By Naeem Aslam

European and US futures are trading close to the flatline, as investors continue to argue that the current rally has taken the price action too high and too fast.

If you look at the major stock indices, such as the S&P500 or the Nasdaq 100, you will see that these majors have clocked seven out of eight weeks in positive territory — which is something more than remarkable. At the same time, it is more than enough to raise alarm bells that the current rally could begin to lose its mojo.

Having said this, there are many arguments that investors can make in favour of this rally, as well as plenty of room for the current rally to continue to push the stock indices higher.

Their arguments are based on the resilience of the economic data, which doesn’t really show that any of the major economies are going to have a hard landing.

Secondly, there is enough optimism among investors that the Fed will cut rates sooner than later, and not many are still buying the news that the Fed will cut rates only once this year. Lastly, there is hope for the US elections and the subsequent surge in the equity markets.

Tuesday’s focus will be on consumer health, and nothing is more important than US retail sales data, which explains the actual health of the US economy.

The month-on-month retail sales number is expected to improve from its previous reading of 0.0%; the forecast is 0.3%.

If the actual number matches expectations, it would be positive news for the market, and the stock indices are more than likely to improve further.

There is already heavy upward momentum in the tech sector, which is primarily driven by AI stocks and CAPEX expectations. And an improvement in retail sales data will only bring more positive news.

However, traders must remember that we are in a unique market environment where positive news can have negative consequences. If the data is positive, market participants may expect a gradual response from the Fed regarding a potential rate cut.

Given the market’s preference for dovish monetary policy, this could lead to a potential retracement in the major stock indices.

Cryptos lose direction

In the crypto sphere, things aren’t looking that great. The current momentum in the cryptocurrency world has lost its narrative, leaving traders deeply confused about the future direction.

On Monday, we saw a significant sell-off in prices, during which the price of bitcoin experienced pressure from sellers. And Tuesday is not that different — it seems like bears want to push a new support zone, which could be near the $60,000 level.

If the price drops near that level, the narrative doesn’t improve, and bargain hunters don’t intervene, we could witness a significant downturn in the cryptocurrency market.

Overall, we are in the third cycle of crypto price action: the first cycle is where the bitcoin price action begins to move upward, and we saw this when BTC moved sharply higher. The second cycle is where altcoin prices rise while bitcoin prices remain relatively flat. The third cycle is when bitcoin prices begin to move lower and altcoins tank — this is where we are now.

In terms of fundamentals, traders and investors are more eagerly waiting for the US election, as that will mainly impact the mining industry. The mining players hope that Trump will come into power — and many CEOs of major mining companies have already met Mr. Trump.

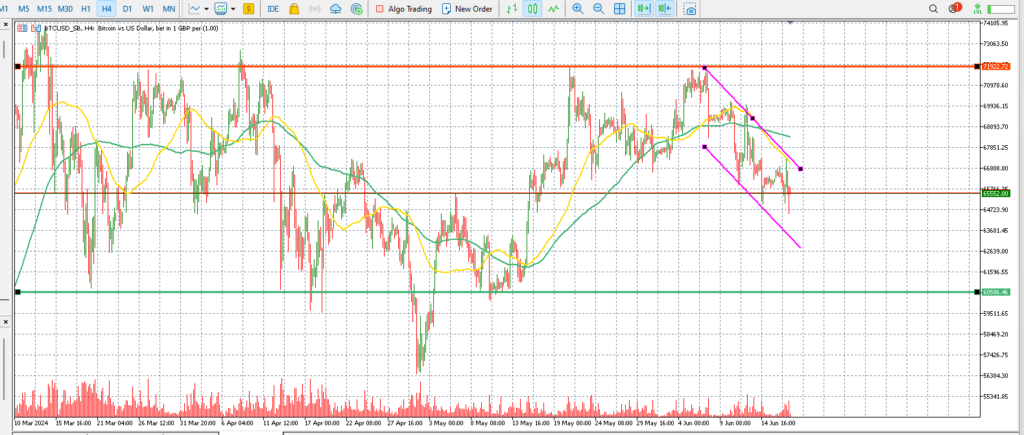

The below chart shows important price levels for the Bitcoin price.

Bitcoin chart by Zaye Capital Markets

Risk takes shine away from Gold

Just like Bitcoin, goldv prices are also on the move, but to the downside. The main reason for this is due to differences in risk appetite.

Traders and investors primarily favour riskier assets, and they know that they can get more bang for their buck by taking risks. This has taken the shine away from gold prices, which is why the prices are moving to the downside.

In terms of technicals, it is likely that the price action may actually test the support of $2,300 in the coming days, as it appears that the bulls are failing to defend.

A break of the major support without any new buyers at that level may push the yellow metal’s price further lower towards the next important price level of $2,150.

Naeem Aslam is Chief Investment Officer at Zaye Capital Markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Zaye Capital Markets.