By Han Tan, Market Analyst at FXTM

US and European equity futures are rising, although Asian stocks are mixed, as investors hold on to hope that the US economy will see another round of fiscal stimulus sooner rather than later. The White House seems to have made another shift in its negotiating tactics, now reportedly wanting to reach a stimulus deal with Democrats despite President Trump calling off talks as recently as Tuesday.

Investors have clearly been sensitive to the on/off fiscal stimulus talks, as US equities appear primarily driven by expectations surrounding the outcome of these intense discussions. Amid the drama between the White House and Democrats which add to the political shenanigans leading up to the November presidential elections, it’s evident that investors are clinging on to any sliver of hope that the world’s largest economy will see additional fiscal aid.

While political wrangling continues, the S&P 500 has shown its resilience, having climbed about 6.5% since flirting with a technical correction in late September. The US equities benchmark is set to register its second consecutive weekly gain and is now just some 3.7% away from its record high.

Meanwhile, the Nasdaq Composite Index is about 5.3% off its own record high, on the cusp of posting its third straight week of gains. The tech-heavy index is chipping away at the 11.8% peak-to-trough gap which slammed equities during last month’s selloff.

This rebound in US stocks, while still relatively nascent, is once again testament to the overall supportive environment for the asset class. The tremendously accommodative monetary policy stances around the world are ensuring that the downside for equities is currently limited.

Though the September pullback was necessary to remove some of the market froth that had built up since March, it has in turn allowed investors to buy the dip, taking advantage of the opportunities that had manifested in recent weeks.

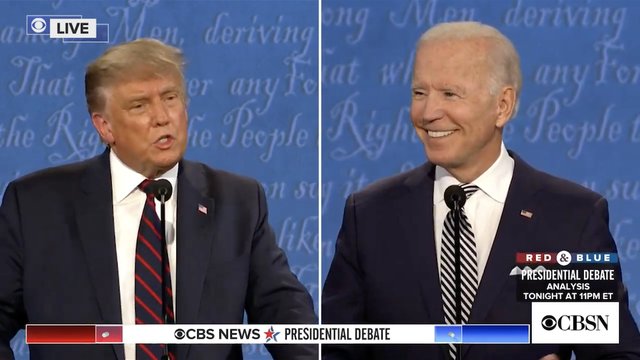

Still, investors remain wary of the risks that lie ahead. While a Biden win and a ’Blue Sweep’ would ensure a broader programme of fiscal measures for the US economy, the risk of a protracted wait for the election’s outcome cannot yet be ruled out completely. Such an outcome could leave investors in limbo, which may trigger a bout of risk aversion in the markets.

Unless the fiscal stimulus deal is agreed before November 3, a delayed result from the polls in turn starves the world’s largest economy of some much-needed aid.

The latest US weekly jobless claims show that the number of Americans who are applying for unemployment benefits remains stubbornly high. Although the number of continuing claims has fallen below the psychologically important 11 million mark for the first time since the pandemic broke out in the US, it still remains well above pre-pandemic levels that numbered fewer than 2 million.

An agreement over the next stimulus package would certainly justify the recent climb in US equities, while potentially encouraging these indices to restore more of its prior record gains.

However, these advances are not yet fully assured, as elevated political uncertainty and a stalling global economic recovery could still drag riskier assets lower.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius