By Hussein Sayed, Chief Market Strategist at FXTM

Markets have been on a roller coaster ride this week. The S&P 500 and Nasdaq 100 have had daily average moves of 1.65% and 2%, respectively, and while the Chicago Board Options Exchange’s (Cboe) volatility index has cooled down slightly from the highs reached on Tuesday, it still remains elevated around 28.

This isn’t surprising given the news developments over the past few days, from President Trump’s Covid-19 diagnosis to him returning to the Oval office, and then his tweet announcing an end to stimulus talks followed the next day by new tweets urging Congress to pass a targeted piecemeal package.

That is a lot for investors and traders to digest with less than four weeks to Election Day, and even before that we have the earnings season which kicks off next week.

Despite all the noise, it is becoming more evident that fiscal stimulus remains the top priority for markets.

Few doubt that a new package is coming, but the timing is the most critical aspect. The longer it takes, the more businesses will shut down and more jobs be laid off.

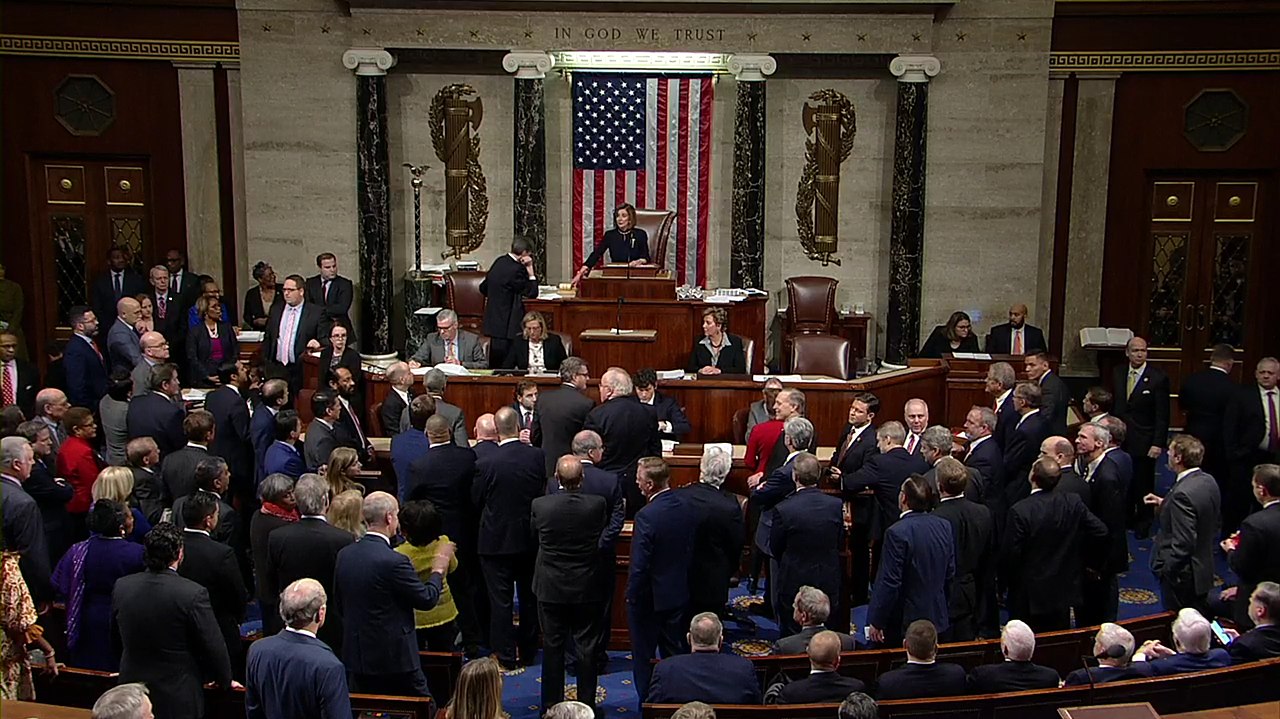

At the moment, investors remain overly optimistic that the House will approve a targeted stimulus package, but there is a high chance of disappointment given past experience. Expect volatility to remain elevated until November 3 and maybe well beyond if Joe Biden wins the election and Donald Trump refuses to concede, which is another underestimated risk.

The FOMC minutes released on Wednesday acknowledged that interest rates will remain near zero for years to come, but the US bond market reacted with disappointment pushing 10-year yields towards 0.8%.

That’s simply because the Federal Reserve failed to offer new specific details that investors were craving for, especially on metrics that will determine the next rate move. There also wasn’t more guidance on the asset purchase programme, which markets were hoping the Fed will increase, given the current state of the economy.

Overall, the minutes seemed tilted to the hawkish side, given the information we already know. This should explain why the Dollar selloff was limited despite the sharp rally in equities.

In commodity markets, Oil edged slightly higher as Hurricane Delta is set to make landfall on the Gulf Coast by Friday. More than 180 offshore facilities have been evacuated which is likely to halt 1.5 million barrels of output.

However, it’s the demand side of the equation that is likely to have more weight over the medium-term and that’s likely to keep any gains in check.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius