By Lukman Otunuga, Senior Research Analyst at FXTM

Things just got worse for financial markets as rising panic surrounding the coronavirus pandemic pummeled equities around the world.

Asian shares continued the slump on Friday plunging deeper into the abyss, while European markets posted their worst one-day drop in history on Thursday. Overnight, the sell-off on Wall Street was so severe that the Dow Jones and S&P 500 experienced their biggest one-day declines since 1987, after triggering circuit breakers for only the second time in a week.

Markets are highly volatile with Trump’s travel ban on 26 European countries clearly adding more fuel to fire, and now global stocks are ablaze. It seems the ongoing uncertainty from the coronavirus outbreak is set to continue burning the outlook for the global economy.

What is more alarming is that these gut-wrenching declines across stocks have come despite emergency action by the Federal Reserve, Bank of England and European Central Bank to rescue markets. There seems to be little faith over the effectiveness of monetary policy shielding the economy from the impact of the coronavirus, with fiscal measures seen as a better alternative in stabilising conditions.

Markets currently remain in panic mode with risk aversion the dominant theme. Equities around the world are likely to remain severely depressed amid the darkening mood, with safe-haven assets like the Dollar and Japanese Yen, the best destinations for safety.

Dollar regains mojo as investors rush to safety

King Dollar stood tall against every G10 currency on Thursday, as investors sprinted towards the world’s most liquid currency amid the market meltdown.

A sense of disappointment with the government’s response to the rising infections in the United States is fostering caution and unease. The jump in risk aversion is boosting appetite for the Dollar, despite expectations around the Fed announcing more interest rate cuts, with around 100bp now priced in over the next week.

Focusing on the technical picture, the Dollar Index has staged an incredible rebound on the daily charts with prices trading around 97.50 early Friday. A solid daily close above this level could re-open the doors back towards 98.30. However, should 97.50 prove to be reliable resistance, prices could sink back towards 97.00.

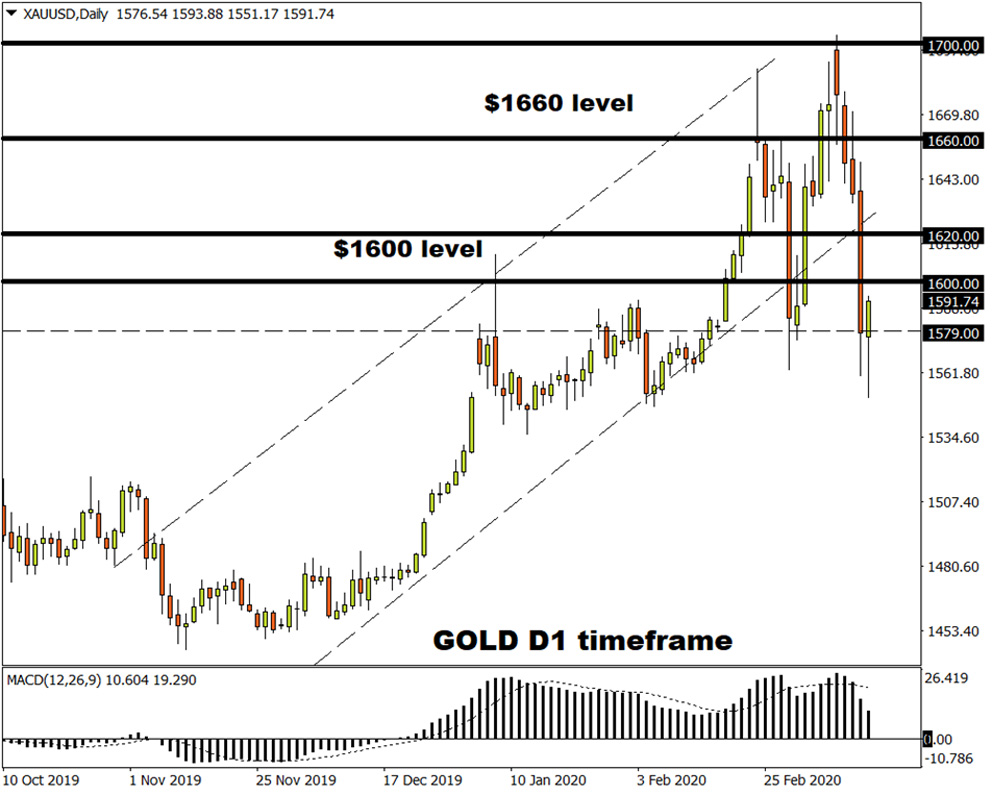

Commodity spotlight – Gold

Not even safe-haven Gold has escaped the brutal market sell-off, as the pandemic panic sweeping global equities forced investors to cover margin calls.

The precious metal has depreciated over 5% this week despite the market chaos, which puts it on track for its biggest weekly loss since 2011. An appreciating Dollar also added to the pain with prices trading around $1591.

Focusing on the technical picture, prices are bearish with sustained weakness below $1600 opening the doors towards $1555. If bulls to secure a weekly close above $1600, the next key level of interest will be found at $1620.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius