By Lukman Otunuga, Senior Research Analyst at FXTM

As monetary policy bazookas prove ineffective against the coronavirus-induced market chaos, central banks are taking unprecedented steps in defending their respective economies against the pandemic.

Over the last 24 hours, the U.S. Federal Reserve dropped an atomic monetary bomb by announcing an open-ended unlimited quantitative easing programme in an effort to promote stability across financial markets.

Although the initial reaction was somewhat mixed with shares on Wall Street closing in the red overnight, investors seem to be taking heart from the Fed’s limitless pledge, as Asian stocks roared back to life Tuesday morning and US futures jumped. However, this positive market mood is unlikely to last given how the U.S. Senate once again failed to move ahead with a $2 trillion coronavirus stimulus package at the start of the week.

If the global economy is a tin bucket filled with water, the coronavirus outbreak has drilled multiple holes into it and monetary policy bazookas are unable to stop the bucket from leaking. While fiscal policies could plug some of the holes, the solution may have to be a new bucket which, in this instance, is a cure to the coronavirus.

More Pound pain as UK enters lockdown?

Sterling could be set for more weakness after Prime Minister Boris Johnson ordered a three-week lockdown to reduce the spread of the coronavirus.

With “non-essential” shops and services being ordered to shut as part of the strict new measures, consumption could be hit, stimulating fears over the United Kingdom entering a recession.

The latest flash manufacturing and services PMI data for March will be released later Tuesday. The Pound may end up offering a muted response to the data as investors focus on the three-week national lockdown and what it means for the economy.

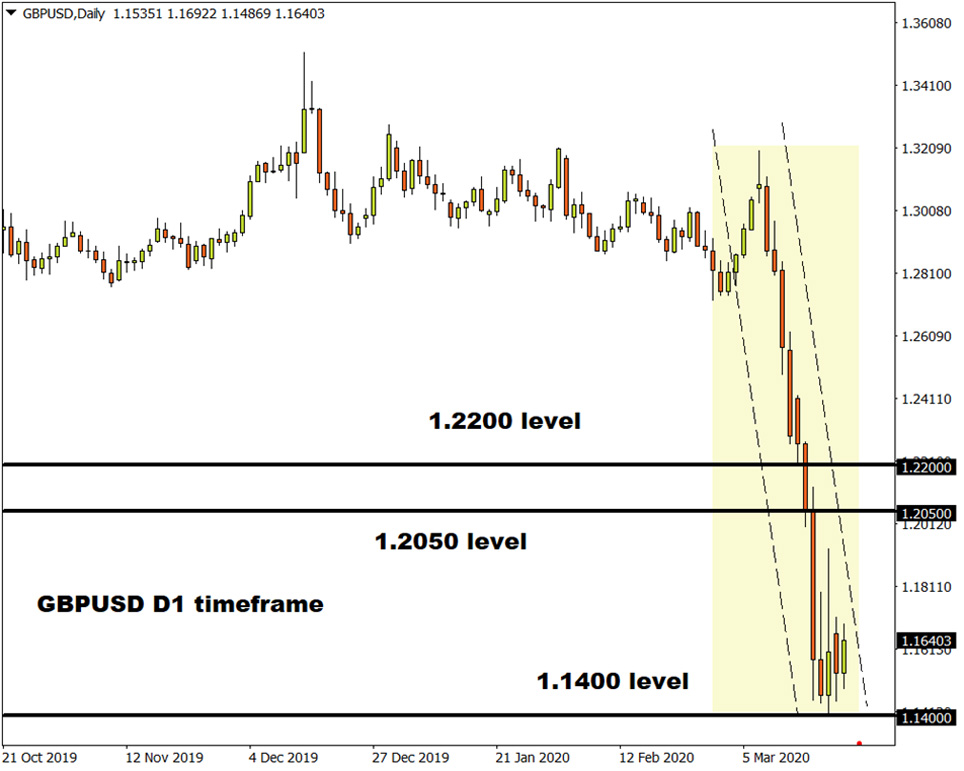

Focusing on the technical outlook, a picture is worth a thousand words and this remains true for GBPUSD which is trading at levels not seen since 1985. Consolidation at the lows points to further downside with the first key level of interest at 1.1400. A break below this level could open the floodgates towards 1.1300 or lower.

Commodity spotlight – Gold

Everyone wanted a shiny piece of Gold over the last 24 hours, after the Fed took unprecedented measures to defend the US economy from the coronavirus outbreak.

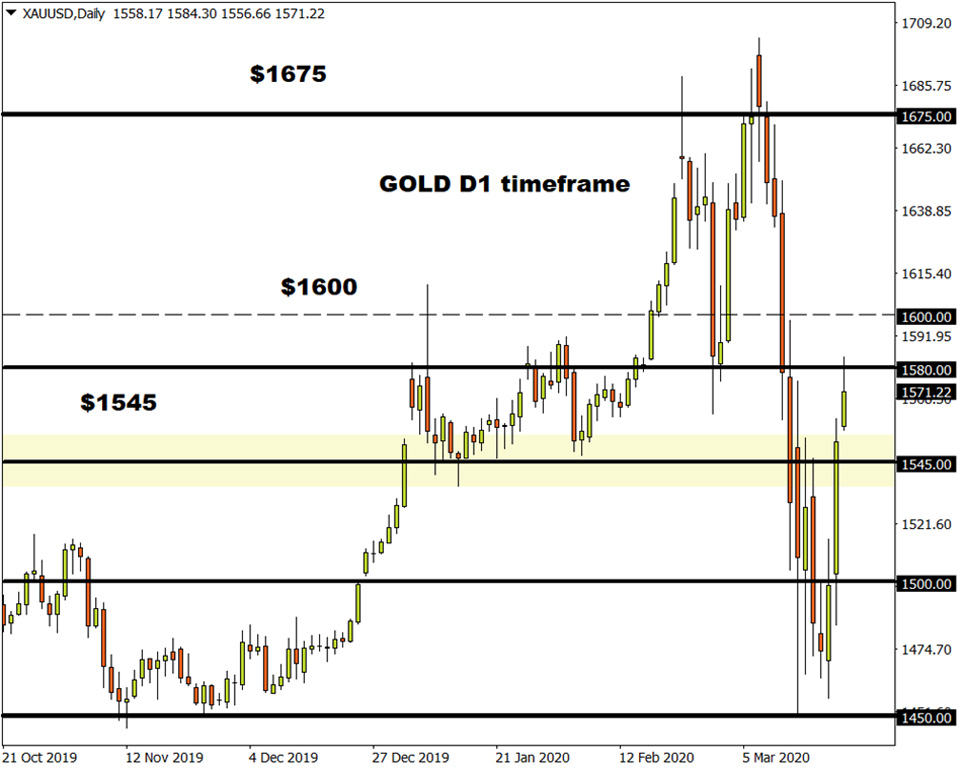

The precious metal has appreciated over 2.7% since the start of the week and has the potential to extend gains on Dollar weakness. A sense of unease over the coronavirus developments and fears around a global recession should support appetite for gold moving forward. Looking at the technical picture, the precious metal has extended gains Tuesday morning with prices trading around $1575. An intraday break above $1580 could swing open the doors towards $1600.

For information, disclaimer and risk warning note visit FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius