The outlook for the global shipping industry has changed to ‘negative’ from ‘stable’ in the wake of the coronavirus outbreak, Moody’s Investors Service said in a new report.

The change to a negative outlook primarily reflects the expected decline in 2020 EBITDA amid sharply reduced demand for container and dry bulk shipping services as the outbreak hits Chinese manufacturing output and demand for coal and iron ore, especially during the first half of 2020, as well as related economic disruption.

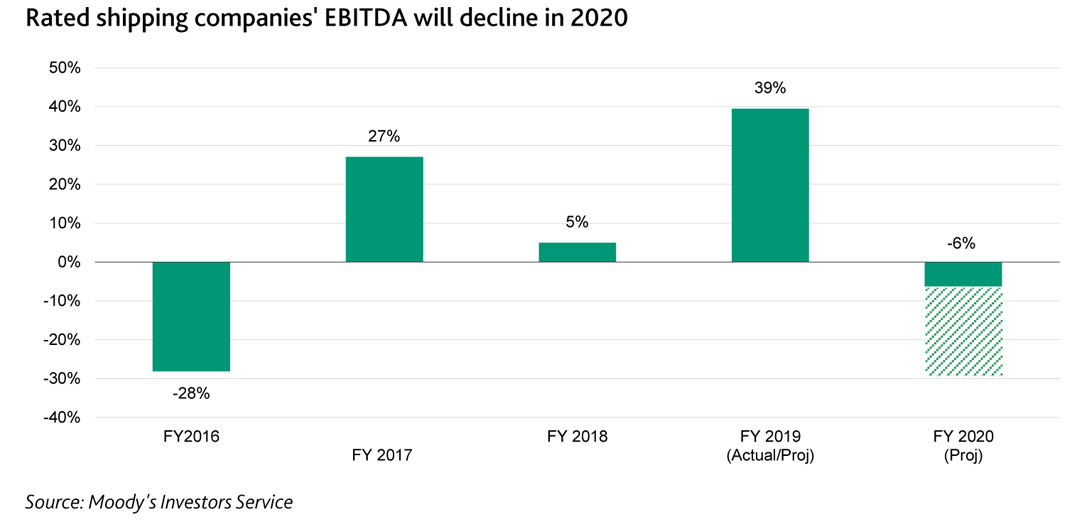

“The earnings of rated shipping companies will likely decline by around 6-10% in 2020 compared with EBITDA growth of almost 40% in 2019,” said Maria Maslovsky, a Vice President and senior analyst at Moody’s.

“Our outlook for the global shipping industry had been stable since May 2017.”

There is a downside risk that the EBITDA of shipping companies globally could decline by 25-30%, similar to levels last seen in 2016 when Hanjin Shipping Co. Ltd. went bankrupt in one of the largest recent failures in the sector.

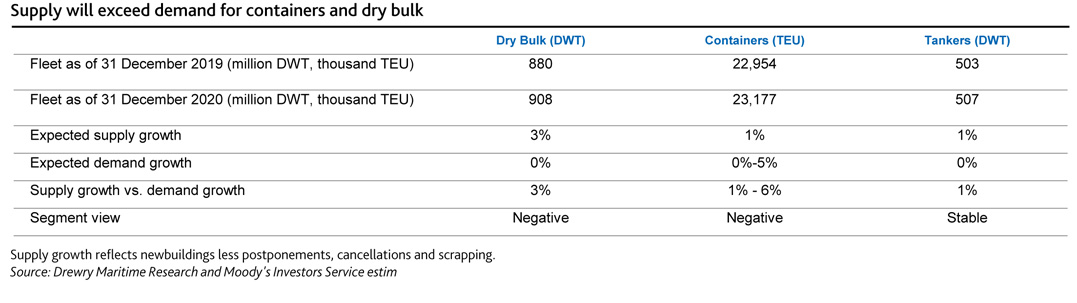

Moody’s expects the supply-demand balance to tilt toward oversupply for the container shipping and dry bulk segments, especially in the first half of this year. The situation is more positive for tankers at the moment given the recent sharp drop in oil prices.

“We had previously expected demand and supply growth to be largely balanced across these three key shipping segments in 2020. The revised supply and demand forecasts reflect our expectations for the conditions in the specific industry sectors taking into account historical industry trends as well as the likely effect of the coronavirus,” the rating agency said.

Moody’s said “we recently revised down our 2020 baseline growth forecasts for all G-20 economies because we expect the coronavirus to hurt economic growth in many countries through first half of 2020 and to hamper trade.

“Our view of the segment also takes into account both the significant slowdown in Chinese manufacturing of containerised goods and the more recent reports of store closings that are likely to lead to reduced inventories. Positively for container shipping companies, the recent drop in oil prices will help offset fuel costs, especially in light of the IMO 2020 low sulphur fuel regulations that came into effect in January.

“Some container liners have indicated that the activity in China is picking up, which is a positive, but we are also mindful of the potential for reduced commercial activity in Europe and North America as these regions battle the coronavirus. Although there are a number of large deliveries of new vessels anticipated in 2020, we would expect many of them to be postponed.”

The Moody’s report said that for dry bulk companies, the slow resumption of manufacturing operations in China is a plus because it suggests improved demand for coal and iron ore, two key dry bulk commodities. In addition, port openings in China will also allow for transportation of grains, another large dry bulk commodity. China is the largest importer of dry bulk commodities and the sharp reduction of Chinese demand sent the Baltic Dry Index (BDI), a key benchmark for dry bulk shipping, toward historical lows.

Positively, the BDI has been rising in recent weeks. Still, as coronavirus takes its toll on countries globally, other large importers of dry bulk goods are either already affected, such as Japan, or are likely to become affected in the coming months (such as India). Fleet growth for dry-bulk shipping companies picked up in 2019, but Moody’s expects it to reduce in 2020 through postponements, scrapping and idling.

The negative pressure on tanker shipping companies from reduced demand for oil and oil products because of the coronavirus outbreak has been unexpectedly mitigated by the recent sharp drop in oil prices. Both spot and charter rates have risen significantly in the past week and are likely to remain at elevated levels through April following the announcement of discounts on oil sales by Saudi Arabia.

“Still, the longer-term picture remains uncertain for the tanker sector and, given the global slowdown in growth, we do not expect a large increase in demand for tankers in the medium term. On the positive side, the sector continues to benefit from scrapping related to IMO 2020,” the rating agency said.

In conclusion, the Moody’s report said “we would consider revising the outlook to stable if both the oversupply of vessels declines materially such that shipping supply growth does not exceed demand growth by more than 2% and year-over-year EBITDA growth appears likely to be between -5% and +10%.”