By Naeem Aslam

Investors are taking a cautious approach when it comes to taking risks.

This week’s economic data hasn’t been so supportive of their investment thesis, and hence they are taking a more calibrated approach with their trading strategy.

Nonetheless, some speculators continue to believe that there are still plenty of reasons to remain optimistic.

This week, investors in the UK and in the US had their full focus on the economic calendar, as there were high hopes in relation to some economic numbers.

Firstly, traders in Britain were focused on the labour market data as there were concerns that the job market is highly fragile due to the cost of living crisis and business activity being subdued.

However, to their surprise, certainly a pleasant one, the UK’s job numbers produced numbers that were much better than expected.

For instance, the unemployment rate dropped to 3.8%, the average earnings index also improved, and the claimant count change came in at 14,100 against the forecast of 15,200. This number boosted morale among sterling traders, but at the same time, it also increased the odds that the Bank of England may keep interest rates higher for longer as the labour market is improving.

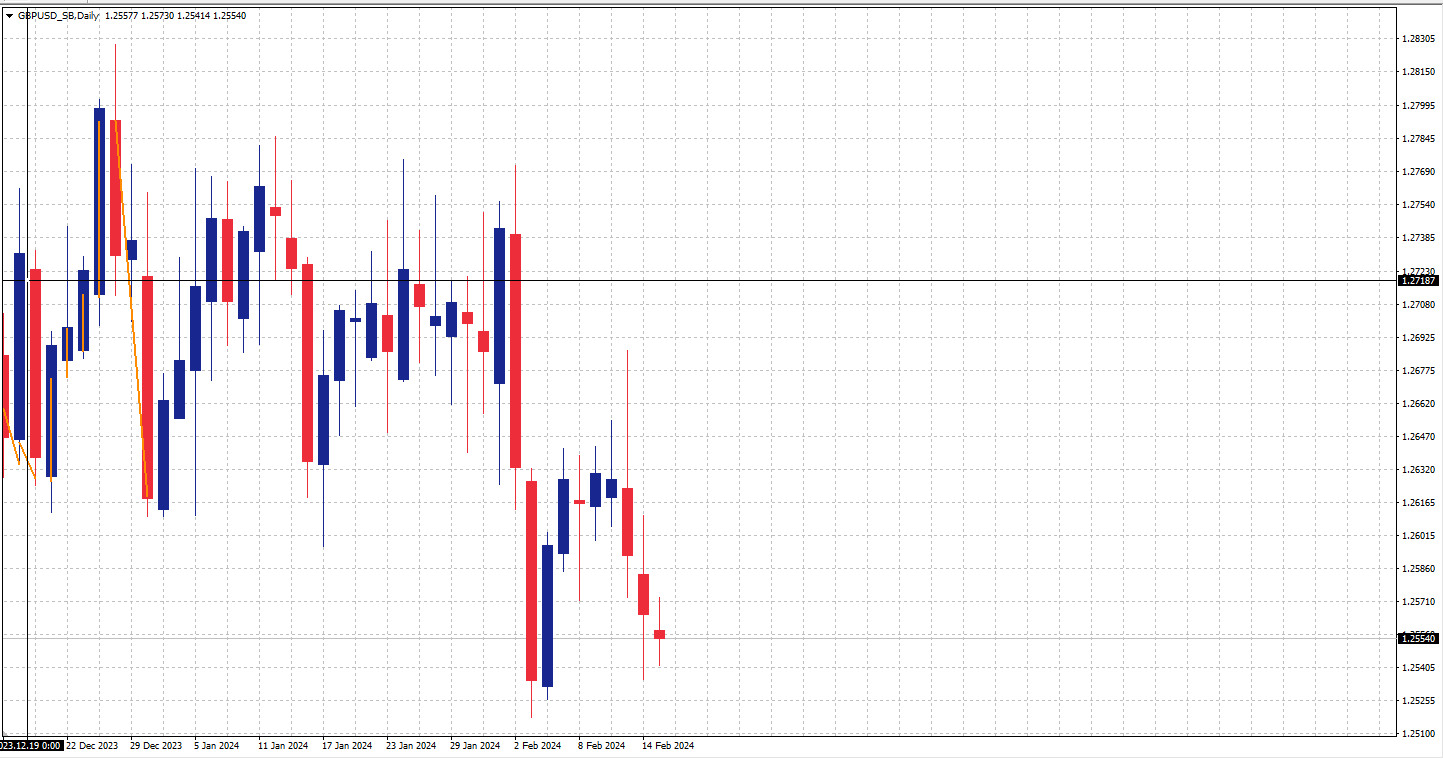

The net result on the GBP/USD was a sell-off, as you can see in the chart below. The sell-off became a little more intense the following day as the inflation data showed that the inflation situation in the UK had started to improve.

The UK’s CPI y/y reading came in at 4%, while the forecast was for 4.1%, and the previous reading was the same as this month. Although a lower inflation reading should have pushed Sterling higher, the reason the chart shows a red candle is mainly due to the fact that traders anticipate the labour market is strong and inflation isn’t making significant improvements. So, the BoE may not take the interest rate cut step as early as many expect.

