An article was published on 24 January which said, “Cypriot banks severed business ties with nearly 60,000 customers – mostly Russian and Ukrainian nationals – between 2014 and 2022, while some 126,000 accounts have been suspended, amounting to approximately EUR 40 bln”.

I look at banking sector numbers every month for my monthly Sapienta Country Analysis Cyprus reports. The EUR 40 bln number therefore struck me as odd, as it seems to imply that deposits had dropped by EUR 40 bln. If deposits had indeed dropped by EUR 40 bln, it would be rather alarming. Luckily this is not the case, for reasons explained below.

Other versions of the article presented the news as the Republic of Cyprus government trying to “clean up its financial image”. This leads me to assume that the source of the information given to the journalist was a government official – who was perhaps not so familiar with bank figures – rather than the Central Bank of Cyprus, which actually produces them.

It does not help that the Central Bank of Cyprus has not had an official spokesperson for something like two years. This raises the barrier to fact-checking.

Now let’s dig into which bits in the article were accurate and which bits were potentially misleading if you take the “EUR 40 bln” as implying that deposits had dropped by that amount.

Yes, around 126,000 bank accounts were closed

The part relating to the number of accounts that have been closed is mainly true. The Central Bank of Cyprus issued a statement on 16 November 2023, which said that banks had closed 125,782 accounts since late 2018. This is close to the “126,000 accounts” in the abovementioned article.

The Central Bank also said that banks had terminated relationships with 42,728 shell companies. Given that not all customers would have been shell companies, this is close enough to the “60,000 customers” and in the article to be fine. The only issue is that the period cited by the Central Bank was from 2018, not from 2014, as stated in the article.

The part that is potentially misleading is where the article implies that the decline in Russian banks accounts amounted to EUR 40 bln. This cannot be the case for the following reasons.

Not even in the crisis did deposits decline by EUR 40 bln

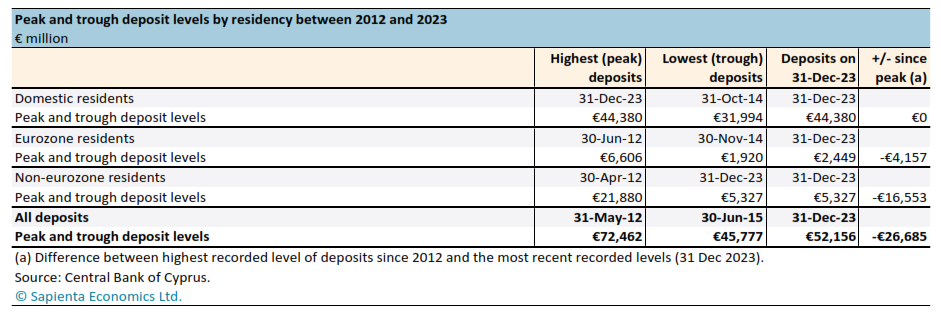

Total deposits in the banking system, including domestic and eurozone deposits, amounted to EUR 52.2 bln at the end of December 2023 (see table). They have actually been rising, not falling, since 2015. By the way this means that banks in Cyprus are extremely liquid. Deposits are double the size of loans. This is a huge change from the crisis-era period of 2012-13.

The period in which Cyprus did suffer a sharp decline of deposits was between 2012 and 2015. Cyprus was thrown into junk rating during 2012 and had a full-blown crisis in March 2013, when eurozone leaders took the decision to “bail in” (haircut) deposits. The banks did not open their doors for 12 consecutive days.

The period in which Cyprus did suffer a sharp decline of deposits was between 2012 and 2015. Cyprus was thrown into junk rating during 2012 and had a full-blown crisis in March 2013, when eurozone leaders took the decision to “bail in” (haircut) deposits. The banks did not open their doors for 12 consecutive days.

Initially the decision was to take a slice of all deposits. After much handwringing on all sides they later decided to haircut only all deposits over EUR 100,000 at the now defunct Laiki and a portion of deposits over EUR 100,000 at Bank of Cyprus.

So how far did deposits fall around the time of the crisis? Central Bank data show that, between a peak of EUR 72.5 bln in May 2012 and a trough of EUR 45.8 bln in June 2015, total deposits – that is, deposits of residents, eurozone residents and others – dropped by EUR 27 bln.

However, much of the 2012-15 drop came from domestic deposits, not external ones. Out of the EUR 27 bln decline in total deposits, EUR 12 bln of the fall was domestic deposits. This makes sense. I certainly held a lot more cash during that period, because we did not know what was going to happen with the banks.

Some might say that these domestic deposits would have included resident Russians. This is true. But the “golden passport” scheme only accelerated after 2015, therefore resident Russian deposits are not likely to have been a large proportion of the total.

In the 2011 census there were only 10,502 people born in Russia living as long-term residents in Cyprus. (The Statistical Service, Cystat, has been rather shy about publishing citizenship by origin for 2021. That is an article for another day.)

So how much have Russian deposits fallen and what level are they at now?

Non-eurozone deposits dropped the most in early 2013

There is no category in the Central Bank data for deposits by nationality as such. The best proxy is non-eurozone deposits.

Non-eurozone deposits peaked at EUR 21.9 bln in April 2012 and had fallen to EUR 5.3 bln by December 2023. In total, therefore, they fell by EUR 16.6 bln – nowhere near EUR 40 bln.

Most of this decline took place in the first few months of 2013 (right before the crisis). Non-eurozone deposits have been trending down ever since but at a much slower pace.

After cross-checking against other figures around a year ago, I concluded that around 80% of non-eurozone deposits were probably Russian.

If my assumption was correct, then Russian deposits today account for about EUR 4 bln in a banking system with EUR 52.2 bln in deposits. So was the “EUR 40 bln” in the article simply a typo? Should it have read EUR 4 bln?

BOC and Hellenic Russian deposits are now below EUR 1 bln

Maybe. But even my EUR 4 bln estimate for Russian deposits seems a little large in light of more recent figures from Bank of Cyprus (BOC) and Hellenic Bank.

In its accounts for the third quarter of 2023, BOC reported that it had just EUR 607 mln in deposits from Russian nationals at the end of September. Hellenic Bank reported that around 1% of deposits were of Russian or Belarusian nationals. From their other data you can infer that this equates to around EUR 155 mln.

Thus, the two banks, which together have two-thirds of the deposit market, hold just EUR 762 mln in Russian deposits. So maybe EUR 4 bln is a big over-estimate.

What we can say for sure is that Russian deposits were never as big as EUR 40 bln and what there was fled long before Ukraine-related sanctions.

For journalists seeking a “smoking gun” on Russian business conducted via Cyprus, therefore, the focus on Russian deposits is the wrong one.

Fiona Mullen is Director of Sapienta Economics and the author of Sapienta Country Analysis Cyprus.