By Naeem Aslam

Investors and traders are reluctant to take any major bets on either side of the market as the whole world is waiting for the most important data, released later Wednesday, US inflation.

This is this economic number that is going to set the tone among investors and traders.

Stock futures are swinging between gains and losses as investors continue to remain on the sidelines.

The futures for the S&P 500 are trading marginally higher, and they have not had a great start for the second quarter compared to the previous quarter, where the stock index recorded decent gains—and this was on top of the stellar performance that the index recorded in all of 2023.

In Europe, the sentiment is also somewhat negative, as the focus again is on US inflation and the Fed’s reaction.

It is true that inflation data in the EU has printed a much better number, and perhaps the ECB is in the most comfortable position compared to other central banks, however, traders know that the European stock market and the price action have a positive correlation with the US stock indices. If the US inflation data fails to impress the Street, it will be a blood bath.

Blood Bath or Stellar Rally

There are two important events unfolding that are going to set the trading tone for the rest of the month.

Firstly, the US inflation reading, which is expected to rise to 3.4%—a number that is well above the Fed target of 2%.

The US CPI y/y reading for the previous month was at 3.2%, and the concern is that this number has actually started to travel in the wrong direction, which means that rather than inflation moving to the downside, we are actually experiencing a number that has started to travel up.

If the US CPI inflation data even matches expectations, I do not think that the US markets will be very pleased, and there are stronger chances of a further sell-off as investors will factor in less chances of a rate cut from the Fed.

If the US CPI number prints anything above 3.4% y/y, it is going to be a blood bath.

Market sentiment will tank, and traders are likely to run for their lives. This is because there is already plenty of pessimism among traders who think that the Fed can’t make another mistake, and given the strength of the US labour market, they have every reason to delay the rate cut.

Equities under pressure

US stock indices are likely to suffer great losses if the US inflation data fails to impress, and this means that the gains that were seen for these indices are likely going to come under threat.

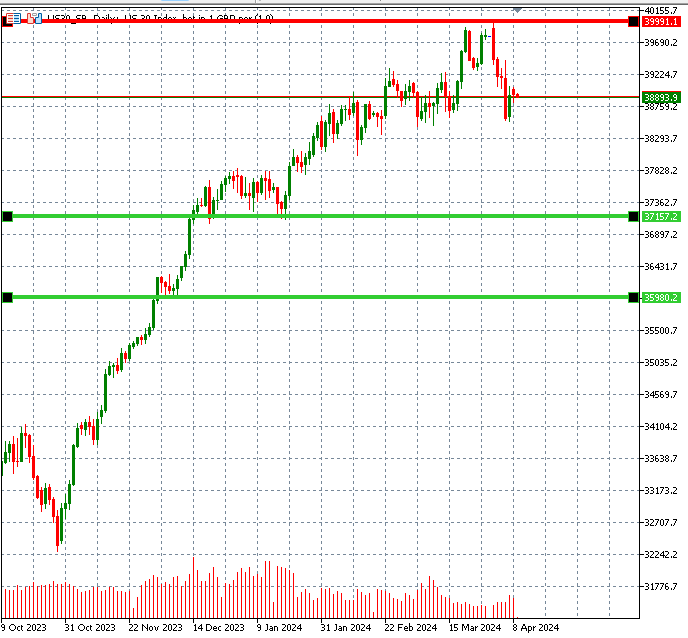

The chart below shows possible support areas where the market is expected to drop, and a break in any of these support areas is more than likely to push the prices further lower.

On the flip side, if the data prints a reading that is better than expected, we will see the Dow Jones industrial average moving sharply higher.

Gold remains volatile

The yellow metal, which is already on fire and has been up more than 15% so far this year, is going to see some wild price action.

So far, the move has been mainly due to two reasons: first, the expectations around the Fed’s interest rate cut. Secondly, the on-going geopolitical tensions pushing investors to look for a hedge, and there is no better hedge than gold.

Even on Monday, when the markets were very much in a zombie zone, the gold price action was no short of Hollywood blockbuster movies’s price action.

If the US inflation data comes in hotter than 3.4%, then we are likely to see what most investors have been waiting for: a pullback. And the reason is the ongoing heightened geopolitical tensions.

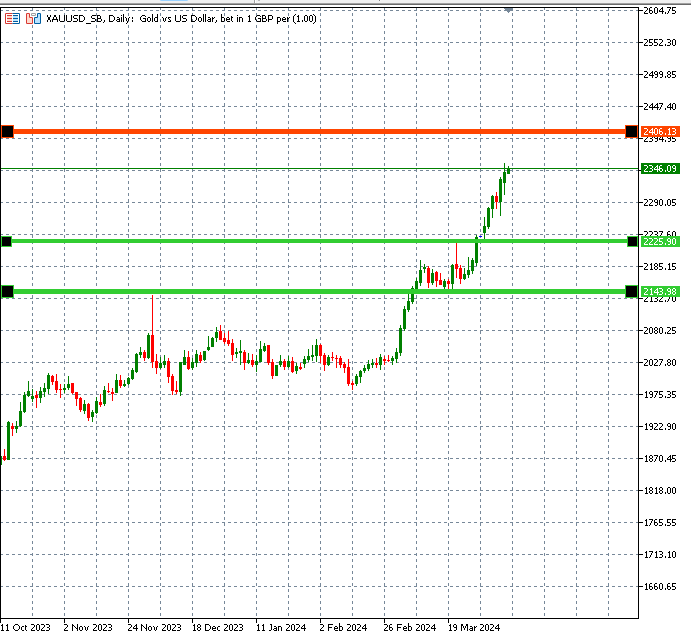

A hot US inflation reading could easily push the price towards the level shown on the charts.

However, if the US inflation number comes in better than forecast, then the current trend is likely to move even further.

Naeem Aslam is Chief Investment Officer at Zaye Capital Markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Zaye Capital Markets.

US 30 Trading Chart by XTB

US 30 Trading Chart by XTB Gold price chart by XTB

Gold price chart by XTB