The soaring cost of living and higher interest threaten to blow open the real estate sector’s recovery, say local stakeholders who want the government to step in.

In comments to the Financial Mirror, Eleni Averkiou, a Danos/BNPRE Group property consultant, said increased interest rates come when the market is picking up pace, building a positive trend.

She said real estate sector stakeholders have already recorded a drop in demand in the housing market due to rising inflation and interest rates.

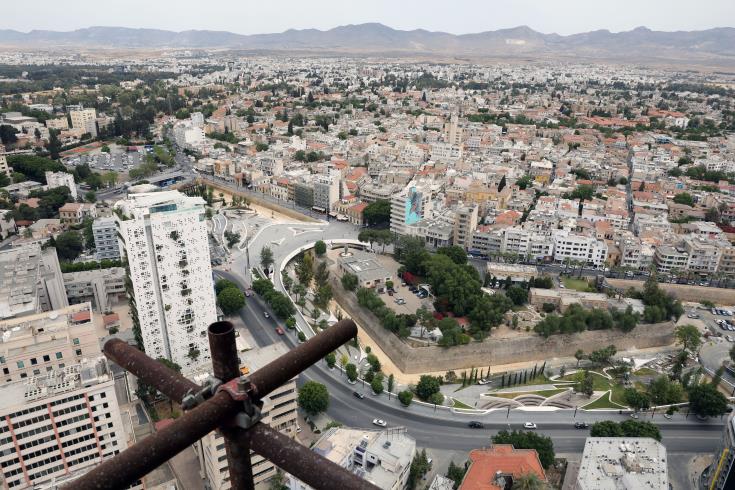

“Following the drop of tight COVID measures, we’ve seen the market take off, mainly driven by local interest and foreign investors for housing and office space,” said Averkiou.

The latest increase in interest levels will knock on savers and anyone who wants to borrow money, impacting mortgage costs.

As she noted, however, this trend is now being halted as Cypriots in the market for a home are pulling out due to a hike in the cost of living.

Before the summer, the key rate was negative; there have already been three increases to 2%, while the European Central Bank is expected to take rates higher during the meeting of its Governing Council on 15 December.

This will make access to credit more difficult, as the European Central Bank’s analysts have reported that borrowing will be considerably more expensive.

“Mortgage interest rates rose significantly in the first half of this year, which may particularly affect house prices and real estate investment,” European Central Bank researchers were quoted by Phileleftheros daily.

“At a time when the ECB is raising interest rates, the models suggest that a one percentage point increase in mortgage rates could lead to a drop in prices of around 9% after two years,” the researchers note.

Danos believes the market is still on the upside, thanks to locals and foreigners with cash in their pockets.

“This source of buyers will soon dry out, leaving the industry in search of buyers.

“At the moment, the market is sustained by interest in one and two-bedroom flats in upcoming areas in cities, mainly by people with money looking to make an investment,” said Averkiou.

Foreclosures

She argued the authorities should intervene to introduce measures to help unblock the sector.

Averkiou said the one thing authorities should be doing is to find ways to overcome the continuous freeze introduced on the foreclosure law by the parliament.

“MPs need to rethink their policies, as the continuous renewal of the freeze on foreclosures is blocking properties linked to non-performing loans to re-enter the market and making banks more reluctant to give out new housing loans.”

Furthermore, as she suggested, the government should re-visit its building coefficient policy, allowing developers to build more floors and apartments, thus being able to offer lower prices.

According to Danos, the average house price in Cyprus is expected to fall for the first time in two years in 2023.

Asked if now is a good time for someone with cash to buy a house, the Danos representative said the period is favourable for those in the market for a home and do not need a mortgage.

“Now is a good time to buy because prices are dropping.

“It would be a good idea to wait until next year when prices are expected to hit their lowest ebb.”

Meanwhile, the main opposition party AKEL has fired at the government for not taking any action to alleviate the pressure on society from increasing interest rates.

It claims the increase has pushed low-income households into despair, as they cannot make their mortgage instalments as their monthly payments rise.

AKEL official Charis Polycarpou said: “The state should ensure, in cooperation with the Central Bank of Cyprus, that the infamous loan Restructuring Code will be implemented to provide solutions for temporary relief of low-income borrowers.”

He said solutions include extending the loan’s repayment period or even paying off the extra amount at the end of the loan.

The communist party wants the government to persuade banks to channel any windfall profits from the increase in interest rates back into the economy.

“We note that in Spain, the government has even decided to tax banks’ windfall profits from increased interest rates,” said Polycarpou.