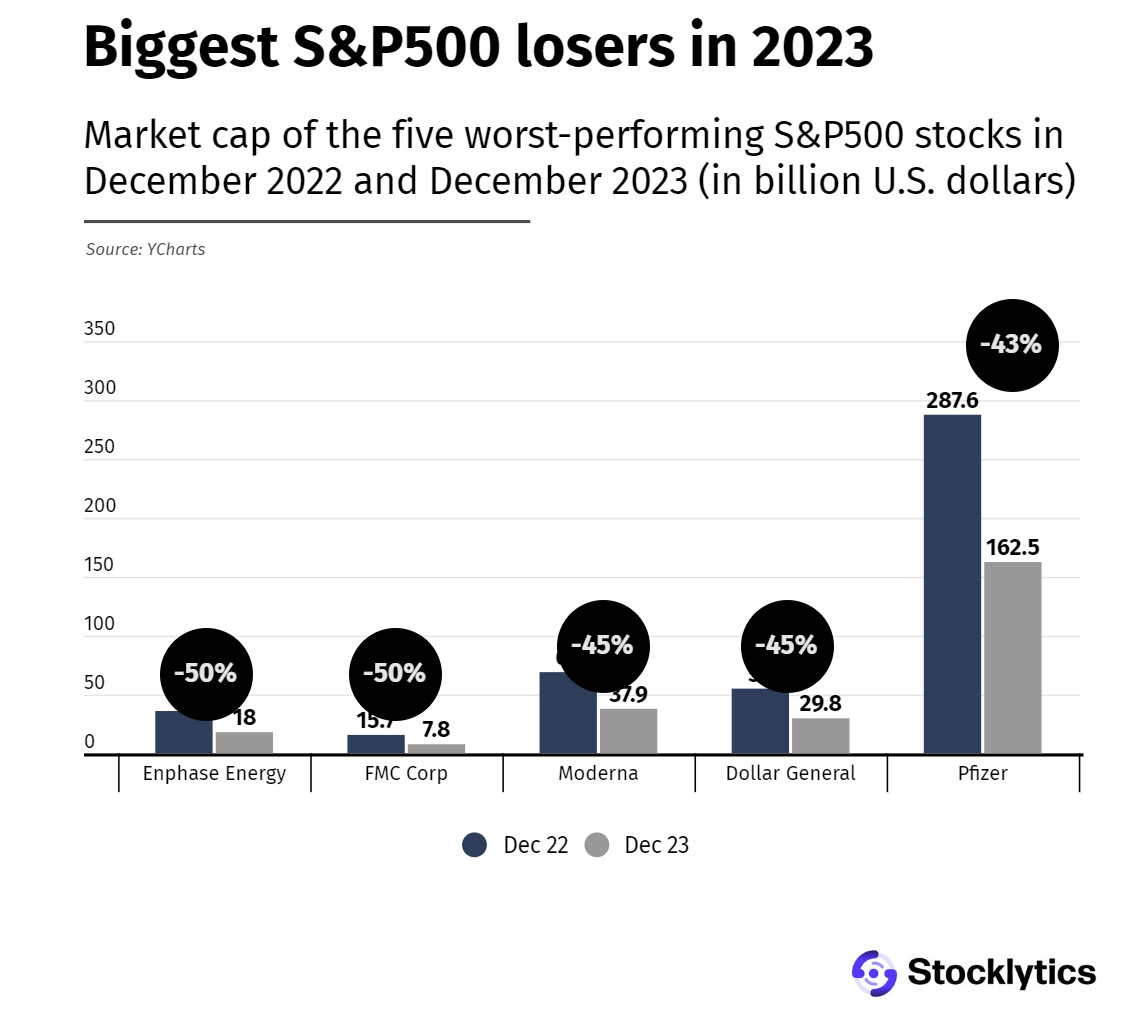

The five worst-performing S&P 500 stocks in 2023 – Enphase Energy, FMC Corporation, Moderna, Dollar General and Pfizer – have collectively lost a whopping $207 bln in stock value, according to data presented by Stocklytics.com.

The US stock market showed a remarkable rally in 2023, helping the benchmark S&P 500 end the year with nine consecutive weeks of growth.

And while plenty of tech giants added hundreds of billions of dollars to their stock values amid the artificial intelligence (AI) craze, nearly one-third of stocks in the S&P 500 were still down for the year.

Unlike tech giants Nvidia, AMD, Tesla and Amazon, which ended the year as the biggest winners on the S&P 500 list, nearly 180 companies took a nosedive during 2023 and lost hundreds of billions of dollars in stock values.

According to YCharts data, Enphase Energy and FMC Corporation took the biggest hit of all S&P 500 companies, losing 50% of their stock values in 2023.

In December 2022, the market cap of Enphase Energy stood at $36 bln. However, by the end of the year, half of that value melted, falling to $18 bln on December 31.

In December 2022, the market cap of Enphase Energy stood at $36 bln. However, by the end of the year, half of that value melted, falling to $18 bln on December 31.

As the second-worst performer in the S&P 500 club, FMC Corporation lost nearly $8 bln in stock value in the twelve months, with the combined value of its stocks falling to $7.8 bln on the last day of 2023.

Big Pharma

COVID-19 medicine producers also took a severe hit in 2023.

The YCharts data show Moderna lost $31 bln or 45% of its stock value last year, falling from $69 bln to only $37.9 bln.

Pfizer also had substantial losses, with $125 bln or 43% of its stock value wiped out in 2023. On December 31, the market cap of the pharmaceutical giant stood at $162.5 bln, down from $287 bln in the same month in 2022.

The popular US chain of variety stores, Dollar General, also ranked among the worst S&P 500 performers, with a 45% market cap drop last year.

Statistics show the company lost more than $25 bln in stock value in the twelve months, the third-largest loss in this group.

Collectively, these five companies have lost more than $207 bln in stock value in 2023, with their combined market cap falling from $463 bln in December 2022 to $256 bln last month.

The five worst-performing stocks reflect how well the industries they work in performed last year.

Healthcare stagnated

For example, the two pharma giants, Pfizer and Moderna, collectively lost more than $150 bln in stock value, while the S&P 500 healthcare sector index stagnated at 0.3% in 2023.

But even that looks good compared to utilities, energy, and consumer staples, the three worst-performing S&P 500 sectors in 2023.

According to MarketWatch data, the utilities sector index saw the biggest drop, falling by 10.2% last year, and marking a second consecutive year of decline. The energy sector index was down by 4.8% in 2023, after plunging by 59% in 2022. The consumer staples sector index followed with a 2.2% decline.

On the other hand, information technology, communication services, and consumer discretionary sectors had the best-performing indexes, surging by 56.4%, 54.4%, and 41%, respectively.