Moody’s has lowered its forecast for global sustainable bond issuance this year from $400 bln to 325 bln after economic fallout from the coronavirus outbreak reduced green bond volumes in the first

By Ryan Sweet – Moody’s Analytics The Federal Reserve on Thursday rolled out additional actions in an effort to stabilise financial markets and be sure liquidity problems do not morph into insolvency

The outlook for Lebanon’s banking system has changed to negative as business activity stalls and the economy slides into paralysis, while the government defaulted on foreign debt payments last month, Moody’s Investors

The coronavirus pandemic will tighten near-term private financing prospects for emerging markets, Moody’s Investors Service said in a new report, as funding will focus on mobilising private capital for water, sanitation and

Low-rated emerging market sovereigns with large near-term international bond repayments and significant reliance on foreign currency, private-sector credit are particularly vulnerable to the impact of deteriorating economic conditions on capital markets, according

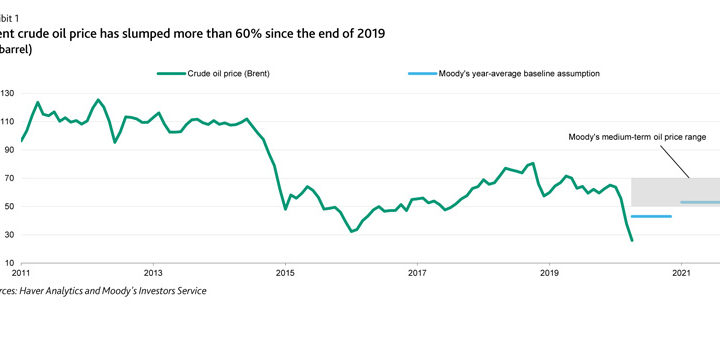

The severity of the credit impact of lower oil prices on oil- and gas-producing sovereigns will vary from country to country, driving divergence in their creditworthiness, Moody’s Investors Service said in a

By John Lonski, Chief Economist, Moody’s Capital Markets Research From the perspective of the U.S. equity market, COVID-19 is the worst natural disaster ever. After setting a record high on February 19,

The outlook for the global shipping industry has changed to ‘negative’ from ‘stable’ in the wake of the coronavirus outbreak, Moody’s Investors Service said in a new report. The change to a

Moody’s expects government financial support for affected businesses and households, in addition to ECB measures and Central Bank of Cyprus moves, to help limit the coronavirus-related impact on banks’ asset quality and

Moody’s Investors Service has revised its Global Macro Outlook and its baseline growth forecasts for all G20 economies. The coronavirus outbreak has spread rapidly outside China to a number of major economies.