As for the USD, this week was mainly about the US CPI data, and the fact that the number on Tuesday failed to impress the Street has impacted sentiment to a large extent.

The US CPI core m/m inched higher to 0.4% against the forecast of 0.3%. The CPI m/m data also moved to the upside with a reading of 0.3%, and the headline CPI y/y number also increased to 3.1% against the forecast of 2.9%.

All of this gave one clear signal to everyone: the Fed is not going to trigger the rate cut button that quickly.

What about risk-on rally?

Speculators over in the UK and in the US continue to believe that a rate cut is going to take place in the second half of this year, regardless of the economic data we have received so far.

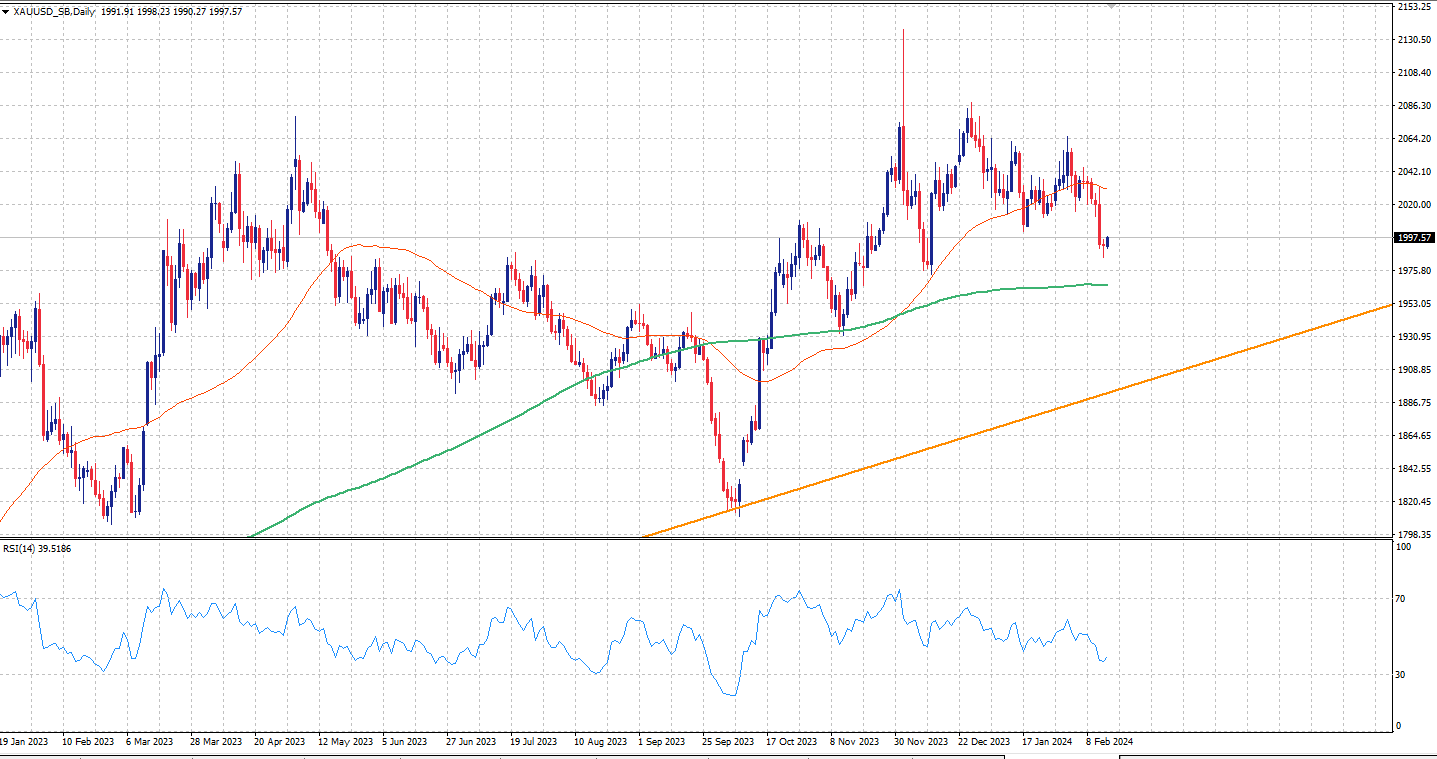

They believe that the Fed and the BoE cannot afford to keep the interest rate this high, as this will eat into their own flash. However, this argument begins to make more sense when one looks at the Gold price, as the price of the yellow metal has dropped below the critical level of $2,000, which has served as a strong support.

The reason that the price has fallen below this mark is mainly because traders believe they can get a bigger bang for their buck if they continue to back riskier assets.

The reason that the price has fallen below this mark is mainly because traders believe they can get a bigger bang for their buck if they continue to back riskier assets.

However, one should take this view with a pinch of salt, as the weakness in the gold price is also due to the strength in the dollar index, and that strength is purely due to the fact that traders believe the Fed may not move as quickly in terms of cutting interest rates as was anticipated.

Naeem Aslam is Chief Investment Officer at Zaye Capital Markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Zaye Capital Markets.