By Jameel Ahmad, Global Head of Currency Strategy and Market Research at FXTM

The Disney story represents a fairy tale of its own that has captured the hearts of generations for close to a century. The Walt Disney Company has also enjoyed a 2019 full of achievements, from completing the acquisition of 21st Century Fox to the successful launch of its new streaming service, Disney+, and its stock value has benefitted, jumping 34% year-to-date, as of December 18.

Full of attractions, old and new

Disney has a loyal following that has grown the brand as a household name for decades. This includes family-friendly and timeless content provided by Walt Disney Pictures, from Snow White to The Pirates of the Caribbean; blockbuster fantasy Marvel Group and the Star Wars franchise; Walt Disney theme parks and resorts – the list goes on. The recent acquisition of 21st Century Fox brings more well-known names in X-men and Deadpool into a company group that has also acquired stakes in Hulu and ESPN.

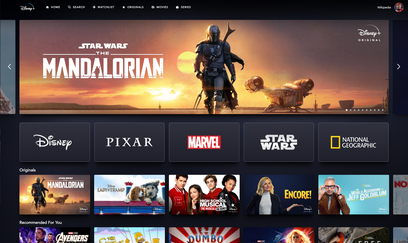

There are a number of reasons to remain upbeat on Disney, starting with the successful launch of its streaming platform Disney+. There have been over 22 million downloads of its application a month since its launch and 10 million sign ups within one day following its November release, meaning that Disney+ is well on track to reach its 60-90 million global subscriber goal before 2024. And this is even before the product is fully launched into international markets.

Investors can also look positively at the fact that Disney has enjoyed a lifespan close to 100 years and has survived each and every challenge that the world economy has faced since the 1920’s. The entertainment legend has risen above economic downturns ranging from the aftermath of the Great Depression, to the global financial crisis in 2008 and everything in between.

If consumers are faced with questions over spending habits, the price point of Disney+ swings the hammer in its favour when considering that it is cheaper than its rival, Netflix. Disney+ costs $6.99 per month with the bundle including Hulu and ESPN+ available at $12.99 a month, compared to the Netflix standard subscription fee of $12.99.

Short term pain, long term gain

While Disney may still face some hurdles with higher operating income and the ongoing integration of Fox’s entertainment assets which subsequently weigh on its revenue over the next two years, all eyes will be on the company’s fiscal Q1 2020 earnings release scheduled in February. If positive guidance on subscriber numbers is provided in the upcoming earnings release, it could boost investor confidence that the potential worldwide popularity of Disney+ supports the view that its share price likely has further upside.

The current consensus among 25 investment analysts polled by CNN Business shows that 19 have a buy recommendation on the stock, with six expressing that it will outperform.

Technical picture suggests multiple support levels

The Disney share price is consolidating after a surge from $111 in April which pushed the stock all the way to its record-high above $150 in late November. While the uptrend still appears intact, there are several possible support levels seen at $135, $130 and $126 should investors decide to take profits on a star performer of the Dow Jones Industrial Average in 2019.

For information, disclaimer and risk warning note visit www.ForexTime.com

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius