Moody’s has cut the covered bonds issued by five Turkish banks by one notch, following successive downgrades of 13 banks on Tuesday and Turkey’s sovereign last Friday, warning of possible balance-of-payments crisis as it cuts the country’s debt rating deeper into junk.

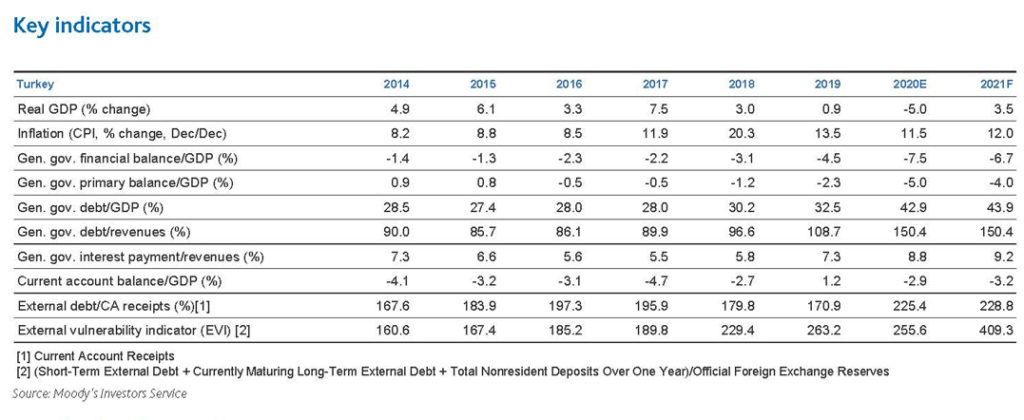

Moody’s Investors Service downgraded the country from B1 to ‘B2 negative’ on rising external vulnerabilities on September 11, saying Turkey’s foreign-currency reserves as a percentage of GDP have reached a multi-decade low.

Justifying the downgrade, the rating agency said the deterioration of the economy was “significantly weakening the government’s ability to cover external debt repayments and increasing Turkey’s vulnerability to shifts in international investor sentiment.”

Bloomberg reported on Monday that “Turkey has blown through its foreign-exchange reserves faster than any other major developing economy this year, with state-run lenders intervening in the market to support the lira as it slid to successive all-time lows.”

On Wednesday, Moody’s downgraded to Ba3 from Ba2 the ratings of covered bonds issued by five Turkish banks – Akbank T.A.S., Sekerbank T.A.S., Turkiye Garanti Bankasi A.S., Turkiye Vakiflar Bankasi T.A.O. and Yapi ve Kredi Bankasi A.S.

As a result of the lowering of the credit rating assessments, Moody’s said it assesses a higher probability that these issuers would cease making payments under the covered bonds.

On Tuesday, Moody’s downgraded the foreign currency long-term deposit ratings of 12 banks in Turkey; the long-term counterparty risk ratings (CRR) and the long-term counterparty risk assessments (CRA) of six banks; and the long-term senior unsecured rating of one bank by one notch and the long-term foreign currency CRR of three banks by two notches.

The outlooks on the long-term deposit and debt ratings of all the Turkish banks rated by Moody’s remain negative, in line with the negative outlook on the sovereign rating. The negative outlooks reflect the downside risks associated with a balance of payments crisis, which could lead to capital controls and restrictions on foreign currency outflows.

These banks are Akbank, Alternatifbank A.S., Denizbank A.S., HSBC Bank A.S., QNB Finansbank A.S., T.C. Ziraat Bankasi A.S., Turk Ekonomi Bankasi A.S., Turkiye Garanti Bankasi, Turkiye Halk Bankasi A.S., Turkiye Is Bankasi A.S., Turkiye Vakiflar Bankasi (Vakifbank) and Yapi Kredi.

Moody’s has maintained the “very weak + macro profile” it assigns to Turkish banks, reflecting the rating agency’s unchanged view on the operating environment for banks.

Despite a challenging economic environment and funding market conditions for Turkish banks, Moody’s notes that Turkish banks’ reliance on short term wholesale foreign funding has reduced moderately ($44 bln at end-June 2020, from $64 bln available at end-April 2019) while foreign currency liquidity has been maintained at broadly similar levels ($90 bln at end-June 2020).

The negative outlook on all long-term deposit, senior and issuer ratings reflects the downside risks associated with the authorities’ inadequate reaction function, which makes Turkey more likely to suffer a balance of payments crisis, which might lead to capital controls and restrictions on foreign currency outflows.

An upgrade is unlikely, given the current negative outlook. The outlook could be changed to ‘stable’ following a stabilisation of Turkey’s sovereign outlook, an improvement of the operating environment, which would stabilise the banks’ stock of problem loans and profitability, and a further structural reduction of the banks’ reliance on foreign currency funding.

An upgrade is unlikely, given the current negative outlook. The outlook could be changed to ‘stable’ following a stabilisation of Turkey’s sovereign outlook, an improvement of the operating environment, which would stabilise the banks’ stock of problem loans and profitability, and a further structural reduction of the banks’ reliance on foreign currency funding.

A further downgrade could be driven by a downgrade of the sovereign rating, deterioration in Turkey’s operating environment, a higher-than-expected deterioration of asset quality and profitability, or a material decline in capital ratios.

Sovereign downgrade at par with Egypt, Jamaica and Rwanda

Friday’s sovereign credit rating cut to B2 is five levels below investment grade and on par with Egypt, Jamaica and Rwanda, Bloomberg said.

Moody’s, which last downgraded Turkey more than a year ago, now ranks it one level lower than S&P Global Ratings and two notches below Fitch Ratings. Turkey held an investment-grade score from two of the three major credit assessors prior to the July 2016 coup attempt against President Recep Tayyip Erdogan.

Erdogan declared Turkey to be under “economic attack” following Fitch’s decision last month to revise the outlook to negative.

Erdogan said in Istanbul on Saturday after the Moody’s announcement that Turkey’s economy is on the rise and not dipping at the moment, but “they are downgrading our ratings again. Do what you want to do, your ratings are of no importance.”

Turkey’s standing with investors has suffered as Erdogan pursued an approach that prioritised growth above all else. The reliance on credit stimulus has exposed the vulnerabilities of the $750 bln economy and came at the expense of inflation and currency instability.

Turkey’s credit-default swaps, local-currency debt and the lira have been the worst performers in emerging markets this quarter. The nation has spent its foreign-exchange reserves faster than any other major developing economy this year, with state-run lenders intervening in the market to support the lira as it slid to successive all-time lows.

Meanwhile on Tuesday, Moody’s also downgraded to B2 from B1 the long-term issuer ratings of the Metropolitan Municipalities of Istanbul and Izmir, with the outlooks on both municipalities’ ratings remaining negative.

Due to their close institutional, financial and operational linkages with the Turkish government, “metropolitan municipalities, including Istanbul and Izmir, cannot act independently of the sovereign and do not have enough financial flexibility to permit their credit quality to be stronger than that of the sovereign.”

Moody’s expects a significant impact on financial results in 2020 and 2021 from weaker revenues but also additional cost related to the coronavirus pandemic. Both cities have only limited cash reserves and significant exposure to foreign currency debt, which is exposing them to additional risk.

Against this backdrop, the rating agency said Izmir and Istanbul still display robust operating performance, predictable shared taxes paid by the government and large and diversified economic bases, which should help mitigate the pressures on their budgets.

Moody’s concluded that a further downgrade of Turkey’s sovereign rating would lead to a downgrade of the two cities’ ratings, while an upgrade of the two cities’ ratings is unlikely given the negative outlook.