 2009 and then 168 in 2020.

Over the last decade, the IPOs fluctuated at 123 (2011), 132 (2012), 220 (2013), 268 (2014), 162 (2015), 100 (2016), 176 (2017), and 214 (2018).

The report issued a future outlook for the U.S. IPO market after a successful 2020 despite the pandemic.

“The growth should continue as the country returns to normal operations from the pandemic, thanks to the vaccine roll out and increasing investor confidence,” it said.

“Furthermore, with investing becoming more attractive to young people, participation in IPO is expected to grow in-line with the trend.”

Factors propelling IPO growth

Companies planning to go public faced uncertainty and valuation concerns. Therefore, IPO activity during Q1 2020 was low.

During the third quarter of the year, there was a significant increase in IPO activity, reflecting the lifting of lockdown measures and stimulus packages released by the Federal Reserve.

Companies in industries that benefited from the pandemic also contributed to the IPO frenzy across the U.S. last year. From the second quarter, the technology sector and biotech bounced thanks to their demand in the pandemic resulting in these sectors’ companies going public. For instance, there has been a demand for wearables and sensor technologies as health awareness grows.

At the same time, technology products helped people connect and be entertained during the pandemic. Overall, the tech and health sector helped IPO prove resilient in 2020.

Furthermore, direct listing gained traction in 2020 as it offered an opportunity for companies to raise capital thanks to policy changes approved by the Securities and Exchange Commission following a proposal by the New York Stock Exchange.

Before the change in law, raising capital was the main difference between a traditional IPO and a direct listing. Following SEC’s directive, companies had a new alternative of going public through the direct listing and raising money in the process.