Residential property sales are on the rise, with Cyprus real estate stakeholders confident that an upward trend in demand and, consequently, prices recorded in 2021 will continue next year.

Although short of pre-2008 levels, before the real estate property crisis hit, stakeholders are satisfied with residential property sales figures, seeing the market stabilise at its highest mark for over a decade.

Property prices in Cyprus have bounced back by 87% compared to the first quarter of 2008, according to rating agency DBRS.

Commenting on the rise in residential properties, the Cyprus Property Owners Association chair George Mouskides said 2021 was an unexpectedly good year, with sales close to those recorded in pre-COVID 2019.

“Sales have been on the rise since 2013, when the market had hit rock bottom, except for 2020, due to the coronavirus outbreak and restrictions.

“However, residential properties are back in demand as a result of an overall improvement of the island’s financial situation.”

He added that prices are also rising, bolstered by demand, and an unprecedented increase in the cost of building materials pushes prices of new properties up by more than 20%.

Mouskides noted that people’s finances are in better shape as promotions in the financial and the public sector that were put on ice have been rebooted, while the civil service has lifted a freeze on hirings.

“This has brought about a change in people’s psychology and outlook, making them more confident to go out and buy a house or property.

“As real estate stakeholders, we feel the upward trend will continue into 2022, although at a slower pace if we don’t encounter unexpected events such as the appearance of a more deadly strain of the coronavirus.”

The real estate expert said the drive in the residential market is the demand for flats in town centres, which makes up almost 70%.

Houses in town suburbs are also in demand at a lower rate.

Nicosia demand

He noted that Nicosia leads demand for residential properties, powered mainly by Cypriots looking to buy a home.

“Limassol is surprisingly close, despite the demise of the citizenship for investment scheme. With Paphos still seeing demand from British expats and Chinese investors.”

Antonis Loizou, a seasoned property expert, echoed Mouskides’ optimism, arguing that residential property sales were also boosted by banks’ willingness to give mortgages to young couples, aided by a government scheme subsidising interest rates.

The scheme provides for the subsidy of interest of 1.5% for four years, and the maximum grant is now €24,000.

The ceiling on loans for house purchase rises to €400,000 from €300,000.

Loizou argued that demand will continue in 2022, as people have more money in their pockets, especially former bank employees who were pushed into retirement due to staff cuts.

“These people were sent on their way, but not without handsome compensation.

“Many of these people are now looking to buy residential property, either to set up a home or for investment.

“With deposit interest rates at their lowest ebb in recent history, many will be looking to invest in property, which offers good returns.

“All of this has us feeling confident that 2022 will be a similar year to 2021, with the demand for residential properties driven by the demand for flats in town centres and near universities.”

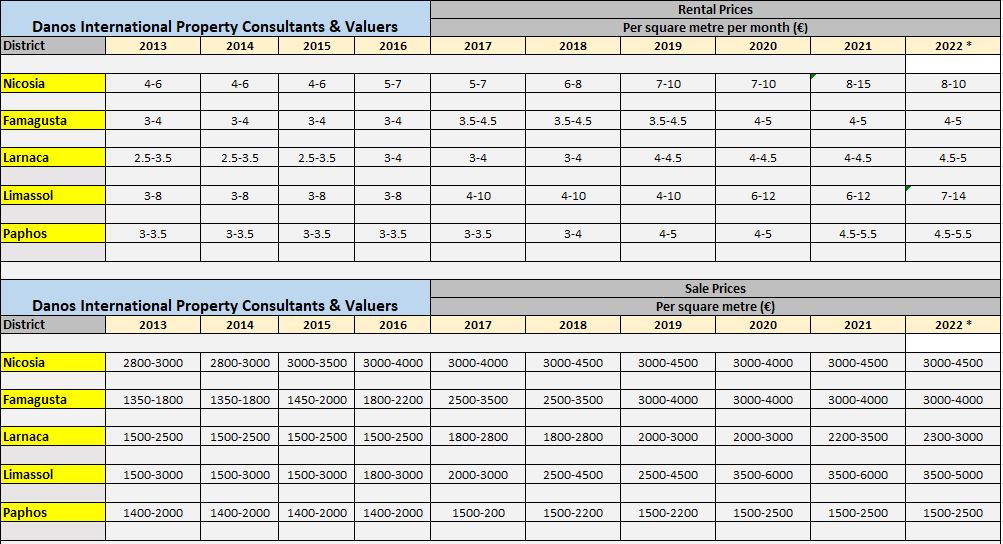

Loucas Georgiou, Head of Property Studies & Valuations at BNP Paribas/ Danos Real Estate, said that property prices in 2021 were at their highest since 2013.

Danos estimates that sales prices for residential property are 50% higher than they were in 2013, while they expect them to remain more or less the same in 2022.

“Despite the demise of the citizenship for investment scheme, the residential property market has had a good year in 2021, all things considered,” said Georgiou.

The demand for high-end property has dropped by 50%, “but demand has been compensated by locals and foreigners looking for a home or an investment opportunity”.

“With negative deposit rates and the scars of the turmoil in the banking sector in 2013 still fresh, people will be looking for safe investments”.

He added that projects in coastal towns, such as the marina development in Larnaca, attract foreign investors from Israel and Lebanon.

They are also looking for protection from instability in the region.