The new government has presented its first official medium-term budgetary targets since taking office on February 28, with rating agency DBRS Morningstar saying it signals fiscal policy continuity.

While the election of President Nikos Christodoulides in February marked a shift in Cypriot politics as his candidacy was not backed by either of the two largest political parties DISY and AKEL, the medium-term budgetary targets signal fiscal policy continuity, DBRS said, echoing a similar comment by Moody’s just after the president’s election.

Christodoulides is expected to continue the government’s fiscal discipline and rollout economic reform, Moody’s had said.

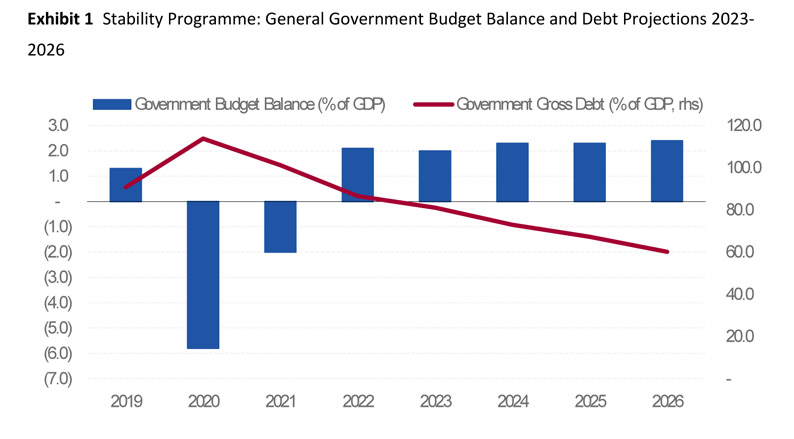

DBRS noted that similar to the projections of the previous government’s Draft Budget 2023 released in October 2022, the Stability Programme 2023-2026, published on May 3, “forecasts recurring budgetary surpluses and, as a result, a marked reduction in the high public debt burden over the next few years.”

Recurring Surpluses

DBRS Morningstar said the new government seeks to solidify last year’s improvement in the fiscal balance over the medium-term.

“In 2022, the general government budget balance turned into a surplus of 2.1% of GDP from a deficit of 1.7% in 2021, driven by a strong increase in tax revenues and one-off factors such as a large decrease in COVID-19 support measures. Looking ahead, the Stability Programme projects the government to register average annual budgetary surpluses of 2.3% during 2023-2026.

“Taking into account the projected surpluses and strong growth dynamics, the Stability Programme forecasts a strong decrease in the general government debt-to-GDP ratio from 86.5% in 2022 to 60.1% in 2026.

“This debt trajectory is broadly in line with the October 2022 debt projections of the previous government, which had forecast a decrease in government debt to 72.3% of GDP by 2025,” the rating agency said.

Strong growth in Q1

DBRS Morningstar said actual fiscal outcomes remained favourable in Q1 2023. The general government balance posted a surplus of 1.1% of GDP compared to 0.9% in Q1 2022 on the back of strong economic growth dynamics.

“While national authorities have not released GDP data for Q1 2023 so far, monthly indicators such as tourist arrivals and retail trade turnover point to still strong growth in external and internal demand. This favourable economic growth dynamic, in tandem with still high inflationary pressures, benefitted public finances by contributing to an upswing in nominal tax revenues.

“General government revenues rose by a very large 13.7% in Q1 2023 on a year-on-year basis, which more than offset the strong increase in total expenditure by 11.4%. The latter resulted largely from the partial indexation of public sector wages and pensions to high inflationary pressures in early 2023.”

Growth dynamics

The favourable medium-term budgetary projections of the Stability Programme are not based on specific fiscal consolidation measures but, instead, on the assumption that strong economic growth dynamics will continue to bolster public tax revenues over the next years, the rating agency said.

“Total public revenues are projected to increase by an annual average rate of 5.7% during the years 2023-2026 which, in turn, would accommodate rising public expenditure (+5.6%). In terms of economic growth, the Stability Programme expects real GDP growth to average 3.0% during 2023-2026.

“On the supply side, important service sector activities such as ICT and tourism are likely to remain the main growth drivers. We expect the number of tourist arrivals to continue to increase not least as a result of the opening of new large-scale tourist facilities over the next months including the Limassol casino resort. Furthermore, domestic investment activity is likely to be supported by the inflow of NextGenerationEU funds over the next years.

“On the supply side, important service sector activities such as ICT and tourism are likely to remain the main growth drivers. We expect the number of tourist arrivals to continue to increase not least as a result of the opening of new large-scale tourist facilities over the next months including the Limassol casino resort. Furthermore, domestic investment activity is likely to be supported by the inflow of NextGenerationEU funds over the next years.

“While our baseline scenario expects growth dynamics to remain favourable, we note that the economic and the fiscal outlooks are exposed to important downside risks such as an escalation of the conflict in Ukraine or higher global financial fragility, which would likely weaken external and internal demand.

“A stronger-than-currently expected weakening of economic activity, in turn, would likely weigh on government tax revenues. Furthermore, a potential new economic shock might require a step-up in government support measures as has been the case during the COVID-19 pandemic.

Rising star

Earlier this month, Moody’s identified Cyprus as a “potential rising star” to see its rating raised to ‘investment grade’ after 11 years of lingering in junk mode, according to a report released on Monday.

The rating agency cited the island’s significant improvement in the public debt-to-GDP ratio as a key factor in its positive outlook, in its latest report on “fallen angels”.

At the end of April, another rating agency, Capital Intelligence, affirmed the Republic of Cyprus’ long-term foreign currency rating (LT FCR) and short-term foreign currency rating (ST FCR) at ‘BBB-’ and ‘A3’, respectively, saying that the outlook on the ratings remains ‘stable’.

The agency said its ratings “reflect the demonstrated resilience of the economy and improving fiscal fundamentals, with the budget position returning to surplus and general government debt declining at a faster-than-expected pace.”