By Han Tan, Market Analyst at FXTM

Market fears surrounding US inflation has fuelled declines in global equities, with Asian benchmark indices falling in tandem with the drop in US stocks.

On Wednesday, the Dow fell 1.99% to register its largest single-day loss since January, wiping out all of its month-to-date gains, while the S&P 500 and the Nasdaq dropped by more than 2%, respectively.

The MSCI Asia Pacific index continued in the same vein on Thursday morning by erasing all of its year-to-date gains.

Markets spooked by higher-than-expected CPI

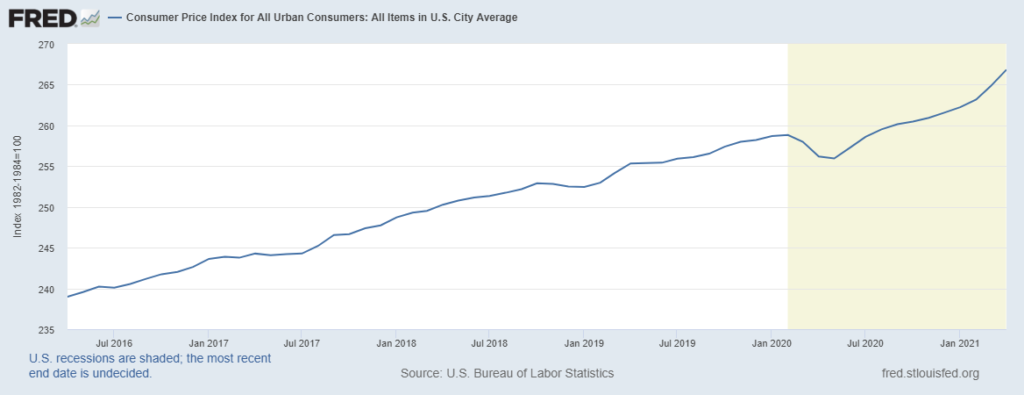

Wednesday’s US inflation data release shoulders much of the blame for extending this week’s selloff. The headline consumer price index increased by 0.8% compared to the month prior, which was its highest print since 2009.

Meanwhile, the core CPI which strips out food and energy saw its highest reading since 1982 with a 0.9% rise month-on-month.

Meanwhile, the core CPI which strips out food and energy saw its highest reading since 1982 with a 0.9% rise month-on-month.

Investors have been caught in a whirlwind of US economic data – from last Friday’s utterly disappointing non-farm payrolls to Wednesday’s higher-than-expected inflation data – which have resulted in a volatility spike.

on Wednesday, the VIX index soared past its 200-day moving average to reach its highest levels since March.

Inflation reaction differs … for now

The latest inflation prints are stoking market fears that runaway prices may crimp the ongoing economic recovery, while potentially forcing the Federal Reserve’s hand to intervene by reining back its support measures.

US stocks and Treasuries have tumbled under the weight of uncertainty over the inflation outlook and its implications on the Fed’s policy timelines. 10-year US Treasury yields made another run for the psychologically important 1.70% mark, which in turn lifted the US dollar along the way and the breakeven rates on the same tenor have reached a new eight-year high.

Shortly after the inflation figures were released, Federal Reserve Vice Chairman Richard Clarida sought to reiterate the central bank’s view that such readings on inflation are set to be “transitory” and that policymakers remain some ways from paring down its asset purchases.

It’s a message that markets clearly have a tough time swallowing as they continue to question policymakers’ will to sit on their hands and ride this out.

More volatility ahead?

These concerns could be further stoked by incoming US economic data releases, including Thursday’s weekly jobless claims and PPI figures, as well as Friday’s releases of retail sales, industrial production and the Michigan consumer sentiment and inflation expectations.

Still, considering the extent of the reaction so far, market moves may be relatively muted over the coming days. Early Thursday, the futures contracts for the Dow, S&P 500 and Nasdaq 100 erased earlier gains, leaving dip buyers pondering their next opportunity to wade back in.

What is clearer is that the US inflation outlook remains the major theme in play for markets. Investors appear ever willing to adjust their expectations and subsequently their asset allocations according to the shifting nuances in this debate which remains far from over.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, Exinity Limited is regulated by the Financial Services Commission of Mauritius