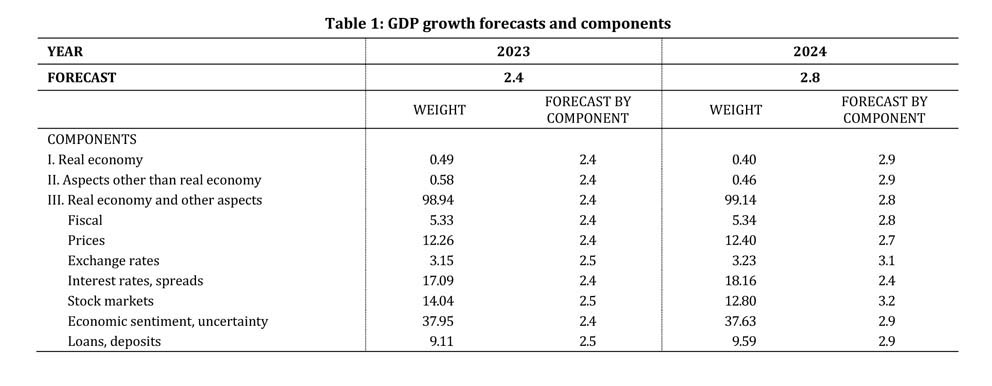

Real GDP growth is forecast to slow from 5.1% in 2022 to 2.4% in 2023 before picking up to 2.8% in 2024, according to the latest economic Outlook from the University of Cyprus.

GDP growth decelerated further in the second quarter of 2023, resulting in a lower-than-expected growth rate, according to the October issue of the Outlook produced by the university’s Economics Research Centre.

Consequently, the growth forecasts for 2023 and 2024 have been downgraded by 0.6 and 0.1 percentage points, respectively, compared to the July issue.

“Tighter credit conditions, elevated prices, and the slowdown in Cyprus’ trading partner economies weigh on domestic growth prospects considerably,” said the report, signalling further loss of growth momentum.

Moreover, third-quarter indicators (July-September), mainly relating to external demand, suggest that domestic activity has softened further.

Nevertheless, factors supporting the growth outlook include favourable labour market conditions, resilient business confidence in Cyprus, growth in new business loans, further improvements in stock market indices, and strong fiscal performance.

Inflation to decrease

The ERC outlook said inflation (based on the Consumer Price Index) is forecast to decrease from 8.4% in 2022 to 3.9% in 2023 and 2.6% in 2024, mainly due to tighter credit conditions and past declines in international commodity prices and domestic inflation.

“The decline in CPI inflation between the second and third quarters was marginal.

“Moreover, price developments have shown an uptick recently, particularly in September,” while the annual declines in global oil prices moderated significantly.”

Therefore, inflation forecasts for 2023 and 2024 have been revised upwards by 0.9 and 0.6 percentage points, respectively, relative to those in the July issue.

The Outlook for growth and inflation is accompanied by downside and upside risks.

“Geopolitical uncertainty has increased considerably, possibly affecting economic activity and prices in Cyprus over the following quarters.

“The lower-than-expected growth rate incorporated in the forecast revision also reflects the materialisation of downside risks relating to the impact of sanctions against Russia on external demand for services in Cyprus, despite strong tourist inflows”.