Moody’s has lowered its forecast for global sustainable bond issuance this year from $400 bln to 325 bln after economic fallout from the coronavirus outbreak reduced green bond volumes in the first quarter, even as social bond issuance rose to a record, Moody’s Investors Service said in a report.

“We now expect green bond volumes of $175-225 bln this year, down from our original $300 bln forecast,” said Matthew Kuchtyak, AVP-Analyst at Moody’s.

“However, we maintain our combined $100 bln forecast for social and sustainability bonds, given the heightened market focus on coronavirus response efforts,” the analyst said.

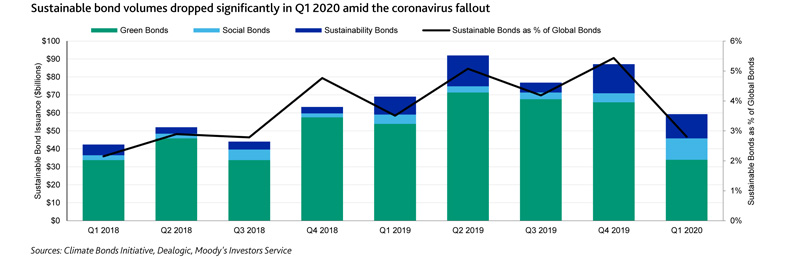

The rating agency’s report said that total sustainable bond issuance fell to $59.3 bln in the first quarter of 2020, down 32% from the previous quarter, as green bond volumes declined 49% to $33.9 bln. Still, social bond issuance reached $11.9 bln, more than double the previous quarterly record, while sustainability bonds registered a strong $13.4 bln total.

The surge in social and sustainability bonds has been primarily led by multilateral development banks, which have increasingly turned to these instruments to finance their coronavirus response efforts.

“Greater emphasis on social finance and sustainable development will likely be one of the lasting outcomes of the coronavirus crisis,” said Kuchtyak.

There was an increase in liquidity borrowings in the first quarter by investment-grade companies seeking to fortify balance sheets in anticipation of an economic slowdown. This was especially evident in the last two weeks of March when a surge of borrowing contributed to an all-time monthly record for new bond issuance from US investment-grade companies. Such borrowings are often brought to market quickly with proceeds not tied to specific projects, two characteristics that potentially explain the drop in use-of-proceeds sustainable bonds.

Moody’s continues to see a number of factors supporting growth in sustainable bonds over the long run. These include strong investor demand, heightened governmental focus on climate change and sustainable development, gradual greening of the financial system, and increased issuer focus on highlighting sustainability plans to stakeholders.