The appetite for challenger banks remains high as consumers increasingly embrace digital solutions to benefit from elements such as convenience in banking. Consequently, more challenger bank operators are joining the market while defying the economic meltdown.

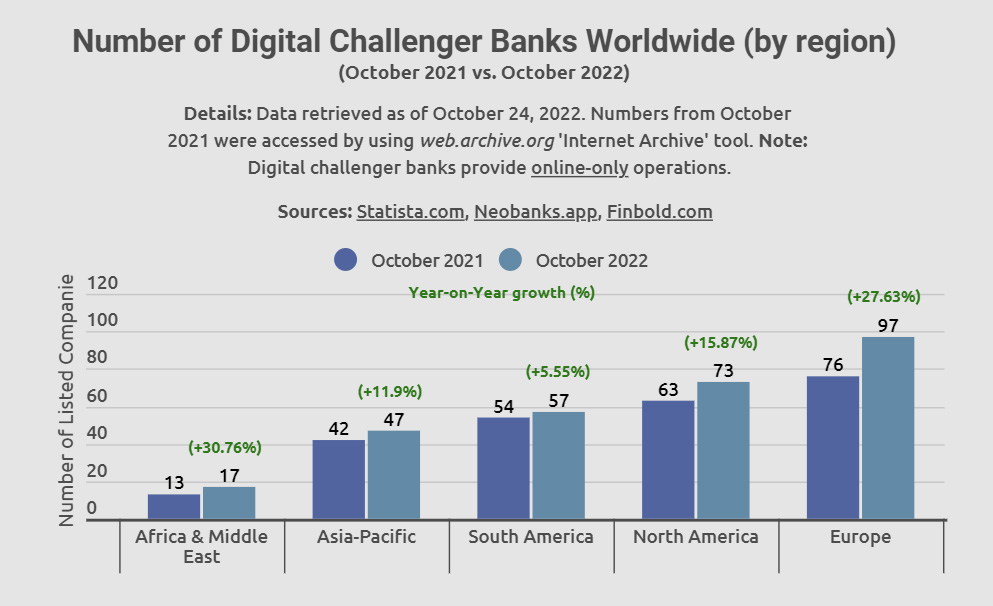

In particular, data acquired by Finbold indicates that as of October 2022, there were 291 challenger banks worldwide. The figure represents an addition of 43 new digital banks or a growth of 17.33% from a similar period last year.

Europe was home to 97 challenger banks, the highest number worldwide, representing a growth of 27.63% from 76 recorded in October 2021.

Elsewhere, North America currently has 73 challenger banks, recording a growth of 15.87% from 2021’s 63 banks. At the same time, in 2022, South America hosted 57 platforms or a growth of 5.55% from 54 that operated in the region as of October 2021.

The Asia-Pacific region has 47 banks which grew 11.9% from last year’s figure. Finally, the Middle East and Africa accounted for the least share of challenger banks at 17, although the region recorded the highest annual growth at 30.76%.

Impact of a possible recession

The Finbold report highlights that the growth in challenger banks has emerged amid prevailing fears of a recession, potentially impacting the operators differently.

“Overall, a possible recession presents several scenarios. The economic uncertainty can potentially end challenger banks’ impressive run since, in such an environment, they will likely lose the battle to traditional competitors with the financial muscles to withstand market conditions,” the study showed.

At the same time, the report pointed out that, “with challenger banks having experienced growth in the wake of a crisis, a recession could present another opportunity. In this case, the platforms can rise to the occasion and offer products that cushion customers against market shocks.”

Overall, the sustainability of challenger banks is dependent on other factors like the ability to generate profits. Notably, most entities still rely on venture capital funding to sustain growth.